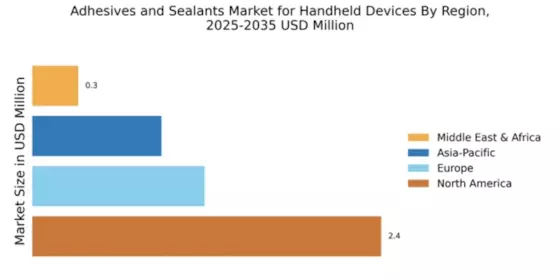

Market Growth Projections

The Global Adhesives and Sealants for Handheld Devices Market Industry is poised for substantial growth, with projections indicating a market size of 5.49 USD Billion in 2024 and an anticipated increase to 11.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.74% from 2025 to 2035, reflecting the increasing reliance on advanced adhesive technologies in the production of handheld devices. The market dynamics are influenced by various factors, including technological advancements, rising consumer demand, and regulatory compliance, all contributing to a robust and evolving landscape for adhesives and sealants in the handheld device sector.

Increasing Smartphone Penetration

The increasing penetration of smartphones globally significantly influences the Global Adhesives and Sealants for Handheld Devices Market Industry. With millions of new smartphone users emerging each year, the demand for reliable adhesive solutions to ensure device integrity and longevity is paramount. This trend is particularly pronounced in emerging markets, where smartphone adoption rates are skyrocketing. As manufacturers strive to produce more durable and aesthetically pleasing devices, the reliance on advanced adhesives becomes more pronounced. By 2035, the market is anticipated to expand to 11.3 USD Billion, reflecting the critical role adhesives play in the production of smartphones and other handheld devices.

Growing Consumer Electronics Market

The Global Adhesives and Sealants for Handheld Devices Market Industry is significantly impacted by the growing consumer electronics market. As consumer electronics continue to evolve, the demand for high-quality adhesives that can withstand rigorous usage and environmental conditions becomes increasingly important. This growth is evident in various sectors, including wearables, tablets, and gaming devices, where adhesive solutions are essential for assembly and performance. The continuous innovation in consumer electronics is expected to drive the market forward, with projections indicating a robust growth trajectory as manufacturers seek to enhance product quality and user satisfaction through superior adhesive technologies.

Regulatory Standards and Compliance

Regulatory standards and compliance requirements are becoming increasingly stringent within the Global Adhesives and Sealants for Handheld Devices Market Industry. Manufacturers are compelled to adhere to environmental regulations and safety standards, which necessitate the use of compliant adhesive solutions. This trend is particularly relevant in regions with strict environmental policies, where the demand for eco-friendly and non-toxic adhesives is on the rise. As a result, companies are investing in the development of sustainable adhesive technologies that meet regulatory requirements while maintaining performance. This shift not only enhances product safety but also positions manufacturers favorably in a competitive market.

Rising Demand for Lightweight Materials

The Global Adhesives and Sealants for Handheld Devices Market Industry experiences a notable surge in demand for lightweight materials, driven by the increasing consumer preference for portable and compact devices. Manufacturers are increasingly adopting advanced adhesive technologies to ensure optimal bonding while minimizing weight. This trend is particularly evident in the smartphone and tablet sectors, where the integration of lightweight materials enhances user experience and device performance. As a result, the market is projected to reach 5.49 USD Billion in 2024, with a significant portion attributed to innovations in adhesive formulations that cater to the lightweight requirements of modern handheld devices.

Technological Advancements in Adhesive Formulations

Technological advancements in adhesive formulations play a crucial role in shaping the Global Adhesives and Sealants for Handheld Devices Market Industry. Innovations such as the development of nanotechnology-based adhesives and bio-based sealants are gaining traction, offering superior performance characteristics. These advancements not only improve the durability and longevity of handheld devices but also align with the growing sustainability trends in manufacturing. The market is expected to witness a compound annual growth rate of 6.74% from 2025 to 2035, as manufacturers increasingly invest in research and development to create high-performance adhesives that meet the evolving needs of consumers.