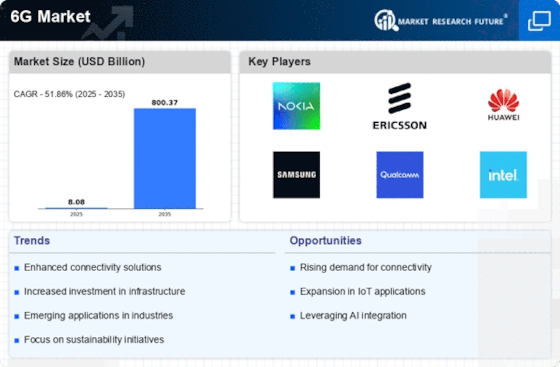

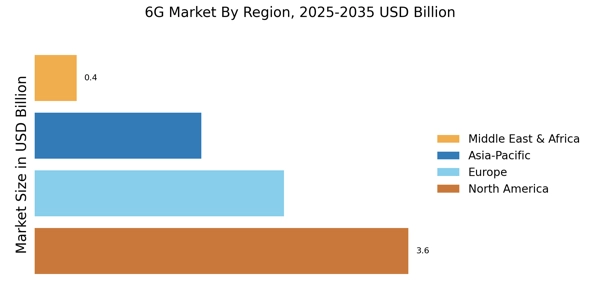

North America : Innovation and Investment Hub

North America is poised to dominate the 6G Market, driven by significant investments in research and development, alongside a robust regulatory framework. The region is expected to hold approximately 45% of the global market share, with the United States being the largest contributor, followed by Canada. The demand for enhanced connectivity and advanced applications in sectors like healthcare and smart cities is propelling growth. Key players such as Qualcomm, Intel, and Verizon are at the forefront of 6G Market development, leveraging their technological expertise and extensive infrastructure. The competitive landscape is characterized by collaborations between telecom operators and technology firms, fostering innovation. The U.S. government is actively supporting initiatives to accelerate 6G Market deployment, ensuring the region remains a leader in telecommunications.

Europe : Regulatory Framework and Innovation

Europe is emerging as a significant player in the 6G Market, with a projected market share of around 30%. The European Union's regulatory frameworks and funding initiatives are driving innovation and collaboration among member states. Countries like Germany and France are leading the charge, focusing on sustainable technologies and digital transformation. The demand for high-speed connectivity and IoT applications is a key growth driver in the region. The Germany 6G market is driven by strong industrial digitization initiatives, automotive innovation, and government-backed research programs supporting next-generation wireless technologies.

The Spain 6G market is gradually emerging, supported by EU-funded research initiatives and increasing interest in advanced mobile communication technologies. The competitive landscape features major players such as Ericsson and Nokia, who are investing heavily in R&D to develop next-generation technologies. Collaborative projects funded by the EU, such as the Hexa-X initiative, aim to create a unified vision for 6G Market. This strategic approach positions Europe as a hub for technological advancements and regulatory leadership in the global 6G Market landscape.

Asia-Pacific : Emerging Powerhouse in 6G Market

Asia-Pacific is rapidly emerging as a powerhouse in the 6G Market, expected to capture approximately 20% of the global share. Countries like China and South Korea are leading the way, driven by government initiatives and substantial investments in telecommunications infrastructure. The China 6G market is witnessing significant momentum, driven by strong government support, large-scale R&D investments, and active participation from leading telecom equipment manufacturers. The South Korea 6G market is advancing rapidly due to early technology trials, strong semiconductor capabilities, and strategic collaborations between telecom operators and research institutions.

The Japan 6G market is gaining traction as the country focuses on next-generation connectivity for smart infrastructure, robotics, and advanced industrial applications. The region's focus on smart cities and advanced mobile applications is fueling demand for 6G Market technologies. Key players such as Huawei and Samsung are heavily involved in 6G Market research and development, collaborating with local governments to enhance connectivity. The competitive landscape is marked by aggressive strategies to roll out next-generation networks, with a strong emphasis on innovation and technological advancements. The region's dynamic market environment is set to accelerate the adoption of 6G Market solutions across various sectors.

Middle East and Africa : Resource-Rich Frontier for 6G Market

The Middle East and Africa region is gradually recognizing the potential of the 6G Market, with an estimated market share of around 5%. Countries like the UAE and South Africa are investing in telecommunications infrastructure to support future connectivity needs. The demand for enhanced mobile broadband and digital services is driving interest in this Market technologies, supported by government initiatives aimed at digital transformation. The competitive landscape is characterized by partnerships between local telecom operators and global technology firms. Companies like ZTE are exploring opportunities in the region, focusing on building robust networks. The region's unique challenges and opportunities present a fertile ground for innovation, as stakeholders work towards integrating advanced technologies into their economies. The GCC 6G market is at an early stage of development, with countries such as the UAE and Saudi Arabia investing in future-ready telecommunications infrastructure and digital transformation strategies.