Growing Adoption of 5G Technology

The rollout of 5G technology is significantly influencing the 3D TSV and 2.5D Market. With its promise of ultra-fast data transmission and low latency, 5G is set to revolutionize various applications, including smart cities, autonomous vehicles, and enhanced mobile broadband. These applications necessitate advanced semiconductor solutions that can handle increased data traffic and processing demands. 3D TSV and 2.5D technologies are well-positioned to meet these requirements, as they enable higher integration density and improved performance. Market analysts suggest that the demand for 3D TSV and 2.5D solutions could see a substantial uptick, potentially exceeding 25% growth as 5G networks become more widespread.

Rising Focus on Energy Efficiency

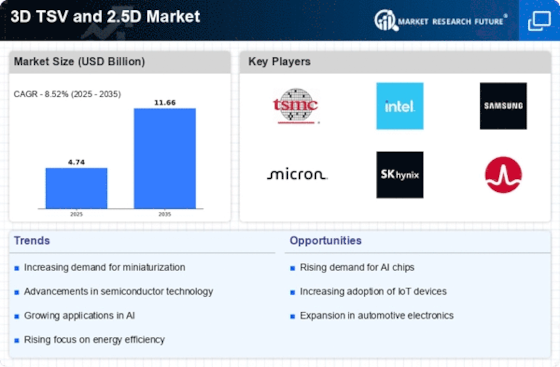

Energy efficiency is becoming a critical consideration in the 3D TSV and 2.5D Market. As environmental concerns grow, manufacturers are increasingly seeking solutions that minimize energy consumption while maximizing performance. 3D TSV technology, with its compact design, can reduce the power required for data transfer between chips, thus contributing to lower overall energy usage. Furthermore, the integration of energy-efficient materials and designs in 2.5D architectures is likely to enhance their appeal in the market. Industry reports indicate that energy-efficient semiconductor solutions are expected to capture a significant share of the market, with projections suggesting a growth rate of around 18% in the coming years.

Increasing Need for Data Storage Solutions

The 3D TSV and 2.5D Market is experiencing a surge in demand for advanced data storage solutions. As data generation continues to escalate, driven by the proliferation of IoT devices and big data analytics, the need for efficient storage technologies becomes paramount. The 3D TSV technology, with its ability to stack multiple memory chips vertically, offers significant advantages in terms of space efficiency and speed. Reports indicate that the market for data storage solutions is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to propel the adoption of 3D TSV and 2.5D technologies, as they provide the necessary performance enhancements to meet the increasing data storage requirements.

Advancements in Semiconductor Manufacturing Processes

The 3D TSV and 2.5D Market is benefiting from ongoing advancements in semiconductor manufacturing processes. Innovations such as improved lithography techniques and enhanced materials are enabling the production of more complex and efficient chip designs. These advancements facilitate the development of 3D TSV and 2.5D technologies that offer superior performance and reliability. As manufacturers adopt these new processes, the cost of production may decrease, making these technologies more accessible to a broader range of applications. Analysts predict that the market for advanced semiconductor manufacturing is likely to grow at a rate of approximately 12% annually, further driving the adoption of 3D TSV and 2.5D solutions.

Emergence of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into various sectors is driving the 3D TSV and 2.5D Market. These technologies require substantial computational power and memory bandwidth, which 3D TSV and 2.5D architectures can effectively provide. The ability to process large datasets quickly and efficiently is crucial for AI applications, and the vertical stacking of chips in 3D TSV technology allows for reduced latency and increased data transfer rates. As industries increasingly adopt AI and ML solutions, the demand for high-performance computing systems that utilize 3D TSV and 2.5D technologies is expected to rise, potentially leading to a market expansion of over 15% annually.