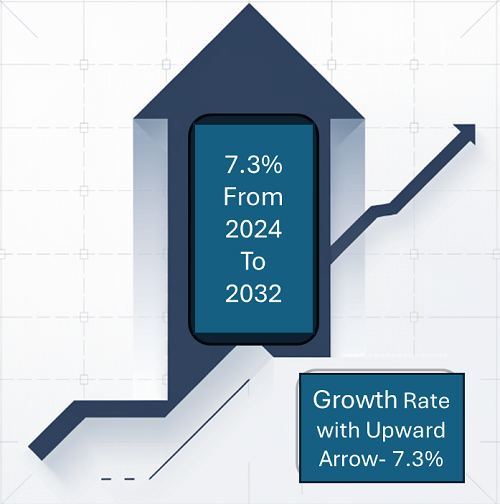

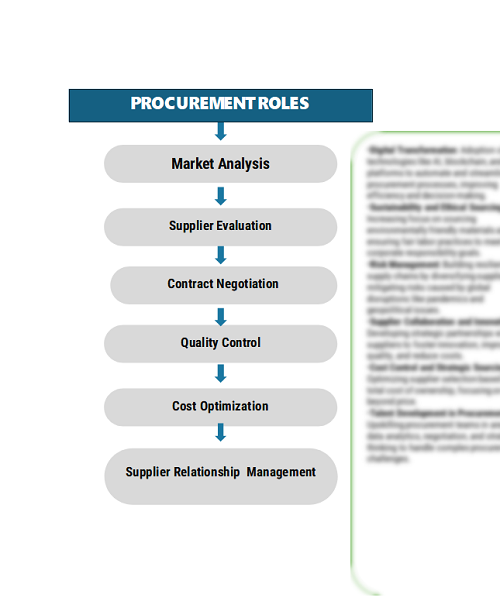

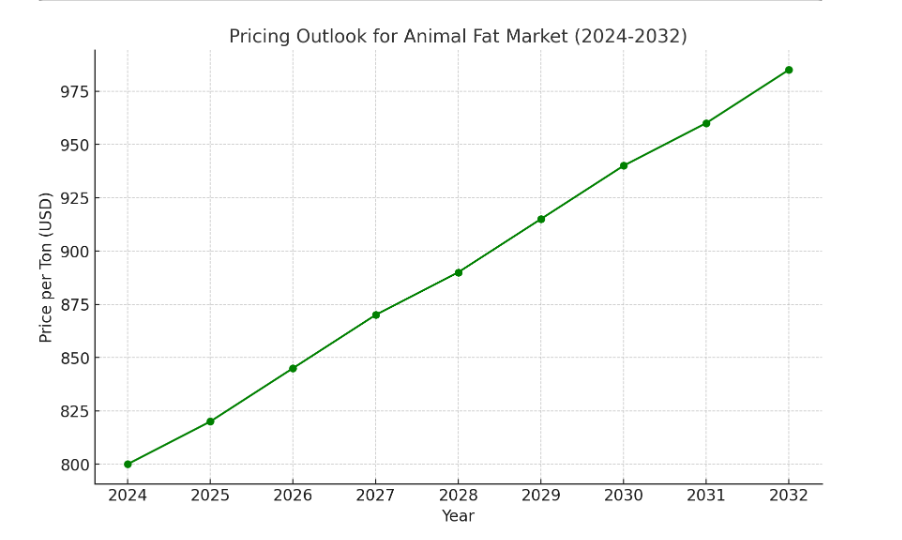

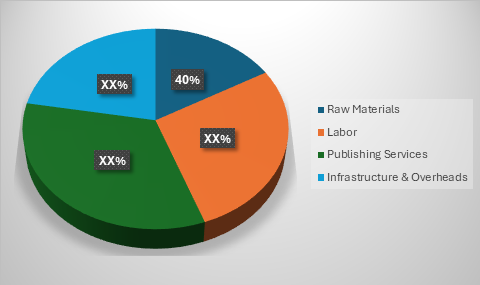

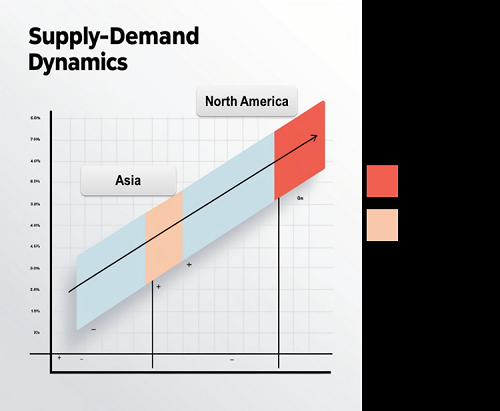

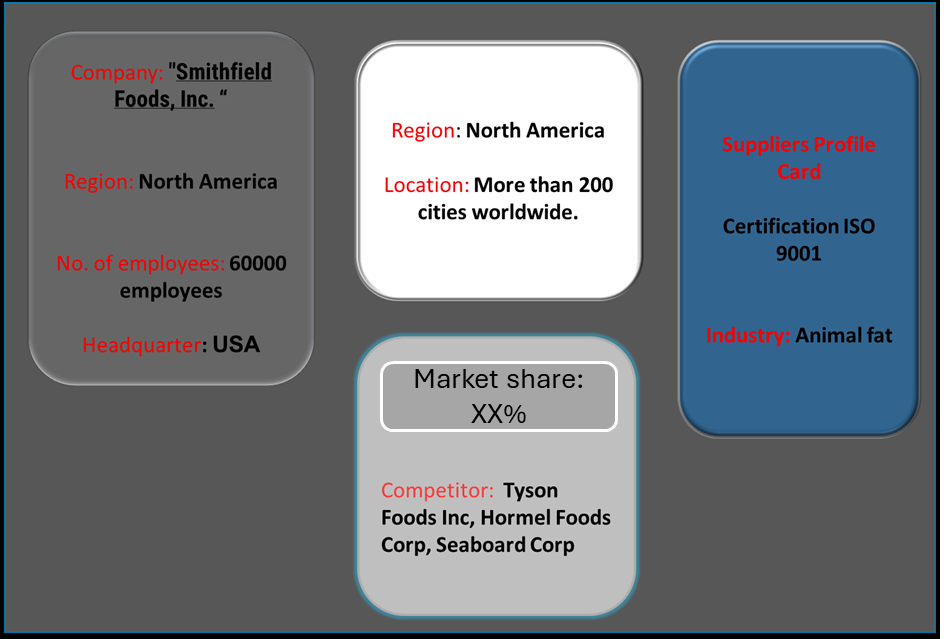

The global analytical testing services market is undergoing rapid growth, driven by advances in technology, increased regulatory requirements, and the rising demand for high-quality data. Companies in the pharmaceutical, food and beverage, environmental, and healthcare sectors are investing heavily in testing services to ensure product safety, quality, and compliance. Our report explores the latest trends in analytical testing procurement, focusing on cost-saving strategies through resource sharing and digitalization. By implementing advanced digital tools for procurement, companies can improve forecasting for testing needs, streamline sample management, and reduce costs associated with logistics and data handling. The growing emphasis on environmentally sustainable practices and innovative testing methodologies further refines procurement approaches, enabling companies to remain competitive and responsive in a dynamic regulatory landscape. The outlook for the analytical testing services market is positive, with strong growth anticipated through 2032 driven by multiple factors: Market Size: The global analytical testing services market is projected to reach approximately USD 15.46 billion by 2032, with an expected compound annual growth rate (CAGR) of around 7.3% from 2024 to 2032. Growth Rate: 7.3% Sector Contributions: Growth is primarily driven by: Pharmaceutical Testing: Increasing demand for quality assurance and regulatory compliance in drug development and production. Food & Beverage Testing: Rising consumer demand for product transparency and food safety is pushing for more rigorous testing protocols. Funding Initiatives: Companies are investing in advanced testing technologies and automation to enhance accuracy, reduce turnaround times, and meet stringent regulatory standards. Regional Insights: The Asia-Pacific region is experiencing rapid growth driven by increased demand for testing in pharmaceutical and food sectors, while North America and Europe focus on advanced testing technologies and environmentally sustainable practices to meet regulatory and quality standards. Key Trends and Sustainability Outlook: Increased Regulatory Compliance: Stricter global regulations are driving demand for comprehensive testing services across industries. Advancements in Testing Technology: Growth in automation, AI, and precision instruments is enhancing testing accuracy and efficiency. Rising Demand for Outsourced Services: Companies are outsourcing testing to reduce operational costs and focus on core activities. Focus on Sustainability: Environmentally friendly testing practices and reduced waste protocols are gaining prominence. Digital Transformation: Adoption of digital tools in lab data management and reporting is improving transparency and traceability. Growth Drivers: Expansion of Pharmaceutical and Biotech Sectors: New drug developments and stricter quality controls are driving testing demand. Food Safety Requirements: Growing consumer demand for safe, transparent food products boosts the need for testing services. Healthcare Growth: The rise in personalized medicine and diagnostics requires rigorous analytical testing. Environmental Concerns: Increased focus on pollution control and waste management is driving demand for environmental testing. Technological Innovation: Continuous advancements in testing methodologies expand capabilities and attract industry investment. Overview of Market Intelligence Services for Analytical Testing Services Recent analyses highlight that the analytical testing services market faces challenges due to rising operational costs and increasing regulatory requirements. Market reports provide cost projections and identify opportunities for procurement savings, enabling companies to manage expenses while ensuring quality and compliance. By leveraging these insights, stakeholders can adopt cost-effective strategies and improve procurement processes, maintaining efficiency and meeting industry standards in an evolving market. Procurement Intelligence for Analytical Testing Services: Category Management and Strategic Sourcing Pricing Outlook for Analytical Testing Services: Spend Analysis The pricing landscape for analytical testing services is projected to remain stable in the near term, although slight increases may be anticipated due to several influencing factors. One significant driver of potential price increases is the rising costs associated with operational aspects of testing services. These include increased expenses for laboratory equipment, reagents, and compliance with regulatory standards. As the demand for high-quality analytical testing continues to grow across various industries, such as pharmaceuticals, food and beverage, and environmental testing, these rising operational costs may exert upward pressure on service pricing. Graph shows general upward trend pricing for analytical testing services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic. These improvements can lead to more competitive pricing structures in the long run. Furthermore, strategic partnerships within the analytical testing sector can foster collaborative approaches to cost management. Overall, while the analytical testing industry faces challenges from rising costs, the focus on technological advancements and strategic collaborations positions it to manage pricing effectively. As demand for reliable testing continues to grow across various sectors, maintaining competitive pricing while ensuring quality and efficiency will be crucial for service providers. Cost Breakdown for the Analytical Testing Services Total Cost of Ownership (TCO) and Cost Saving Opportunities: Research Materials (40%) Description: Raw materials in analytical testing services primarily include reagents, standards, solvents, and laboratory supplies required for conducting tests and experiments. These materials are crucial for ensuring the accuracy and reliability of test results. Trends: The costs associated with raw materials have seen a steady increase due to several factors. Supply chain disruptions caused by global events, including the COVID-19 pandemic and geopolitical tensions, have affected the availability of essential materials. Labor (XX) Description: XX Trends: XX Publishing Services (XX%) Description: XX Trends: XX Infrastructure & Overheads (XX%) Description: XX Trends: XX Cost Saving Opportunities: Negotiation Lever and Purchasing Negotiation Strategies In the analytical testing services sector, optimizing procurement strategies presents substantial opportunities for cost savings and enhanced operational efficiency. By forming collaborative partnerships with suppliers and other industry players, testing laboratories can leverage shared resources and pooled purchasing power, effectively reducing individual costs. Such alliances can lead to better negotiation positions with suppliers, resulting in favourable terms and pricing. The adoption of innovative technologies in laboratory processes can significantly improve production efficiency while minimizing material waste. Investing in state-of-the-art equipment and automation not only streamlines workflows but also enhances the accuracy of testing outcomes, ultimately leading to reduced operational costs. Moreover, embracing sustainable practices within the supply chain can lower raw material expenses and attract a growing segment of environmentally conscious clients. For instance, sourcing eco-friendly reagents and employing green chemistry principles can enhance a lab's marketability while contributing to cost reductions. Additionally, integrating digital tools for inventory management can help analytical testing services optimize their operations by minimizing excess stock and ensuring that supplies are replenished just in time. Supply and Demand Overview for Analytical Testing Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM) The analytical testing services market is growing rapidly, driven by increasing demand across industries such as pharmaceuticals, food and beverages, and chemicals. This demand is fueled by the need for accurate testing, regulatory compliance, and quality assurance, with collaborations between businesses, testing labs, and regulatory bodies playing a key role in meeting market needs. Demand Factors: 1. Rising Consumer Demand: The increasing focus on quality and reliability in testing services is driving higher demand across various sectors, including pharmaceuticals, food safety, and environmental monitoring. 2. Regulatory Compliance: Stricter regulations and quality standards in industries such as healthcare and food production are fuelling the need for accurate analytical testing to ensure compliance. 3. Technological Advancements: Innovations in testing methodologies and equipment are expanding the range of services offered, leading to increased demand from clients seeking advanced testing capabilities. 4. Growth in End-Use Industries: The expansion of industries such as biotechnology, environmental services, and materials science is further propelling the demand for analytical testing services. Supply Factors: 1. Raw Material Availability: The availability of reagents and laboratory supplies can fluctuate, impacting the production capacity and cost of analytical testing services. 2. Laboratory Capacity: The ability of testing laboratories to scale operations efficiently and manage workflow directly affects the supply of analytical services in the market. 3. Technological Advancements: Innovations in laboratory processes and automation can enhance operational efficiency and influence the supply dynamics of analytical testing services. 4. Regulatory Environment: Changes in regulatory standards and accreditation requirements can affect the supply of services by imposing new operational guidelines and compliance costs. Regional Demand-Supply Outlook: Analytical Testing Services The Image shows growing demand for analytical testing services in both North America and Asia, with potential price increases and increased Competition. North America: Dominance in Analytical Testing Services. North America particularly the U.S. and Canada, continues to lead in the analytical testing services market, characterized by: 1. High Consumer Demand: There is a growing need for analytical testing across various sectors, including pharmaceuticals, food and beverage, and environmental monitoring, driven by increased awareness of quality and safety standards. 2. Established Industry Infrastructure: The region boasts a robust network of laboratories and testing facilities that provide comprehensive services, ensuring high standards of accuracy and reliability. 3. Regulatory Support: Strong regulatory frameworks and compliance requirements in industries such as healthcare and food production are driving demand for analytical testing services, ensuring that products meet safety and efficacy standards. 4. Innovation and Technology Adoption: North American laboratories are increasingly adopting advanced technologies and automation to enhance testing capabilities, improve efficiency, and reduce turnaround times, solidifying their competitive advantage in the market. North America Remains a key hub analytical testing services can price drivers Innovation and Growth. Supplier Landscape: Supplier Negotiations and Strategies for Analytical Testing Services The analytical testing services market is diverse, with both global and regional providers offering services across industries such as pharmaceuticals, food, and chemicals. These suppliers play a key role in shaping market dynamics, impacting pricing, technological advancements, and service accessibility. The market is competitive, with large laboratories and specialized firms focusing on regulatory compliance and advanced testing methodologies. While major players dominate the market, smaller and emerging firms are carving out a niche by specializing in specific sectors and offering innovative testing solutions. Some key suppliers in the analytical testing services market include: SGS Eurofins Scientific Intertek Group plc Thermos Fisher Scientific Bureau Veritas ALS Limited TUV SUD Pace Analytical Services LabCorp Drug Development Key Developments Procurement Category Significant Development: Key Development Description Impact on Market Increased Automation Adoption of automated testing technologies to improve efficiency and reduce human error. Enhances throughput and accuracy, leading to faster turnaround times and lower operational costs for laboratories. Expansion of Environmental Testing Growing focus on environmental compliance and sustainability testing due to regulatory pressures. Increases demand for services related to air, water, and soil testing, driving revenue growth in the analytical testing sector. Development of Mobile Testing Labs Emergence of mobile laboratories for on-site testing in remote or underserved areas. Provides faster and more accessible testing services, especially in emergency situations or in regions with limited laboratory access. Enhanced Regulatory Compliance Stricter regulations across industries requiring comprehensive testing and documentation. Boosts demand for analytical testing services as companies seek to ensure compliance and avoid penalties, leading to sustained market growth. Growth of Biopharmaceutical Testing Increased investment in biopharmaceuticals driving the need for specialized testing services. Expands the market for analytical testing services related to drug development, quality control, and regulatory submissions. Analytical Testing Services Attribute/Metric Details Market Sizing Global analytical testing services market is projected to reach approximately USD 15.46 billion by 2032, with an expected compound annual growth rate (CAGR) of around 7.3% from 2024 to 2032. Analytical Testing Services Technology Adoption Rate Around 60% of companies in the industry are adopting advanced testing and automation tools to enhance accuracy and efficiency. Top Analytical Testing Services Strategies for 2024 Focus on optimizing testing processes, ensuring compliance with regulatory standards, expanding service portfolios, and reducing costs. Analytical Testing Services Process Automation 45% of companies have automated key testing and analysis processes to improve workflow efficiency. Analytical Testing Services Process Challenges Key challenges include rising operational costs, regulatory complexities, and the need for continuous innovation in testing methods. Key Suppliers Leading providers include Eurofins Scientific, SGS, Thermos Fisher Scientific, Intertek, and Labcorp, offering a wide range of analytical testing services. Key Regions Covered North America, Europe, and Asia-Pacific, with key markets in the U.S., Germany, China, and Japan due to strong industrial and regulatory support. Market Drivers and Trends Growth driven by increasing demand for quality control, regulatory requirements, and advancements in analytical technologies.Analytical Testing Services Market Overview

To stay competitive in the analytical testing services market, companies are enhancing procurement strategies by using spend analysis tools to track vendor expenditures and improve supply chain efficiency through market intelligence. Effective category management and strategic sourcing are crucial for cost-effective procurement and ensuring timely access to essential resources for delivering high-quality analytical testing services.

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide a comprehensive analysis of the analytical testing services landscape, identifying key suppliers. We offer spend analysis, supplier performance assessments, and market insights to help source high-quality, cost-effective testing solutions

We assist in evaluating TCO by considering costs related to testing procedures, regulatory compliance, equipment, and maintenance. Our analysis helps you understand the long-term financial impact of sourcing analytical testing services.

We offer a risk management framework that identifies supply chain disruptions, regulatory challenges, and supplier reliability issues, helping you mitigate risks in the procurement of analytical testing services.

Our Supplier Relationship Management (SRM) services focus on fostering strong partnerships with providers, ensuring collaboration, favourable contract terms, and consistent quality assurance.

We outline best practices for sourcing analytical testing services, including supplier categorization, pricing strategies, and contract management to make informed, strategic procurement decisions.

Digital transformation enhances procurement by automating processes and leveraging analytics, allowing you to track supplier performance, market trends, and optimize strategies in real-time.

Our supplier performance management tools enable you to monitor service providers, ensuring they meet quality, timelines, and compliance standards, leading to better procurement outcomes.

We support your negotiations by offering market insights, helping you secure better pricing, volume discounts, and flexible payment terms through data-driven strategies.

We provide market analysis tools that offer insights into global trends, supplier market share, and price forecasts, enabling informed procurement decisions.

Our solutions guide you through regulatory compliance, ensuring that providers adhere to necessary standards for quality, safety, and approval processes.

We provide strategies such as backup suppliers and contingency plans to manage disruptions and ensure continuity in testing services.

Using our performance tracking tools, you can monitor key metrics like quality, delivery timelines, and compliance for analytical testing providers, supporting better future procurement decisions.

We identify providers with sustainable practices, ensuring they meet environmental and ethical standards in their testing operations.

Our pricing analysis compares service costs across providers, evaluating trends and negotiation opportunities to ensure the best pricing for your needs.

Table of Contents (TOC)

Executive Summary: Market Overview, Procurement Insights, and Negotiation Leverage

. Analytical Testing Services Market Overview

. Key Highlights

. Supply Market Outlook

. Demand Market Outlook

. Category Strategy Recommendations

. Category Opportunities and Risks

. Negotiation Leverage and Key Talking Points

. Impact of Macroeconomic Factors (e.g., COVID-19, Inflation)

Research Methodology: Procurement Intelligence, Market Analysis, and Spend Analysis

Tools

. Definition and Scope

. Research Objectives for the Analytical Testing Services Market

. Data Sources and Approach

. Assumptions and Limitations

. Market Size Estimation and Forecast Methodology

Market Analysis and Category Intelligence

. Market Maturity and Trends

. Industry Outlook and Key Developments

. Drivers, Constraints, and Opportunities

. Regional Market Outlook within the Analytical Testing Services Market

. Procurement-Centric Five Forces Analysis

. Mergers and Acquisitions (M&As)

. Market Events and Innovations

Cost Analysis, Spend Analysis, and Pricing Insights

. Cost Structure Analysis

. Cost Drivers and Savings Opportunities

. Total Cost of Ownership (TCO) Analysis

. Pricing Analysis and Expected Savings

. Billing Rate Benchmarking

. Factors Influencing Pricing Dynamics

. Contract Pointers and SLAs

. Market Cost Performance Indicators

. Risk Assessment and Mitigation Strategies

. Spend Analytics and Cost Optimization

Supplier Analysis and Benchmarking

. Analytical Testing Services Supply Market Outlook

. Supply Categorization and Market Share

. Analytical Testing Services Market Supplier Profiles and SWOT Analysis

. Supplier Performance Benchmarking

. Supplier Performance Evaluation Metrics

. Disruptions in the Supply Market

Technology Trends and Innovations

. Current Industry Technology Trends

. Technological Requirements and Standards

. Impact of Digital Transformation

. Emerging Tools and Solutions

. Adoption of Standardized Industry Practices

Procurement Best Practices

. Sourcing Models and Strategies

. Pricing Models and Contracting Best Practices

. SLAs and Key Performance Indicators (KPIs)

. Strategic Sourcing and Supplier Negotiation Tactics

. Industry Sourcing Adoption and Benchmarks

Sustainability and Risk Management: Best Sustainability Practices

. Supply Chain Sustainability Assessments

. Corporate Social Responsibility (CSR) Alignment

. Risk Identification and Assessment

. Contingency Planning and Supplier Diversification

. Holistic Risk Mitigation Strategies

Category Strategy and Strategic Recommendations

. Market Entry Strategies

. Growth Strategies for Market Expansion

. Optimal Sourcing Strategy

. Investment Opportunities and Risk Analysis

. Supplier Innovation Scouting and Trends

. Cross-Functional Collaboration Frameworks

Future Market Outlook

. Emerging Market Opportunities

. Predictions for the Next Decade

. Expert Opinions and Industry Insights

Appendices: Procurement Glossary, Abbreviations, and Data Sources

. Glossary of Terms

. Abbreviations

. List of Figures and Tables

. References and Data Sources