Market Trends

Key Emerging Trends in the Tendinitis Treatment Industry

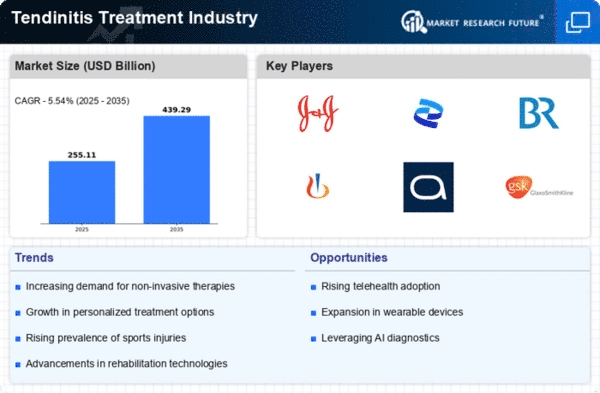

The Tendinitis Treatment market within the Americas and Europe is undergoing dynamic changes encouraged by factors including an aging population, extended sports activities-related accidents, and advancements in clinical treatment options. This market encompasses numerous tendencies aimed at imparting effective and centered answers for individuals coping with tendinitis. The market trends are driven by a growing occurrence of tendinitis, specifically among most of the aging population and people engaged in sports. Sports-associated accidents, such as overuse of tendons, contribute substantially to the superiority of tendinitis in both the Americas and Europe. A first-rate trend is the focal point of regenerative remedy for Tendinitis Treatment. Stem mobile therapies, platelet-rich plasma (PRP) injections, and different regenerative approaches are gaining traction as they intend to promote tissue restoration and regeneration, supplying capability and long-term benefits for tendinitis patients. The pharmaceutical sector is witnessing innovations in medications, in particular, those designed for Tendinitis Treatment. Anti-inflammatory capsules, pain relievers, and topical treatments are being developed to address the signs of tendinitis, presenting sufferers with centered relief. The market traits are leaning in the direction of precision remedy for tendinitis, thinking about individual variations in response to treatment. Tailoring interventions based on affected persons' unique factors, which include genetics and way of life, is becoming a key consideration for optimizing treatment results. Wearable generation plays a function in tendinitis control, especially in the tracking of bodily pastimes and biomechanics. These technologies offer real-time information, allowing healthcare carriers to customize treatment plans and music-affected person development more correctly. The adoption of telehealth services is growing, supplying patients within the Americas and Europe with the right of entry to faraway consultations with healthcare specialists. This trend complements the accessibility of Tendinitis Treatment, taking into consideration well-timed steering and follow-up appointments without the need for in-person visits. The regulatory landscape is evolving, impacting the Tendinitis Treatment market. Stricter policies and compliance necessities ensure the protection and efficacy of treatments, fostering an extra transparent and responsible market for tendinitis treatments. While improvements are going on, challenges related to the value of Tendinitis Treatments persist. Market traits are step by step addressing those demanding situations, focusing on improving healthcare accessibility and affordability to reach a broader patient populace. Collaborative research efforts and ongoing medical trials are using innovation in Tendinitis Treatment. Partnerships among pharmaceutical businesses, studies establishments, and healthcare vendors boost the development of novel cures and make contributions to the growth of remedy alternatives. The market for tendinitis treatment within the Americas and Europe is poised for a continued boom, driven by an aggregate of improvements in regenerative medication and pharmaceutical improvements and a focal point on personalized care.

Leave a Comment