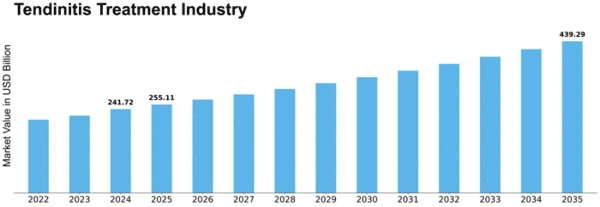

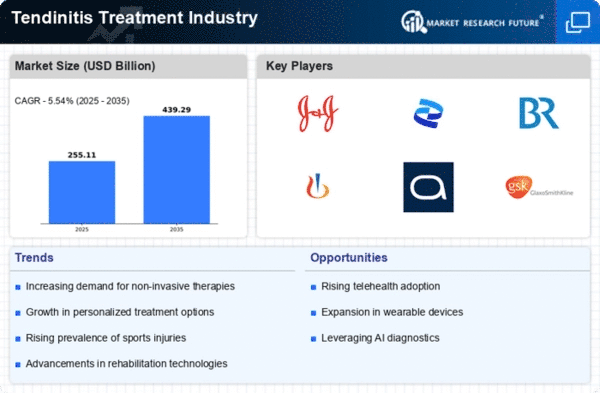

Tendinitis Treatment Industry Size

Tendinitis Treatment Industry Growth Projections and Opportunities

The Americas and Europe Tendinitis Treatment market is encouraged by way of demographic traits, in particular, the aging population. As the average age increases, the prevalence of tendinitis rises, growing a better demand for treatments and influencing market increase. The occurrence of tendonitis is related to sports activities and bodily interest traditions in these regions. High degrees of sports participation contribute to tendinitis cases, shaping market dynamics by emphasizing the want for specialized treatments catering to athletes and active individuals. Workplace ergonomics and occupational elements affect the Tendinitis Treatment market. Certain occupations that contain repetitive movements or pressure on specific tendons contribute to tendinitis development, influencing the demand for remedies tailor-made to occupational causes. Lifestyle-associated conditions, including weight problems and sedentary existence, affect the occurrence of tendonitis. The need strikes the market for holistic treatment strategies addressing lifestyle elements that contribute to tendinitis, emphasizing the importance of patient education and lifestyle interventions. Advances in regenerative medicine affect the Tendinitis Treatment panorama. The development of remedies consisting of platelet-rich plasma (PRP) and stem mobile treatments contributes to market dynamics by supplying innovative and alternative methods to conventional remedies. Technological innovations in remedy modalities influence market factors. Advancements in physical therapy techniques, minimally invasive methods, and wearable technologies for rehabilitation have contributed to the evolution of Tendinitis Treatment options, shaping market developments. Ongoing studies and development efforts contribute significantly to market dynamics. Investments in understanding the molecular and genetic foundation of tendinitis drive the improvement of centered treatments, impacting the availability of powerful treatments inside the market. Patient awareness and the trend in the direction of self-care impact market elements. Increased awareness about tendinitis signs, preventive measures, and self-care techniques contributed to early diagnosis and patient-pushed demand for unique treatments, influencing the market boom. The kingdom of healthcare infrastructure and the right of entry to treatment centers affect market dynamics. Disparities in healthcare sources and treatment availability throughout one-of-a-kind areas impact patients' right of entry to Tendinitis Treatments, developing versions in demand. Insurance insurance and repayment guidelines impact the Tendinitis Treatment market. The accessibility of remedies is impacted with the aid of compensation mechanisms, with favorable policies using patient entry to influence market growth. The monetary impact of tendinitis and the affordability of healthcare services have an impact on market dynamics. Economic issues, consisting of the price of medicines and healthcare services, play a function in affected persons getting admission to Tendinitis Treatments and typical market tendencies.

Leave a Comment