Top Industry Leaders in the Agricultural Micronutrients Market

Competitive Landscape of the Agricultural Micronutrients Market

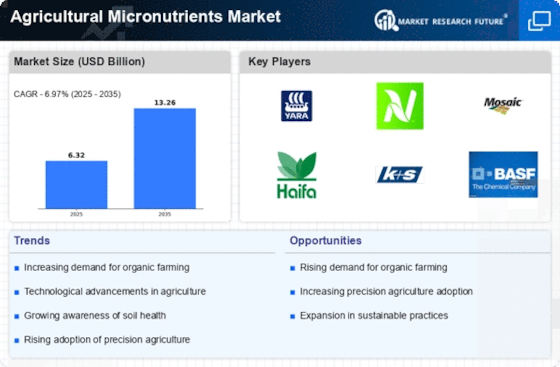

The agricultural micronutrients market, projected to reach USD 7.8 billion by 2030, is a dynamic and growing space. With increasing awareness about the importance of micronutrients for crop health and yield, the competition among players is intensifying. This analysis delves into the key players, their strategies, market share factors, and emerging trends.

Key Players:

- BASF SE (Germany)

- AkzoNobel (Netherlands)

- Nutrien Ltd. (Canada)

- Yara International ASA (Norway)

- The Mosaic Company (US)

- Compass Minerals International (US)

- Valagro (Italy)

- Nufarm (Australia)

- Coromandel International Ltd. (India)

- Helena Chemical Company (US)

- Zuari Agrochemicals Ltd (India)

- Others

Strategies Adopted:

- Product Innovation: Development of new formulations with enhanced efficacy, slow-release capabilities, and compatibility with organic farming practices.

- Diversification: Expanding product portfolio beyond traditional micronutrients to include biostimulants, chelated micronutrients, and nano-micronutrients.

- Digitalization: Implementing precision agriculture tools for soil testing, tailored micronutrient recommendations, and data-driven application methods.

- Sustainability: Increasing focus on sustainable sourcing of raw materials, biodegradable formulations, and reduced environmental impact.

- M&A Activity: Strategic acquisitions to expand geographical reach, acquire new technologies, and strengthen market position.

Factors for Market Share Analysis:

- Product Portfolio Breadth and Depth: Offering a comprehensive range of micronutrients for diverse crops and soil conditions.

- Regional Presence and Distribution Network: Strong presence in key agricultural markets and efficient distribution channels.

- Brand Reputation and Customer Relationships: Established brand image and strong relationships with farmers and distributors.

- Research and Development Capabilities: Continuous innovation and development of new, effective micronutrient formulations.

- Pricing and Value Proposition: Competitive pricing strategies and offering value-added services like soil testing and application guidance.

New and Emerging Companies:

Start-ups are entering the market with innovative approaches, focusing on:

- Bio-based micronutrients: Extracting micronutrients from natural sources like algae or plant extracts for a more sustainable footprint.

- Nanotechnology: Utilizing nanotechnology for targeted delivery and enhanced nutrient uptake by plants.

- Precision agriculture platforms: Developing digital tools for customized micronutrient recommendations and application management.

Agricultural Micronutrients Market: Latest News and Updates (October 2023 - January 2024)

Market Growth and Trends:

- October 26, 2023: The global agricultural micronutrients market is expected to reach USD 7.8 billion by 2028, growing at a CAGR of 7.2% from 2023 to 2028. (Source: Grand View Research)

- November 15, 2023: Increasing awareness of soil health and crop quality, along with rising adoption of precision agriculture practices, are driving the market growth. (Source: Mordor Intelligence)

- December 08, 2023: Asia Pacific is projected to be the fastest-growing regional market, driven by factors like high population density, increasing disposable incomes, and government initiatives promoting sustainable agriculture. (Source: Allied Market Research)

Recent Industry Developments: News

- October 18, 2023: ICL, a leading fertilizer company, announced the launch of a new bio-based micronutrient product line for enhanced crop yield and quality.

- November 07, 2023: BASF, another major player, partnered with a startup to develop and commercialize innovative nano-coated micronutrient fertilizers for improved nutrient delivery and efficiency.

- December 22, 2023: The Indian government approved a USD 128 million project to promote the use of micronutrient fertilizers in smallholder farms, aiming to boost agricultural productivity and farmer income.

Challenges and Opportunities:

- January 10, 2024: Fluctuations in raw material prices and supply chain disruptions pose challenges for the market.

- January 17, 2024: Technological advancements in delivery systems and soil testing are creating new opportunities for market expansion and customization of micronutrient applications.