Rising Demand for Sustainable Agriculture

The Global agricultural disinfectants Industry is witnessing a notable shift towards sustainable agricultural practices. Farmers increasingly recognize the importance of reducing chemical residues and enhancing food safety. This trend is driven by consumer preferences for organic products and regulatory pressures aimed at minimizing environmental impact. As a result, the demand for eco-friendly disinfectants is on the rise, contributing to the market's growth. In 2024, the market is projected to reach 4.18 USD Billion, with a significant portion attributed to sustainable solutions that align with global agricultural standards.

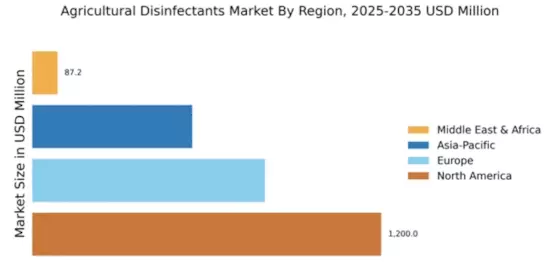

Emerging Markets and Global Trade Dynamics

The Global Agricultural Disinfectants Industry is experiencing growth due to emerging markets and evolving global trade dynamics. Countries in Asia-Pacific and Latin America are increasingly investing in agricultural modernization, leading to higher demand for disinfectants. As these regions expand their agricultural sectors, the need for effective pathogen control becomes paramount. Furthermore, global trade agreements facilitate the exchange of agricultural products, necessitating stringent biosecurity measures. This trend is likely to bolster the market, as the demand for agricultural disinfectants rises in tandem with increased agricultural productivity.

Regulatory Support for Agricultural Practices

Regulatory frameworks supporting the use of agricultural disinfectants are shaping the Global Agricultural Disinfectants Industry. Governments worldwide are implementing stringent guidelines to promote safe and effective disinfectant use in agriculture. These regulations not only ensure food safety but also encourage the adoption of innovative disinfectant solutions. Compliance with these regulations often necessitates the use of approved disinfectants, thereby driving market demand. As regulatory bodies continue to emphasize the importance of biosecurity measures, the market is poised for growth, aligning with global agricultural standards.

Increasing Awareness of Plant Health Management

The Global Agricultural Disinfectants Industry is significantly influenced by the growing awareness of plant health management among farmers. Effective disease management is essential for maximizing crop yields and ensuring food security. Disinfectants play a vital role in preventing the spread of pathogens that can devastate crops. As farmers become more educated about the benefits of using disinfectants, the demand for these products is likely to increase. This heightened awareness is expected to contribute to a compound annual growth rate of 4.1% from 2025 to 2035, reflecting a robust market trajectory.

Technological Advancements in Disinfectant Formulations

Innovations in disinfectant formulations are playing a crucial role in the Global Agricultural Disinfectants Industry. Advanced technologies, such as nanotechnology and biocontrol agents, are enhancing the efficacy of disinfectants while reducing toxicity. These developments not only improve pathogen control but also cater to the growing demand for safer agricultural practices. The integration of smart technologies in application methods further optimizes usage, leading to cost savings for farmers. As the industry evolves, these technological advancements are expected to drive market growth, with projections indicating a market value of 6.5 USD Billion by 2035.