Rising Automotive Production

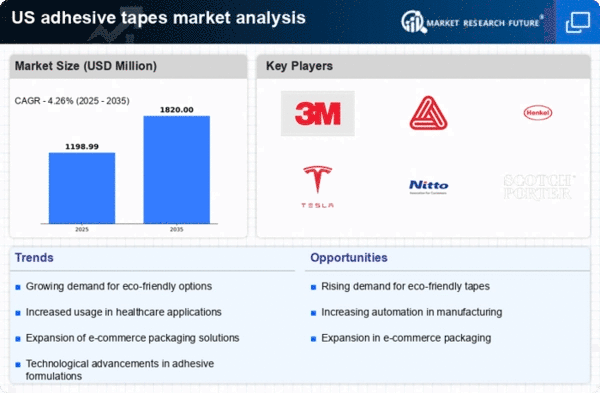

The adhesive tapes market is significantly influenced by the automotive industry's growth in the United States. With the production of vehicles on the rise, manufacturers are increasingly utilizing adhesive tapes for various applications, including interior assembly, exterior bonding, and insulation. In 2025, the automotive sector is projected to represent around 25% of the adhesive tapes market. This trend is fueled by the need for lightweight materials that enhance fuel efficiency and reduce emissions. The adhesive tapes market is likely to see a substantial increase in demand as automotive manufacturers seek advanced adhesive solutions that meet stringent performance standards.

Expansion of the Healthcare Sector

The adhesive tapes market is experiencing growth due to the expansion of the healthcare sector in the United States. With an increasing focus on patient care and safety, healthcare providers are utilizing adhesive tapes for various applications, including wound care, medical device assembly, and securing dressings. In 2025, the healthcare segment is anticipated to account for about 15% of the adhesive tapes market. This growth is driven by the rising demand for medical supplies and the need for reliable adhesive solutions that ensure patient comfort and safety. The adhesive tapes market is thus likely to benefit from this trend, as healthcare organizations seek high-quality, specialized adhesive products.

Growing Demand in Construction Sector

The adhesive tapes market is experiencing a notable surge in demand, particularly from the construction sector. As construction activities ramp up across the United States, the need for reliable bonding solutions becomes paramount. Adhesive tapes are increasingly utilized for various applications, including insulation, surface protection, and securing materials. In 2025, the construction industry is projected to contribute significantly to the adhesive tapes market, with an estimated growth rate of 6.5%. This growth is driven by the rising number of residential and commercial projects, which require efficient and durable adhesive solutions. The adhesive tapes market is thus poised to benefit from this trend, as construction companies seek innovative products that enhance efficiency and reduce labor costs.

Increased Focus on Packaging Solutions

The adhesive tapes market is witnessing a shift towards innovative packaging solutions, driven by the growing e-commerce sector in the United States. As online shopping continues to expand, businesses are increasingly seeking effective packaging materials that ensure product safety during transit. Adhesive tapes play a crucial role in securing packages, providing tamper evidence, and enhancing branding through custom prints. In 2025, the packaging segment is expected to account for approximately 30% of the adhesive tapes market. This trend indicates a robust demand for high-performance adhesive tapes that can withstand various environmental conditions, thereby reinforcing the adhesive tapes market as a key player in the packaging landscape.

Technological Innovations in Adhesive Formulations

The adhesive tapes market is benefiting from ongoing technological innovations in adhesive formulations. Manufacturers are investing in research and development to create high-performance tapes that offer superior adhesion, temperature resistance, and durability. These advancements are particularly relevant in industries such as electronics, where precision and reliability are critical. In 2025, the market for specialty adhesive tapes is expected to grow by approximately 8%, driven by the demand for innovative solutions that cater to specific applications. The adhesive tapes market is thus positioned to capitalize on these technological advancements, as companies seek to differentiate their products in a competitive landscape.