Advancements in Engine Technology

The aircraft engine test cells Market is significantly influenced by advancements in engine technology. As manufacturers develop more efficient and powerful engines, the complexity of testing these engines increases. Newer engines often incorporate advanced materials and designs, necessitating specialized testing environments to evaluate performance accurately. The introduction of hybrid and electric propulsion systems further complicates testing requirements, as these technologies demand unique testing protocols. In 2025, it is estimated that the market for advanced engine technologies will grow, leading to an increased need for sophisticated test cells that can accommodate these innovations. This trend is likely to drive investment in the Aircraft Engine Test Cells Market.

Growth of Military Aviation Sector

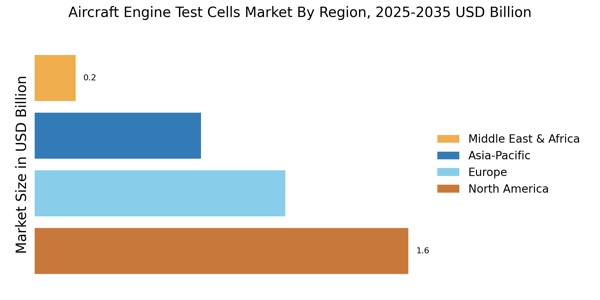

The Aircraft Engine Test Cells Market is also benefiting from the growth of the military aviation sector. As defense budgets increase in various regions, there is a heightened focus on developing and maintaining advanced military aircraft. This growth necessitates robust testing facilities to ensure that military engines perform reliably under demanding conditions. In 2025, military aviation is expected to see a significant uptick in investment, which will likely drive the demand for specialized test cells designed for military applications. The need for precision and reliability in military operations underscores the importance of the Aircraft Engine Test Cells Market, as it plays a critical role in supporting defense capabilities.

Regulatory Standards and Compliance

The Aircraft Engine Test Cells Market is heavily influenced by stringent regulatory standards imposed by aviation authorities. These regulations ensure that all aircraft engines meet safety and environmental performance criteria before they are certified for use. As regulations evolve, manufacturers must adapt their testing processes to comply with new requirements, which often leads to the adoption of more advanced test cell technologies. In 2025, the emphasis on compliance is expected to intensify, particularly with regard to emissions and noise reduction standards. This regulatory landscape compels manufacturers to invest in modern test cells that can provide accurate data and facilitate compliance, thereby driving growth in the Aircraft Engine Test Cells Market.

Increasing Demand for Aircraft Testing

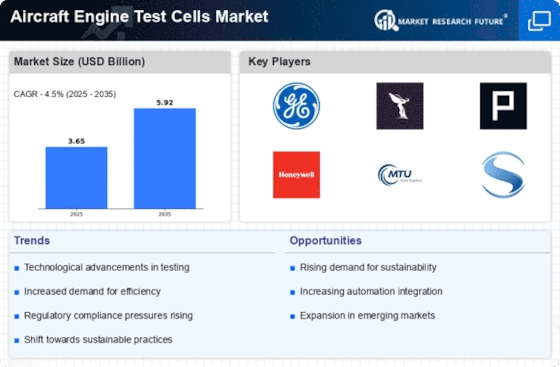

The Aircraft Engine Test Cells Market is experiencing a surge in demand due to the rising number of aircraft being manufactured and operated. As airlines expand their fleets to meet growing passenger and cargo traffic, the need for efficient and reliable engine testing becomes paramount. In 2025, the commercial aviation sector is projected to witness a compound annual growth rate of approximately 4.5%, driving the requirement for advanced test cells. These facilities are essential for ensuring that engines meet performance and safety standards before entering service. Consequently, manufacturers are investing in state-of-the-art test cells to enhance their testing capabilities, thereby propelling the Aircraft Engine Test Cells Market forward.

Focus on Sustainability and Environmental Impact

The Aircraft Engine Test Cells Market is increasingly shaped by the focus on sustainability and reducing environmental impact. As the aviation sector faces pressure to lower its carbon footprint, manufacturers are exploring more eco-friendly engine designs and fuels. This shift necessitates the development of test cells that can evaluate the performance of alternative fuels and assess the environmental impact of new technologies. In 2025, the market for sustainable aviation fuels is projected to expand, prompting a corresponding need for test facilities capable of conducting relevant assessments. Consequently, the Aircraft Engine Test Cells Market is likely to see a rise in investments aimed at enhancing testing capabilities for sustainable technologies.