Jan 2025: Amphenol acquired TPC Wire & Cable, enhancing its product portfolio with high-performance wire and cable solutions tailored for harsh environments, including aerospace and defense applications. TPC Wire & Cable will operate as a standalone business unit within Amphenol under the new name “Amphenol TPC Wire & Cable (Amphenol TPC)” and will retain its headquarters location in Macedonia, Ohio.

Jan 2021: Lynxeo remains Airbus’ major supplier of aerospace cables with multi-year contract. Company has reinforced its long-lasting relationship with Airbus with a new contract to supply specialized aerospace cables and wires that form the electrical backbone of civilian and military aircraft and helicopters. The new contract establishes Lynxeo as a major supplier to Airbus for high-performance, lightweight cables that play a major role in aircraft efficiency, passenger comfort and safety. Over the contract duration, Lynxeo will focus on new solutions for the future generation of electric and hybrid aircraft.

Nov 2024: TTI, Inc. – Asia a leading distributor of electronic components of TE Connectivity (TE) has won TE Connectivity Aerospace, Defense and Marine (AD&M) Business Distributor of the Year 2024. In Fiscal Year 2024, TTI Asia demonstrated remarkable performance, achieving significant increases in both bookings and billing. Additionally, the company proactively expanded its customer base and generated substantial new sales opportunities.

Feb 2024: Cablecraft Motion Controls (“Cablecraft”), a Torque Capital Group portfolio company has announced that it has completed the purchase of Radial Bearing Corp. (“Radial”), a leading designer and manufacturer of rod ends and spherical bearings. Based in Danbury, Conn., Radial has a rich history of delivering engineered solutions in the aerospace, defense, and industrial markets.

Cable and Wire for Aerospace and Defense Market Segmentation

Cable and Wire for Aerospace and Defense Market by Type Outlook

- Cable

- Coaxial Cable

- Power Cable

- Shipboard Cable

- Others

- Wire

Cable and Wire for Aerospace and Defense Market by Voltage Outlook

- Low Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

Cable and Wire for Aerospace and Defense Market by Material Outlook

- Copper

- Aluminium

- Stainless Steel

- Polyimide

- Teflon

Cable and Wire for Aerospace and Defense Market by Application Outlook

- Communication Systems

- Navigation Systems

- Military Ground Equipment

- Power Distribution

- Others

Cable and Wire for Aerospace and Defense Market by Certification Outlook

- AS/EN 4058

- ASTM D638

- IEC 60228

- MIL-DTL-24682

- UL 1581

Cable and Wire for Aerospace and Defense Market by Conductor Size Outlook

- 12 AWG

- 14 AWG

- 16 AWG

- 18 AWG

- 20 AWG

Cable and Wire for Aerospace and Defense Market by End-Use Outlook

- Aircraft Wiring

- Avionics Systems

- Defense Electronics

- Ground Support Equipment

- Space Systems

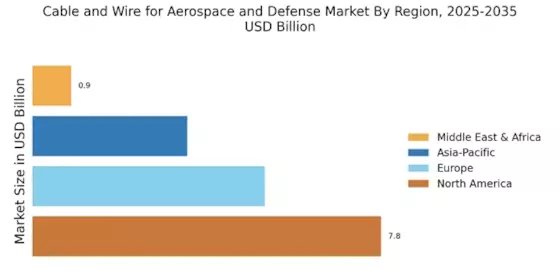

Cable and Wire for Aerospace and Defense Market Regional Outlook

- North America

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South & Central America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East & Africa