Advancements in Battery Technology

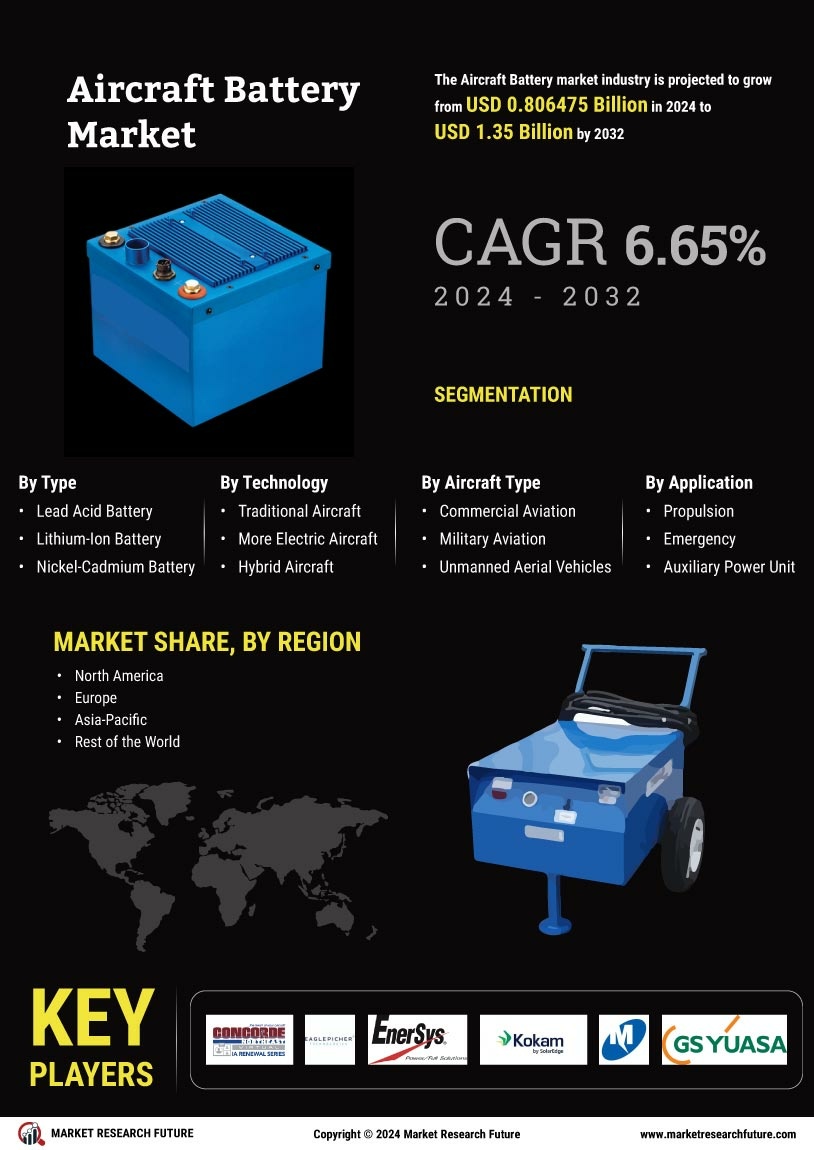

Technological innovations are reshaping the aircraft battery Market, particularly in the realm of battery chemistry and design. Recent advancements in lithium-sulfur and solid-state batteries promise to deliver higher energy densities and improved safety profiles compared to traditional lithium-ion batteries. These innovations are crucial for meeting the energy demands of modern aircraft, which require batteries that can sustain longer flight durations and quicker charging times. The market is witnessing a shift towards these next-generation battery technologies, which are expected to capture a significant share of the Aircraft Battery Market. As manufacturers adopt these advancements, the competitive landscape is likely to evolve, with a focus on performance and reliability.

Increasing Demand for Electric Aircraft

The Aircraft Battery Market is experiencing a notable surge in demand for electric aircraft, driven by the aviation sector's commitment to reducing carbon emissions. As airlines and manufacturers prioritize sustainability, the shift towards electric propulsion systems becomes more pronounced. According to recent estimates, the electric aircraft segment is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend necessitates advanced battery technologies that can provide the required energy density and efficiency. Consequently, the Aircraft Battery Market is likely to witness increased investments in research and development to meet these evolving requirements, thereby fostering innovation and enhancing market competitiveness.

Growing Investment in Urban Air Mobility

The Aircraft Battery Market is poised to benefit from the burgeoning investment in urban air mobility (UAM) solutions. As cities explore innovative transportation alternatives, electric vertical takeoff and landing (eVTOL) aircraft are emerging as viable options. This segment is attracting substantial venture capital and government funding, with projections indicating that the UAM market could reach several billion dollars within the next decade. The success of eVTOL aircraft hinges on the development of efficient and lightweight battery systems that can support short-range flights. Consequently, the Aircraft Battery Market is likely to see increased demand for specialized batteries tailored to the unique requirements of urban air mobility applications.

Regulatory Support for Sustainable Aviation

The Aircraft Battery Market benefits from a robust framework of regulatory support aimed at promoting sustainable aviation practices. Governments and aviation authorities are implementing stringent emissions regulations, which compel manufacturers to adopt cleaner technologies. For instance, initiatives such as the European Union's Green Deal and various national policies incentivize the development of electric and hybrid aircraft. This regulatory landscape not only encourages investment in advanced battery technologies but also stimulates demand for high-performance batteries that comply with new standards. As a result, the Aircraft Battery Market is poised for growth, as stakeholders align their strategies with these regulatory mandates to enhance environmental performance.

Focus on Battery Recycling and Sustainability

Sustainability is becoming a central theme in the Aircraft Battery Market, particularly concerning battery recycling and lifecycle management. As the aviation sector seeks to minimize its environmental footprint, the emphasis on recycling used batteries is intensifying. Initiatives aimed at developing efficient recycling processes not only reduce waste but also recover valuable materials, thereby contributing to a circular economy. The market is witnessing collaborations between battery manufacturers and recycling firms to establish sustainable practices. This focus on sustainability is expected to drive innovation within the Aircraft Battery Market, as stakeholders strive to create eco-friendly solutions that align with broader environmental goals.