Top Industry Leaders in the Advanced Biofuels Market

*Disclaimer: List of key companies in no particular order

Competitive Landscape of Advanced Biofuels Market: Navigating the Green Wave

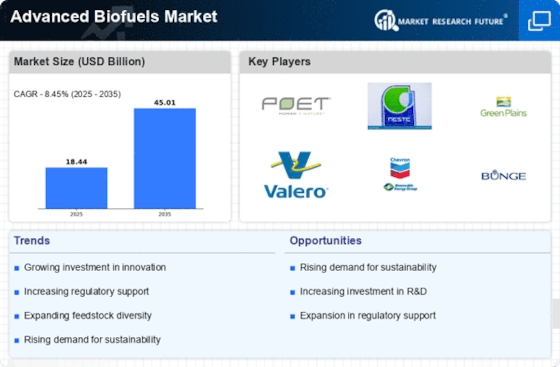

The advanced biofuels market, poised for significant growth in the coming decade, presents a dynamic and diverse landscape where established players and budding innovators battle for market share. Understanding this competitive environment is crucial for navigating the opportunities and challenges this sector presents.

Key Player Strategies:

- BASF SE (Germany)

- Clariant AG (Switzerland)

- INEOS Group Ltd. (UK)

- Evonik Industries AG (Germany)

- Shell PLC (UK)

- ExxoMobil Corporation (U.S.)

- Borregaard AS (Norway)

- Austrocel Hallein GmbH (Austria)

- UPM (Finland)

- VERBIO (Germany)

- Technology & Feedstock Innovation: Leading companies like Gevo,Neste, and Amyris prioritize research and development to optimize production processes, explore novel feedstocks (algae, waste biomass), and refine conversion technologies (pyrolysis, fermentation). This focus on innovation aims to reduce production costs, enhance fuel performance, and expand feedstock options, ultimately leading to a competitive edge.

- Strategic Partnerships & Acquisitions: Collaboration is key. Companies like BP and Eni are forming partnerships with technology developers and feedstock suppliers to secure feedstock access and accelerate technology adoption. Additionally, strategic acquisitions like Valero's purchase of Diamond Green Diesel aim to expand production capacity and diversify product offerings.

- Sustainability & Cost Reduction: With stringent environmental regulations and pressure to achieve carbon neutrality, sustainability is paramount. Companies are investing in biorefineries with lower greenhouse gas emissions and exploring carbon capture and storage technologies. Additionally, cost reduction remains a critical focus, with efforts directed towards optimizing feedstock procurement, streamlining production processes, and increasing operational efficiency.

Factors for Market Share Analysis:

- Production Capacity & Technology: Companies with larger production capacities and access to advanced conversion technologies hold an advantage. This allows them to cater to larger markets and offer competitive pricing.

- Feedstock Sourcing & Sustainability: Sustainable and reliable feedstock access is crucial for cost control and market acceptance. Companies with diversified feedstock sources and sustainable practices gain favor among stakeholders.

- Geographical Reach & Distribution Networks: Global presence and robust distribution networks enable companies to tap into diverse markets and ensure efficient fuel delivery.

- Brand Recognition & Customer Relationships: Established brands with strong customer relationships benefit from brand loyalty and trust, facilitating easier market penetration for new products.

New & Emerging Trends:

- Second-Generation Biofuels: Technologies that convert non-food feedstocks like agricultural waste and woody biomass into fuels are gaining traction, addressing concerns about food-versus-fuel competition.

- Drop-in Biofuels: These advanced biofuels have identical properties to conventional fuels, enabling seamless integration into existing infrastructure and offering a smoother transition to renewable energy.

- Integration with Biogas & Hydrogen: Blending biofuels with biogas or hydrogen is being explored to create advanced fuel blends with improved performance and lower emissions.

Competitive Scenario:

The market is witnessing both competition and collaboration. Established players like ExxonMobil and Shell are investing heavily in advanced biofuels, leveraging their financial muscle and existing infrastructure. Meanwhile, nimble startups like Lanzatech and REG are pushing boundaries with innovative technologies and feedstocks. Collaboration through partnerships and joint ventures is also prevalent, as companies recognize the need to pool resources and expertise for faster growth.

Industry Developments and Latest Updates

BASF SE (Germany):

- December 2023: Partnered with Neste to develop and produce sustainable aviation fuel (SAF) from renewable feedstocks. (Source: BASF press release)

Clariant AG (Switzerland):

- October 2023: Launched a new bio-based catalyst for the production of biodiesel. (Source: Clariant press release)

Evonik Industries AG (Germany):

- November 2023: Entered into a collaboration with LanzaTech to develop and commercialize cellulosic ethanol technology. (Source: Evonik press release)

ExxonMobil Corporation (U.S.):

- October 2023: Launched a research program to develop advanced biofuels from algae. (Source: ExxonMobil press release)