Government Support and Subsidies

Government initiatives aimed at boosting agricultural productivity are playing a crucial role in The Global Agricultural Harvester Industry. Many countries are implementing policies that provide financial support and subsidies to farmers for the purchase of modern harvesting equipment. This support is particularly evident in developing regions, where governments recognize the need to enhance food security and agricultural efficiency. For example, various agricultural programs have been established to facilitate access to advanced machinery, thereby encouraging farmers to upgrade their equipment. Such initiatives not only stimulate market growth but also promote sustainable farming practices, as modern harvesters are often designed to be more environmentally friendly and resource-efficient.

Rising Demand for Food Production

The increasing global population is driving a substantial rise in food demand, which in turn propels The Global Agricultural Harvester Industry. As populations grow, the need for efficient and effective harvesting solutions becomes paramount. According to recent estimates, food production must increase by approximately 70% by 2050 to meet the needs of the burgeoning population. This demand necessitates the adoption of advanced harvesting technologies that can enhance productivity and reduce labor costs. Consequently, manufacturers are focusing on developing high-capacity harvesters that can operate efficiently in diverse agricultural settings. The integration of automation and precision agriculture techniques is likely to further stimulate market growth, as farmers seek to optimize their operations and ensure food security.

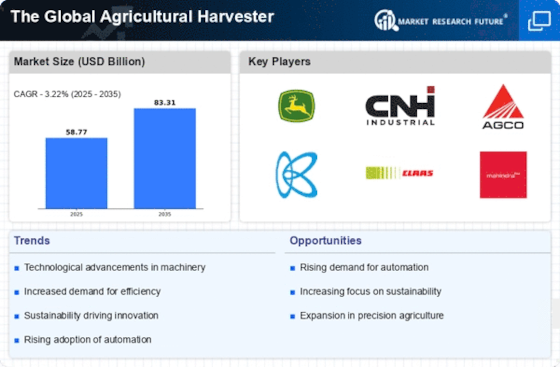

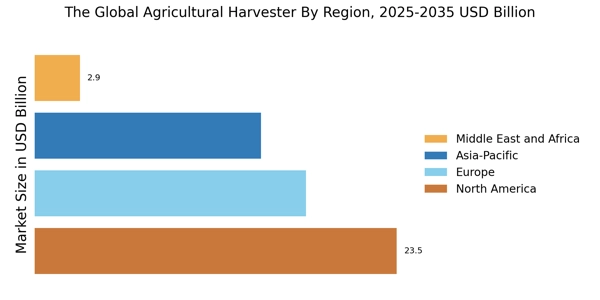

The Global Agricultural Harvester Expansion

The dynamics of The Global Agricultural Harvester Industry. As countries engage in international trade, the demand for agricultural products increases, necessitating efficient harvesting solutions to meet export requirements. Emerging markets, particularly in Asia and Africa, are experiencing rapid growth in agricultural exports, which is driving the need for advanced harvesting technologies. Furthermore, trade agreements and partnerships are facilitating the exchange of agricultural machinery, allowing manufacturers to expand their reach into new markets. This trend is likely to continue, as global demand for food products rises and countries seek to enhance their agricultural capabilities to remain competitive in the international arena.

Increasing Adoption of Sustainable Practices

The growing emphasis on sustainability within the agricultural sector is influencing The Global Agricultural Harvester Industry. Farmers are increasingly seeking harvesting solutions that minimize environmental impact and promote sustainable practices. This trend is reflected in the rising demand for equipment that utilizes less fuel and reduces greenhouse gas emissions. Additionally, the integration of eco-friendly technologies, such as electric and hybrid harvesters, is becoming more prevalent. Market analysts suggest that the shift towards sustainable agriculture could lead to a significant transformation in harvesting practices, as stakeholders prioritize environmental stewardship alongside productivity. This shift may also attract investments from environmentally conscious consumers and organizations.

Technological Innovations in Harvesting Equipment

Technological advancements are reshaping The Global Agricultural Harvester Industry, with innovations such as autonomous harvesters and precision farming tools gaining traction. These technologies enhance operational efficiency and reduce the time and labor required for harvesting. For instance, the introduction of GPS-guided harvesters allows for more accurate and efficient crop collection, minimizing waste and maximizing yield. The market for smart agricultural equipment is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As farmers increasingly adopt these technologies, the demand for sophisticated harvesting machinery is expected to rise, driving market expansion and encouraging further investment in research and development.