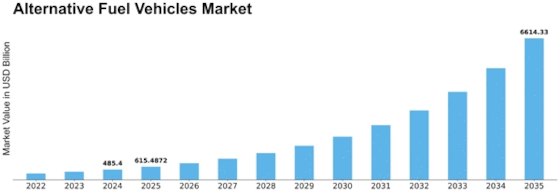

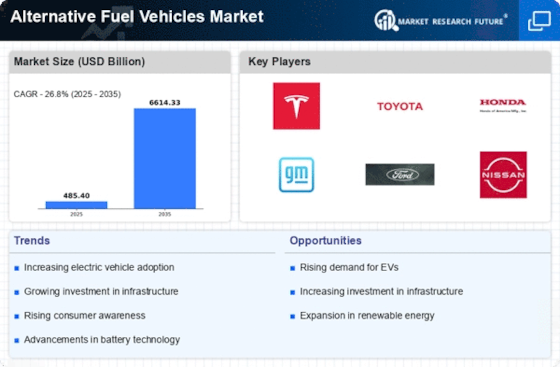

Alternative Fuel Vehicles Size

Alternative Fuel Vehicles Market Growth Projections and Opportunities

An important factor propelling this market is the growing global awareness and concern about natural manageability. Interest in alternative fuel options has increased as the impact of conventional petroleum product-controlled vehicles on air quality and sustainability is becoming more widely acknowledged. Customers and organizations are searching for more reliable and practical energy sources due to the volatile prices of traditional fuels and the uncertainty of global events impacting oil-delivering districts. Interest in alternative fuels has increased because to the desire for energy independence and a reduction in reliance on non-sustainable assets, creating an environment that is conducive to the growth of the AFV industry. Advancements in alternative fuels have improved due to ongoing innovative labor initiatives, making them more reasonable, practical, and effective for everyday use. Advances in battery technology, hydrogen fuel cells, and biofuels have addressed some of the more common concerns associated with AFVs, such as limited range and foundation issues. The benefits of a growing segment of the population align with the seeming social duty of adopting AFVs, stimulating demand for eco-friendly options such as hydrogen fuel cell cars and electric vehicles (EVs). Automakers are responding to shifting consumer preferences by increasing their contributions to AFV items. Enhancing the foundation is a fundamental factor that affects the inevitable acceptance of AFVs. In order to overcome range anxiety and increase consumer confidence in AFVs, it is essential to have access to hydrogen and combustible gas facilities as well as charging stations for electric vehicles. One more step in breaking down a crucial barrier to widespread acceptance will be the expansion of charging organizations and refueling infrastructure. The AFV market is prepared for sustained development as these market variables continue to evolve, providing a promising path for a cleaner and more manageable future in the automotive industry.

Leave a Comment