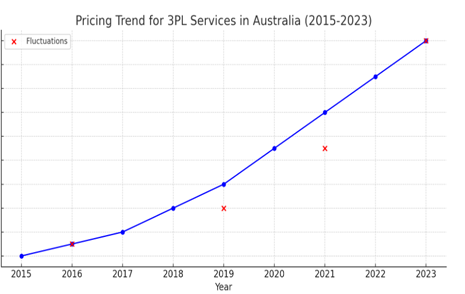

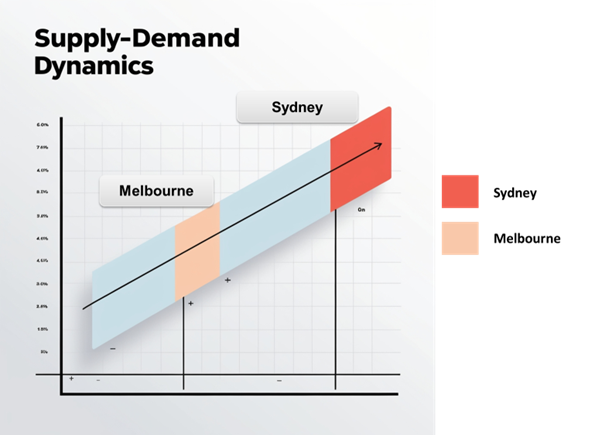

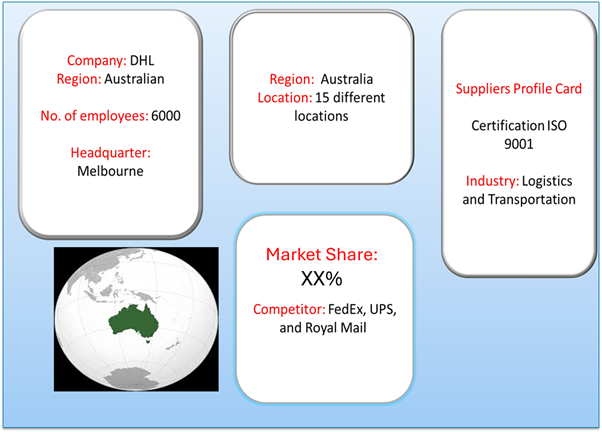

3PL services market Overview The Australian third-party logistics (3PL) market is experiencing significant growth, fueled by the rapid expansion of e-commerce, an increase in trade activities, and a rising demand for integrated logistics solutions. Australia’s strategic geographic location, coupled with a well-developed infrastructure and technological advancements, supports its position as a key player in the global 3PL market. Government initiatives promoting trade and investment also contribute to the growth of logistics services. . Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for 3PL services development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems. The outlook for the 3PL services market in Australia is very positive, with expectations of robust growth driven by the need for efficient supply chain management and logistics solutions. Market Size: The Australian 3PL services market is projected to exceed AUD 16 billion by 2030, growing at a CAGR of 6.2% from 2023 to 2030. Growth Rate: 6.2% Industry Adoption: Major sectors such as retail, healthcare, and manufacturing are increasingly outsourcing logistics operations to 3PL providers to improve operational efficiency and focus on their core business activities. Technological Transformation and Innovations: Advances in logistics technology, including automation, real-time tracking, and AI-driven analytics, are enhancing the efficiency and reliability of 3PL (third-party logistics) services. These innovations support more accurate demand forecasting, inventory management, and route optimization, significantly improving delivery times and reducing costs. Additionally, supplier performance management and vendor performance assessment are becoming critical for companies in this competitive landscape, as businesses seek to ensure optimal service quality and efficiency from their 3PL providers. E-Commerce Boom: The surge in e-commerce activities, particularly post-pandemic, is driving demand for 3PL providers in Australia, who offer specialized services such as warehousing, fulfilment, and last-mile delivery. Sustainability: There is a growing focus on sustainable logistics practices, with 3PL providers in Australia adopting eco-friendly transportation methods and optimizing their operations to reduce environmental impacts. Key Trends and Sustainability Outlook E-Commerce Expansion: The rapid growth of e-commerce in Australia is a primary driver for the demand for 3PL services, as retailers seek to enhance their distribution capabilities and customer service. Sustainability Initiatives: Increasing consumer awareness of environmental issues is pushing 3PL providers to adopt sustainable practices, including greener transportation options and efficient routing strategies. Growth Drivers: Rising E-Commerce Demand: The significant growth in online shopping in Australia is driving the need for warehousing, transportation, and fulfilment services offered by 3PL providers. Outsourcing of Logistics: Businesses are increasingly opting to outsource logistics functions to 3PL providers to concentrate on their core activities and reduce operational expenses. Overview of Market Intelligence Services for the 3PL services Market in Australia The comprehensive analysis from Market Research Future (MRFR) highlights the growth drivers in the Australian 3PL services market, including the burgeoning e-commerce sector, technological innovations, and sustainability efforts. Procurement Intelligence for 3PL Services in Australia: Category Management and Strategic Sourcing To stay ahead in the Australian 3PL services market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective logistics solutions and ensuring the timely availability of critical services, such as warehousing, transportation, and last-mile delivery, to meet the growing demands of various industries. 3PL Services Market Pricing Outlook: Spend analysis The 3PL (third-party logistics) services market in Australia is experiencing significant pricing fluctuations, driven by factors such as rising fuel costs, labor shortages, and the increasing complexity of supply chains. The surge in e-commerce activities, coupled with a growing demand for timely deliveries, is further contributing to the escalation of logistics service costs. The graph shows a general upward trend in pricing for 3PL services market in Australia, likely due to rising costs, increased complexity, and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamics. Comprehensive Price Forecast: Our analysis indicates a consistent upward trend in pricing, influenced by several key factors, including: Rising Fuel Costs: Increasing fuel prices directly impact transportation expenses, leading to higher logistics costs across the board. Labor Market Pressures: Labor shortages and rising wages are driving up operational costs for 3PL providers, affecting pricing strategies. Investment in Technology: The necessity for advanced logistics technologies, such as automation and AI, requires substantial capital investment, contributing to overall service costs. Cost Breakdown for the 3PL Services Market in Australia: Total cost of ownership TCO and cost saving opportunities Transportation Costs (50%) Description: This includes all costs related to freight transportation, such as shipping fees, fuel surcharges, third-party carrier fees, and expenses incurred in the logistics chain from origin to destination. Trends: Fluctuating fuel prices significantly impact transportation costs, which are subject to volatility based on global oil markets. Additionally, the increasing demand for fast and reliable shipping options leads logistics providers to enhance their services, thereby raising operational costs and pushing prices upward. Trends: Cost-Saving Opportunity in the 3PL Services Market in Australia: Negotiation Lever and Purchasing Negotiation Strategies Optimizing procurement strategies in the Australian 3PL services market can lead to significant cost savings and enhanced operational efficiency. Companies can leverage collaborative logistics partnerships to share resources, reducing transportation costs through improved bargaining power. Utilizing advanced route optimization software minimizes fuel consumption and transportation distances, further driving efficiency. Investing in automation technologies, such as robotics in warehousing, can lower labor costs and improve inventory management. Additionally, adopting sustainable practices, like using eco-friendly transportation solutions, not only reduces operational costs but also meets regulatory requirements. Implementing data analytics tools enhances supply chain visibility, helping identify inefficiencies and minimize waste. These strategies align with the growing demand for 3PL services in Australia, driven by e-commerce and globalization. For further insights, you can refer to detailed analyses from various market research sources. Supply and Demand Overview of the 3PL Services Market in Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM) The 3PL services market in Australia is experiencing robust growth driven by the rising demand for efficient logistics solutions, increased e-commerce activity, and advancements in supply chain technologies. Demand is particularly high due to the ongoing need for reliable warehousing, transportation, and distribution services, supported by collaborations among logistics providers, retail companies, and technology firms. This growth is further accelerated by the emphasis on streamlined delivery solutions and last-mile services to meet the evolving needs of Australian businesses across various sectors. Demand Factors: E-commerce Growth: The Australian e-commerce sector is witnessing rapid growth, significantly boosting the demand for third-party logistics (3PL) services. Businesses are increasingly relying on 3PL providers to manage their distribution networks effectively to meet the rising expectations for faster deliveries. Customization & Flexibility: There is a notable trend towards customized logistics solutions. Companies prefer flexible service models from 3PL providers that can adjust to fluctuating market demands. Globalization of Trade: As Australian businesses expand internationally, the need for 3PL services to navigate complex cross-border supply chains has increased, ensuring timely and cost-effective deliveries. Technological Integration: The integration of advanced technologies like IoT, AI, and data analytics is enhancing operational efficiencies, further driving demand for innovative 3PL solutions. Supply Factors: Diverse Service Offerings: Australian 3PL providers are broadening their service offerings, which now include transportation, warehousing, inventory management, and value-added logistics services, catering to a wide array of client needs. Increased Competition: The entry of new players and the expansion of existing companies into the Australian market are fostering competitive dynamics, which improve service quality and drive innovation. Technological Advancements: Continuous innovations in logistics technologies, such as automated systems and real-time tracking, are improving service efficiency and reliability, making 3PL solutions more appealing to businesses. Strategic Partnerships: Collaborations between 3PL providers and various stakeholders, including manufacturers and retailers, are enhancing logistics capabilities and resource management, contributing to improved execution of logistics strategies Australia is emerging as a significant hub for 3PL services, characterized by the following: E-commerce Dominance: Major Australian e-commerce players heavily rely on 3PL services for rapid fulfilment and flexible shipping options, driving market growth. Investment in Infrastructure: Continuous investment in logistics infrastructure, such as transportation networks and warehousing facilities, supports the scalability and efficiency of 3PL operations in the region. Technological Innovation: Australian companies are leading the way in logistics technology advancements, integrating automated systems and analytics to optimize supply chain processes. Regulatory Framework: A stable regulatory environment promotes international trade and logistics operations, facilitating growth and innovation within the 3PL sector. Sustainability Initiatives: There is a growing focus on sustainable logistics practices, with 3PL providers adopting eco-friendly solutions to meet regulatory requirements and consumer preferences. Australia 3PL services innovation and growth Supplier Landscape: Supplier Negotiations and Strategies The supplier penetration in the 3PL services market in Australia is substantial, with a growing number of global and regional players contributing to the provision of logistics, warehousing, and transportation solutions. These suppliers play a crucial role in the overall market dynamics, impacting pricing, service quality, and accessibility. The market is highly competitive, with suppliers ranging from large logistics providers to specialized firms focusing on last-mile delivery and niche logistics solutions. Currently, the supplier landscape is characterized by significant consolidation among top-tier logistics companies, which dominate the market share. However, emerging players and startups are also expanding their footprint by focusing on specialized services and advanced technologies that cater to the specific needs of Australian industries, such as e-commerce and retail. Some of the key suppliers in the 3PL Services Market in Australia include: Key development: Procurement Category Significant Developments Key Development Description Impact on Market E-Commerce Growth Significant increase in online shopping trends post-pandemic. Boosted demand for 3PL services, particularly in last-mile delivery. Technology Integration Adoption of AI, IoT, and automation in logistics operations. Enhanced operational efficiency and real-time tracking capabilities. Sustainability Initiatives Focus on green logistics and reducing carbon footprints. Increasingly important for clients seeking eco-friendly supply chain solutions. Government Investment Funding for transport infrastructure and logistics facilities. Improved logistics capacity and efficiency across the supply chain. Procurement Attribute/Metric Details Market Sizing The 3PL services market in Australia is projected to grow up to USD 10 billion in by 2032, with a CAGR of 6.2% (2024-2032). 3PL Services Adoption Rate 50% of businesses in Australia are adopting 3PL services to streamline logistics, reduce costs, and improve supply chain efficiency. Top 3PL Strategies for 2024 Focus on leveraging automation and AI, improving last-mile delivery, and enhancing customer experience. Sustainability and eco-friendly solutions are also gaining momentum. 3PL Process Automation 40% of Australian 3PL providers have automated key logistics operations, including warehousing, inventory management, and tracking. 3PL Services Challenges Major challenges include addressing supply chain disruptions, meeting rising customer expectations for faster delivery, and optimizing route planning. Key Suppliers Leading 3PL service providers in Australia include DHL Supply Chain, Linfox, DB Schenker, Toll Group, and Kuehne + Nagel, offering integrated logistics solutions such as warehousing, transportation, and distribution. Key Regions Covered Australia-wide, with specific focus on key hubs such as Sydney, Melbourne, Brisbane, and Perth, where logistics infrastructure and demand for 3PL services are high. Market Drivers and Trends Growth is driven by e-commerce expansion, increasing demand for omnichannel logistics, and the need for faster, more efficient deliveries. Trends include the adoption of robotics in warehouses, sustainable logistics practices, and smart supply chain technology.

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide a detailed analysis of the Australian 3PL (Third-Party Logistics) market. We identify top 3PL service providers, assess their capabilities, and offer insights into cost-saving opportunities, performance benchmarks, and supplier landscapes.

We evaluate TCO for 3PL services by analyzing direct costs such as transportation, warehousing, and distribution alongside indirect costs like technology investments, compliance fees, and risk management expenses. Our comprehensive cost analysis ensures clarity on long-term financial impacts.

We provide robust risk management frameworks tailored for the Australian 3PL market, addressing potential challenges like service disruptions, labor shortages, and regulatory compliance risks. Our solutions minimize uncertainties and ensure a resilient logistics supply chain.

Our Supplier Relationship Management (SRM) services help you build and sustain strong partnerships with 3PL providers. This includes negotiating advantageous terms, aligning strategic goals, and fostering collaboration to improve service efficiency and reduce costs.

We guide you through procurement best practices for the 3PL market in Australia, including supplier segmentation, performance monitoring, strategic sourcing, and long-term contract management to optimize logistics operations and cost-effectiveness.

Digital transformation enhances procurement processes through tools like automated supplier tracking, real-time data analytics, and demand forecasting. Our solutions enable you to monitor market trends, track logistics KPIs, and refine procurement strategies.

Supplier performance management ensures consistent delivery of 3PL services. We provide tools and methodologies to evaluate provider performance on metrics like timeliness, accuracy, and compliance, enabling you to maintain high service standards.

Our market intelligence offers data-driven negotiation strategies, empowering you to secure competitive pricing, flexible delivery terms, and favorable service-level agreements. We analyze market conditions to support well-informed supplier discussions.

Our advanced market analysis tools deliver insights into Australian 3PL market trends, supplier performance metrics, and pricing dynamics. These tools empower data-backed decision-making for improved procurement outcomes.

We assist in navigating the regulatory landscape for the 3PL industry in Australia. Our services include compliance assessments, ensuring your logistics providers adhere to local and international standards for safety, environmental sustainability, and operational reliability.

To address supply chain disruptions, we recommend diversification of 3PL providers, leveraging technology for predictive analytics, and establishing contingency plans. Our market insights help secure stable and reliable logistics solutions.

Our performance tracking solutions monitor 3PL providers on key metrics such as delivery timelines, cost efficiency, and customer satisfaction. Regular evaluations ensure continuous improvement and reliability in service.

We identify 3PL providers in Australia who integrate sustainability practices, such as green warehousing and eco-friendly transportation. Our assessments ensure your logistics operations align with environmental and corporate responsibility goals.

We conduct pricing analyses and benchmarking to help you secure competitive rates. By evaluating cost structures, market trends, and supplier-specific pricing models, we support cost-effective decision-making.

Our in-depth market analysis highlights emerging opportunities such as advanced logistics technologies and growing e-commerce demands in Australia. We also outline risks like capacity constraints and cost volatility, helping you stay ahead of industry dynamics.

Table of Contents (ToC)

Executive Summary: Market Overview, Procurement Insights, and Negotiation

Leverage

3PL Services Market Overview

Key Highlights

Supply Market Outlook

Demand Market Outlook

Category Strategy Recommendations

Category Opportunities and Risks

Negotiation Leverage and Key Talking Points

Impact of Macroeconomic Factors (e.g., COVID-19, Inflation)

Research Methodology: Procurement Intelligence, Market Analysis, and Spend

Analysis Tools

Definition and Scope

Research Objectives for the 3PL Services Market

Data Sources and Approach

Assumptions and Limitations

Market Size Estimation and Forecast Methodology

Market Analysis and Category Intelligence

Market Maturity and Trends

Industry Outlook and Key Developments

Drivers, Constraints, and Opportunities

Regional Market Outlook within the 3PL Services Market

Procurement-Centric Five Forces Analysis

Mergers and Acquisitions (M&As)

Market Events and Innovations

Cost Analysis, Spend Analysis, and Pricing Insights

Cost Structure Analysis

Cost Drivers and Savings Opportunities

Total Cost of Ownership (TCO) Analysis

Pricing Analysis and Expected Savings

Billing Rate Benchmarking

Factors Influencing Pricing Dynamics

Contract Pointers and SLAs

Market Cost Performance Indicators

Risk Assessment and Mitigation Strategies

Spend Analytics and Cost Optimization

Supplier Analysis and Benchmarking

3PL Services Supply Market Outlook

Supply Categorization and Market Share

3PL Services Supplier Profiles and SWOT Analysis

Supplier Performance Benchmarking

Supplier Performance Evaluation Metrics

Disruptions in the Supply Market

Technology Trends and Innovations

Current Industry Technology Trends

Technological Requirements and Standards

Impact of Digital Transformation

Emerging Tools and Solutions

Adoption of Standardized Industry Practices

Procurement Best Practices

Sourcing Models and Strategies

Pricing Models and Contracting Best Practices

SLAs and Key Performance Indicators (KPIs)

Strategic Sourcing and Supplier Negotiation Tactics

Industry Sourcing Adoption and Benchmarks

Sustainability and Risk Management: Best Sustainability Practices

Supply Chain Sustainability Assessments

Corporate Social Responsibility (CSR) Alignment

Risk Identification and Assessment

Contingency Planning and Supplier Diversification

Holistic Risk Mitigation Strategies

Category Strategy and Strategic Recommendations

Market Entry Strategies

Growth Strategies for Market Expansion

Optimal Sourcing Strategy

Investment Opportunities and Risk Analysis

Supplier Innovation Scouting and Trends

Cross-Functional Collaboration Frameworks

Future Market Outlook

Emerging Market Opportunities

Predictions for the Next Decade

Expert Opinions and Industry Insights

Appendices: Procurement Glossary, Abbreviations, and Data Sources

Glossary of Terms

Abbreviations

List of Figures and Tables

References and Data Sources