Increased Regulatory Scrutiny

The animal disinfectants market is experiencing heightened regulatory scrutiny, which serves as a significant driver for market growth. Regulatory bodies in the US are implementing stricter guidelines regarding the use of disinfectants in animal care settings. This includes the requirement for efficacy testing and proper labeling of products. As a result, manufacturers are compelled to invest in research and development to ensure compliance with these regulations. The market is projected to expand as companies innovate to meet these standards. This innovation could potentially lead to a more competitive landscape. Furthermore, compliance with regulations not only enhances product credibility but also assures consumers of safety and effectiveness, thereby fostering trust in the animal disinfectants market.

Rising Animal Health Awareness

The increasing awareness of animal health and hygiene is a pivotal driver for the animal disinfectants market. Pet owners and livestock producers are becoming more conscious of the importance of maintaining a clean environment to prevent disease outbreaks. This heightened awareness is reflected in the growing demand for effective disinfectants that can eliminate pathogens. In the US, the animal disinfectants market is projected to reach approximately $1.5 billion by 2026, driven by this trend. Furthermore, educational campaigns by veterinary organizations emphasize the necessity of proper sanitation practices, thereby fostering a culture of health and safety in animal care. As a result, the market is likely to witness a surge in innovative disinfectant products tailored to meet the specific needs of various animal species.

Expansion of the Livestock Sector

The expansion of the livestock sector in the US is a crucial driver for the animal disinfectants market. As the demand for meat, dairy, and other animal products continues to rise, livestock producers are increasingly focused on biosecurity measures to protect their herds from diseases. This focus on disease prevention is leading to a greater reliance on effective disinfectants to maintain hygiene in farms and processing facilities. The animal disinfectants market is expected to benefit from this trend, with projections indicating a growth rate of approximately 5% annually. Moreover, the integration of biosecurity protocols in livestock management practices underscores the importance of sanitation, thereby reinforcing the demand for high-quality disinfectant products.

Growing Demand for Sustainable Practices

The increasing emphasis on sustainability is shaping the animal disinfectants market in the US. Consumers and businesses alike are seeking eco-friendly disinfectant solutions that minimize environmental impact. This trend is prompting manufacturers to develop biodegradable and non-toxic disinfectants that align with sustainable practices. The market for such products is anticipated to grow, as more stakeholders recognize the importance of reducing chemical residues in animal care environments. Additionally, the shift towards sustainable practices is likely to attract investments in research and development, further driving innovation in the animal disinfectants market. As a result, companies that prioritize sustainability may gain a competitive edge, appealing to environmentally conscious consumers.

Technological Advancements in Disinfectant Formulations

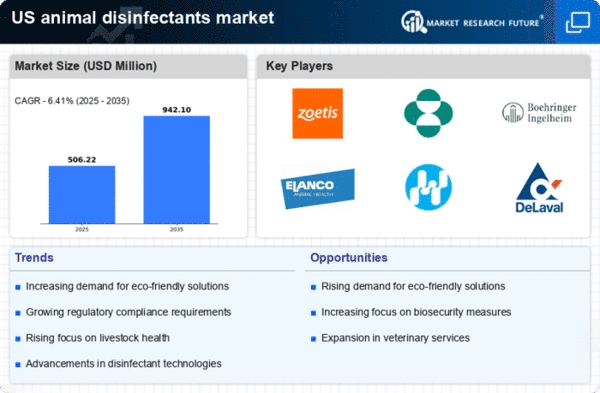

Technological innovations in the formulation of disinfectants are significantly influencing the animal disinfectants market. The development of advanced chemical compounds and delivery systems enhances the efficacy of disinfectants, making them more effective against a broader spectrum of pathogens. For instance, the introduction of nano-disinfectants has shown promising results in improving antimicrobial activity while reducing toxicity. This trend is particularly relevant in the US, where the market is expected to grow at a CAGR of around 6% over the next few years. Additionally, the integration of smart technologies, such as IoT-enabled dispensers, allows for precise application and monitoring of disinfectant usage, thereby optimizing resource allocation. Such advancements not only improve the effectiveness of sanitation practices but also contribute to the overall growth of the animal disinfectants market.