Growth in Construction Activities

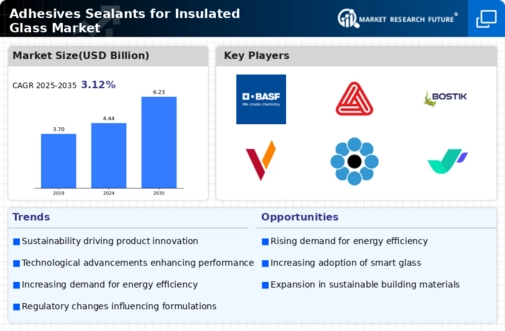

The Global Adhesives Sealants for Insulated Glass Market Industry is significantly influenced by the expansion of construction activities across various regions. The ongoing urbanization and infrastructure development initiatives contribute to an increased demand for insulated glass solutions. As cities expand and new buildings emerge, the need for energy-efficient glazing systems becomes more pronounced. This trend is expected to sustain the market's growth, with a compound annual growth rate (CAGR) of 3.12% projected from 2025 to 2035. The construction sector's robust performance directly correlates with the demand for high-quality adhesives and sealants, positioning the industry for sustained success.

Emerging Markets and Globalization

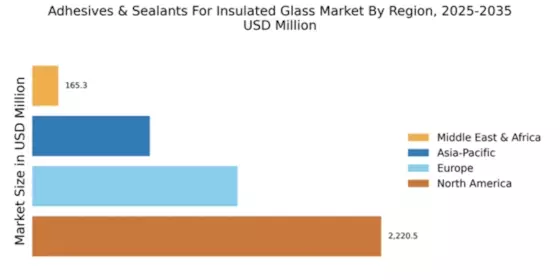

The Global Adhesives Sealants for Insulated Glass Market Industry is witnessing growth fueled by globalization and the emergence of new markets. Developing regions, particularly in Asia-Pacific and Latin America, are experiencing rapid industrialization and urbanization, leading to increased construction activities. This trend creates a substantial demand for insulated glass solutions, thereby driving the need for effective adhesive sealants. As these markets continue to expand, global players are likely to invest in local production facilities to cater to regional demands. The anticipated growth in these emerging markets presents significant opportunities for the industry, fostering a competitive landscape that encourages innovation and collaboration.

Rising Demand for Energy-Efficient Buildings

The Global Adhesives Sealants for Insulated Glass Market Industry experiences a notable surge in demand driven by the increasing emphasis on energy-efficient buildings. As governments worldwide implement stricter energy regulations, the need for high-performance insulated glass solutions becomes paramount. This trend is underscored by the projected market value of 4.44 USD Billion in 2024, reflecting a growing awareness of energy conservation. Insulated glass, enhanced by advanced adhesives and sealants, contributes to improved thermal performance, thereby reducing energy consumption in residential and commercial buildings. Consequently, the industry is poised for growth as stakeholders prioritize sustainability and energy efficiency.

Increasing Awareness of Health and Safety Standards

The Global Adhesives Sealants for Insulated Glass Market Industry is also driven by the rising awareness of health and safety standards in construction and manufacturing. Regulatory bodies are increasingly mandating the use of non-toxic and environmentally friendly materials, prompting manufacturers to innovate and adapt their product offerings. This shift not only aligns with global sustainability goals but also enhances the market's appeal to environmentally conscious consumers. As a result, the demand for compliant adhesive sealants is expected to rise, further propelling the industry's growth as stakeholders prioritize health and safety in their projects.

Technological Advancements in Adhesive Formulations

Technological innovations play a crucial role in shaping the Global Adhesives Sealants for Insulated Glass Market Industry. The development of advanced adhesive formulations, including silicone and polyurethane-based products, enhances the performance and durability of insulated glass units. These innovations not only improve adhesion properties but also provide resistance to environmental factors such as UV radiation and moisture. As a result, manufacturers are increasingly adopting these cutting-edge solutions to meet the evolving demands of the market. The anticipated growth trajectory, with a projected market value of 6.23 USD Billion by 2035, indicates that technological advancements will continue to drive the industry forward.