Rising Demand for Renewable Energy

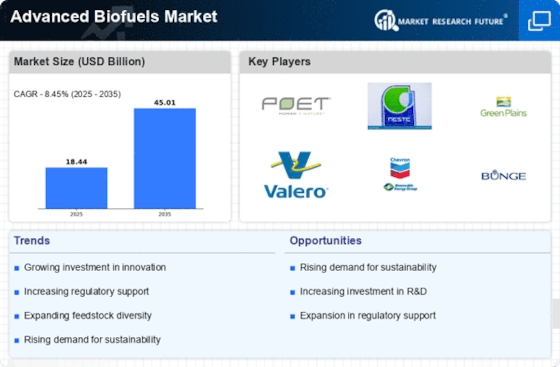

The Advanced Biofuels Market is experiencing a notable surge in demand for renewable energy sources. This trend is largely driven by increasing concerns over climate change and the need to reduce greenhouse gas emissions. According to recent data, the biofuels sector is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is fueled by the transition from fossil fuels to more sustainable energy alternatives, as governments and industries seek to meet renewable energy targets. The Advanced Biofuels Market is positioned to play a crucial role in this transition, providing cleaner fuel options that can significantly lower carbon footprints. As consumers become more environmentally conscious, the demand for advanced biofuels is likely to rise, further propelling market growth.

Supportive Government Policies and Incentives

Government policies and incentives play a pivotal role in shaping the Advanced Biofuels Market. Many countries are implementing supportive measures, such as tax credits, subsidies, and mandates for renewable fuel usage, to encourage the adoption of biofuels. For example, several nations have set ambitious targets for renewable energy consumption, which include specific quotas for biofuels. These policies not only stimulate market growth but also provide a stable regulatory environment that fosters investment. The Advanced Biofuels Market benefits from these initiatives, as they create a favorable landscape for producers and consumers alike. As governments continue to prioritize energy independence and sustainability, the market is likely to see sustained growth driven by these supportive frameworks.

Technological Advancements in Biofuel Production

Technological advancements are significantly shaping the Advanced Biofuels Market. Innovations in production processes, such as the development of more efficient enzymes and fermentation techniques, are enhancing the yield and reducing the costs associated with biofuel production. For instance, recent breakthroughs in cellulosic ethanol production have demonstrated the potential to convert non-food biomass into high-quality biofuels. This not only diversifies feedstock options but also addresses food security concerns. The market is witnessing an influx of investments in research and development, which is expected to drive further innovations. As these technologies mature, they may lead to a more competitive landscape, enabling the Advanced Biofuels Market to capture a larger share of the energy market.

Increasing Investment in Sustainable Technologies

Investment in sustainable technologies is a key driver for the Advanced Biofuels Market. As the world shifts towards greener energy solutions, venture capital and corporate investments in biofuel technologies are on the rise. Reports indicate that investments in biofuel startups and projects have increased significantly, reflecting a growing confidence in the sector's potential. This influx of capital is crucial for scaling production capabilities and enhancing research efforts. Furthermore, partnerships between private companies and research institutions are fostering innovation and accelerating the development of next-generation biofuels. The Advanced Biofuels Market stands to benefit from this trend, as increased funding can lead to breakthroughs that improve efficiency and reduce costs, ultimately making biofuels more competitive with traditional fossil fuels.

Growing Consumer Preference for Sustainable Products

Consumer preferences are increasingly shifting towards sustainable products, which is a significant driver for the Advanced Biofuels Market. As awareness of environmental issues rises, consumers are actively seeking out products that align with their values, including fuels that are derived from renewable sources. This trend is reflected in the growing demand for biofuels, as consumers recognize the benefits of reducing their carbon footprint. Market Research Future indicates that a substantial percentage of consumers are willing to pay a premium for sustainable fuel options. This shift in consumer behavior is prompting companies to invest in advanced biofuels, as they aim to meet the evolving demands of environmentally conscious consumers. The Advanced Biofuels Market is thus positioned to capitalize on this trend, potentially leading to increased market share and profitability.