Top Industry Leaders in the 6G Market

Navigating the Frontier: The Competitive Landscape of the 6G Market

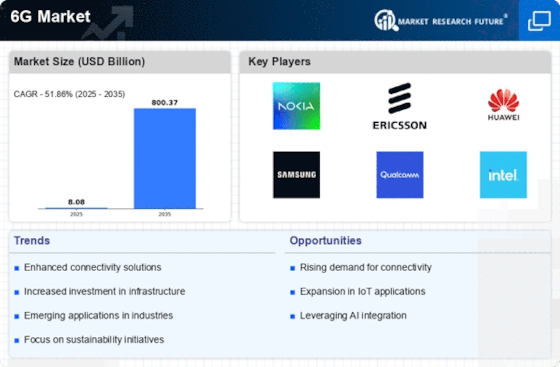

The 6G market, envisioned for commercial rollout in the late 2030s, represents the next evolutionary leap in mobile communications. It promises unprecedented data speeds, ultra-low latency, and ubiquitous connectivity, enabling a plethora of transformative applications across diverse sectors. This nascent market is already attracting major players from various industries, leading to a dynamic and complex competitive landscape.

Key Players:

-

NOKIA

-

SAMSUNG ELECTRONICS

-

HUAWEI TECHNOLOGIES CO. LTD.

-

TELEFONAKTIEBOLAGET LM ERICSSON

-

QUALCOMM TECHNOLOGIES, INC.

-

AT&T INC.

-

LG ELECTRONICS

-

HPE

-

NTT DOCOMO INC.

-

ZTE CORPORATION

-

JIO INFOCOMM LTD.

-

KEYSIGHT TECHNOLOGIES

-

T-MOBILE

-

CIENA CORPORATION

-

INTEL CORPORATION

Strategies for Gaining an Edge:

-

R&D Prowess: Heavy investments in research and development, focusing on core technologies like terahertz communication, AI-powered network management, and secure quantum cryptography, are crucial for differentiation and establishing technological leadership.

-

Strategic Partnerships: Collaborations with universities, research institutions, and other industry players foster knowledge sharing, accelerate innovation, and broaden market reach.

-

Spectrum Access: Securing licenses for the high-frequency millimeter wave bands, the lifeblood of 6G, is critical for network operators and equipment manufacturers.

-

Standardization Leadership: Active participation in the development of global 6G standards ensures compatibility and interoperability, paving the way for widespread adoption.

Factors Shaping Market Share Analysis:

-

Technological Innovation: The ability to develop and commercialize cutting-edge 6G technologies like AI-powered network slicing and dynamic spectrum allocation will be a key differentiator.

-

Infrastructure Deployment: Timely and efficient rollout of 6G infrastructure, including base stations, fiber optic networks, and edge computing platforms, will determine market reach and user experience.

-

Device Ecosystem Development: Creating a diverse and vibrant ecosystem of 6G-compatible devices, from smartphones and wearables to industrial sensors and autonomous vehicles, will be crucial for driving market adoption.

-

Regulatory Landscape: Navigating the evolving regulatory landscape around spectrum allocation, data privacy, and security will be critical for successful market entry and operation.

New and Emerging Companies:

-

Cohere Technologies: Pioneering terahertz communication solutions, aiming to unlock the vast potential of this high-frequency band for ultra-fast data transmission in 6G networks.

-

Light Space: Developing a revolutionary 6G network architecture based on optical fiber and free-space lasers, offering ultra-high capacity and low latency for critical applications.

-

Kymeta: Offering satellite-based 6G connectivity solutions for remote areas and industries like maritime and aviation, bridging the digital divide and unlocking new possibilities.

Current Company Investment Trends:

-

Focus on terahertz research: Major players like Samsung and Huawei are investing heavily in terahertz communication technologies, seen as the key to unlocking the full potential of 6G's ultra-high speeds.

-

Software-defined networks: Leading chipmakers like Qualcomm are investing in software-defined network solutions for 6G, enabling dynamic and flexible network management for diverse applications.

-

AI-powered network optimization: Companies like Ericsson and Nokia are integrating AI into their 6G infrastructure solutions, aiming to optimize network performance, predict anomalies, and automate network management.

-

Cybersecurity advancements: With the increasing security risks associated with 6G's high data speeds and connectivity, companies like Google and Apple are focusing on developing robust cybersecurity solutions for the next-generation network.

Latest Company Updates:

-

December 5, 2023: Nokia and Ericsson sign a partnership agreement to collaborate on 6G research and development.

-

November 8, 2023: Qualcomm announces plans to invest $1 billion in 6G research over the next five years.

-

October 20, 2023: Huawei and ZTE, Chinese telecom giants, pledge to contribute actively to 6G standardization efforts.