Expansion of Aesthetic Clinics and Spas

The Aesthetic Laser Energy Devices Market is experiencing growth due to the expansion of aesthetic clinics and spas. As the demand for aesthetic treatments rises, more practitioners are entering the market, establishing clinics that offer a range of laser-based services. This proliferation of aesthetic facilities is not only increasing accessibility for consumers but also fostering competition among service providers. Industry expert's indicates that the number of aesthetic clinics has increased by approximately 15% in the past three years, contributing to the overall growth of the aesthetic laser energy devices market. Additionally, many clinics are investing in state-of-the-art laser technologies to attract a broader clientele. This trend suggests that the aesthetic laser energy devices market will continue to thrive as more facilities adopt advanced laser solutions to meet consumer demands.

Regulatory Support and Safety Standards

The Aesthetic Laser Energy Devices Market is positively influenced by regulatory support and the establishment of safety standards. Regulatory bodies are increasingly recognizing the importance of ensuring that aesthetic laser devices meet stringent safety and efficacy criteria. This has led to the development of guidelines that promote the safe use of laser technologies in aesthetic procedures. As a result, manufacturers are compelled to innovate and enhance their products to comply with these regulations. Industry expert's reveal that adherence to safety standards not only boosts consumer confidence but also encourages investment in new technologies. The presence of robust regulatory frameworks is likely to foster a more competitive environment within the aesthetic laser energy devices market, ultimately benefiting both practitioners and patients.

Rising Demand for Non-Invasive Procedures

The Aesthetic Laser Energy Devices Market is witnessing a notable increase in the demand for non-invasive cosmetic procedures. Consumers are increasingly seeking alternatives to surgical interventions, favoring treatments that offer minimal downtime and reduced recovery periods. This shift in consumer preference is reflected in the growing popularity of laser treatments for skin rejuvenation, hair removal, and tattoo removal. Market analysis indicates that non-invasive procedures account for a significant portion of the aesthetic laser market, with a projected growth rate of 12% annually. The appeal of non-invasive options is further bolstered by the increasing awareness of the risks associated with surgical procedures. Consequently, the aesthetic laser energy devices that cater to this demand are likely to see enhanced adoption rates among both practitioners and patients.

Increasing Awareness of Aesthetic Treatments

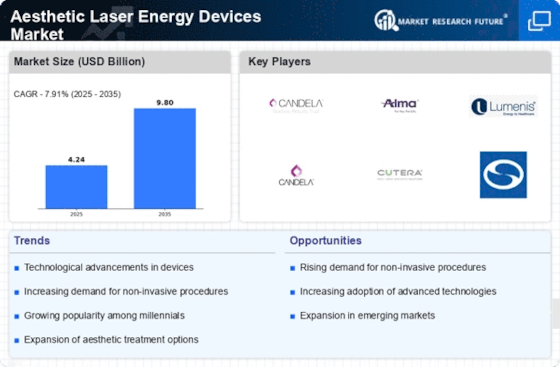

The Aesthetic Laser Energy Devices Market is benefiting from a heightened awareness of aesthetic treatments among consumers. As information becomes more accessible through digital platforms and social media, individuals are more informed about the various options available for enhancing their appearance. This trend is particularly evident among younger demographics, who are increasingly prioritizing aesthetic procedures as part of their self-care routines. Market data suggests that the aesthetic laser energy devices segment is expected to grow significantly, with a compound annual growth rate of 10% over the next five years. This growing awareness is likely to drive demand for innovative laser devices that offer effective and safe treatment solutions. As consumers become more educated about the benefits of aesthetic laser treatments, the market is poised for continued expansion.

Technological Innovations in Aesthetic Laser Energy Devices

The Aesthetic Laser Energy Devices Market is experiencing a surge in technological innovations that enhance treatment efficacy and patient safety. Advanced laser technologies, such as fractional lasers and picosecond lasers, are gaining traction due to their ability to deliver precise energy with minimal damage to surrounding tissues. This has led to a growing preference among practitioners for devices that offer customizable treatment options. According to recent data, the market for aesthetic laser devices is projected to reach USD 4.5 billion by 2026, driven by these innovations. Furthermore, the integration of artificial intelligence in laser devices is expected to optimize treatment protocols, thereby improving patient outcomes and satisfaction. As a result, the demand for technologically advanced aesthetic laser energy devices is likely to continue its upward trajectory.