Market Analysis

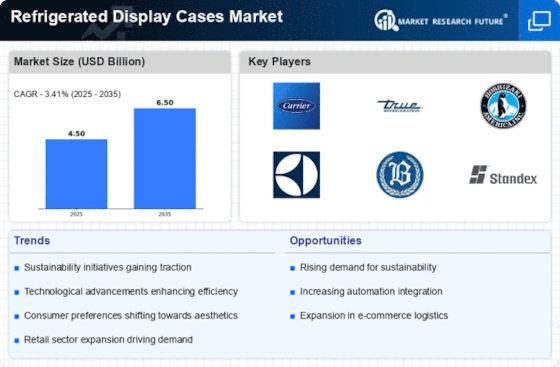

Refrigerated Display Cases Market (Global, 2024)

Introduction

The cooled display case is a major player in the retail and foodservice industries, owing to the rising demand for the efficient and attractive display of perishables. Retailers are investing in new, advanced refrigerated display systems, which not only offer the best possible visibility of products but also ensure the best possible preservation of food. The cooled display case market features a wide range of products, including vertical and horizontal display cases, for different retail settings, such as hypermarkets, convenience stores, and restaurants. Energy-efficiency and eco-friendliness are also gaining importance, and manufacturers are launching new products to meet the latest regulatory standards and consumer expectations. The cooled display case market is highly dynamic, with new opportunities and challenges for the players as they try to cope with the supply chain issues, technological advancements, and changing consumer preferences in the increasingly competitive environment.

PESTLE Analysis

- Political

- In 2024 the government will have made a law on energy efficiency for commercial refrigerators. For example, the Department of Energy will have set a minimum energy consumption of 0.5 kilowatt-hours per day per cubic foot of the cold room. This is a 20 per cent reduction in the previous standards. This political drive towards energy efficiency will make manufacturers innovate and adapt their products to meet these regulations, and in doing so affect their production costs and marketing strategies.

- Economic

- The world inflation rate is expected to stabilize at around 3.5 per cent in 2024, which will have a significant impact on the behavior of consumers and the economic climate. In the retail sector, the operating costs of companies with refrigerated display cabinets rose by 15 per cent in the second quarter of this year, primarily due to rising energy prices and the disruption of the supply chain. In order to reduce costs, companies are increasingly looking for energy-saving solutions, which is driving the demand for advanced refrigerated display technology.

- Social

- It is a fact that in the recent past the tendency of consumers has been to adopt the greenest, the most sustainable methods of production. According to a recent survey, seven out of ten consumers prefer to shop in stores which use energy-saving appliances. The trend towards a more sustainable society has pushed retailers to invest in new refrigerated display cases, which not only reduce energy consumption but also enhance the shopping experience. In addition, the growing concern for food safety and quality is driving demand for advanced solutions to ensure the proper temperature of the goods.

- Technological

- The development of cooling technology is rapidly advancing, and smart cooling systems are gaining ground in the market. It is estimated that by 2024, about 40% of new refrigerated display cabinets will be connected to the Internet, and they will be able to monitor and control temperature and energy consumption in real time. This not only saves energy, but also provides retailers with big data to optimize inventory and reduce waste.

- Legal

- In 2024, the European Union’s F-Gas Regulation becomes a major concern for the manufacturers of refrigerated display cabinets. By 2030, the use of hydrofluorocarbons is to be reduced by 79%. This forces manufacturers to change to more environmentally friendly refrigerants. The fines for not complying with this law can reach up to a hundred thousand euros. Consequently, companies’ viability and market position are adversely affected.

- Environmental

- The effect of refrigerating machines on the environment is now under investigation, and the principal point of concern is the global warming potential of refrigerants. By 2024, the average global warming potential of refrigerants used in refrigerated display cabinets is expected to fall to 1500 from 2,550 this year, as manufacturers are expected to shift to low-GWP alternatives. This shift is a crucial step towards reducing the industry’s carbon footprint, and it is in line with international efforts to combat climate change.

Porter's Five Forces

- Threat of New Entrants

- The market for refrigerated display cases has a medium barrier to entry, as the technology and manufacturing facilities required are substantial. The market leaders can take advantage of economies of scale and the loyalty of their customers to protect their position. However, advances in technology and the growing demand for energy-efficient solutions may lead to new companies entering the market.

- Bargaining Power of Suppliers

- The bargaining power of suppliers in the refrigerated display case market is relatively low. There are numerous suppliers of raw materials and components, which makes the market highly competitive. The manufacturers can easily change suppliers if prices rise or quality deteriorates, which reduces the bargaining power of suppliers. However, the suppliers of certain specialized components may have more bargaining power.

- Bargaining Power of Buyers

- The buyers of the refrigerated display case market have high bargaining power because of the availability of several alternatives and the possibility of comparing prices and features. The retailers and the caterers seek the best value for their investment, which makes them price-sensitive. Moreover, large buyers can negotiate more favorable terms, which increases their bargaining power.

- Threat of Substitutes

- The threat of substitutes in the market for refrigerated display cases is moderate. There are alternative cooling solutions, such as walk-in coolers and freezers, but the specific functionality and design of display cases meet particular retail needs. The threat of substitutes could, however, increase if innovations in packaging and storage solutions bring similar benefits at a lower cost.

- Competitive Rivalry

- The market for refrigerated display cases is highly competitive, with many players vying for market share. Price, quality, energy efficiency, and innovation are the key factors determining the success of a company. Brands are continually improving their products and marketing their offerings to win over consumers.

SWOT Analysis

Strengths

- High demand for energy-efficient and eco-friendly refrigeration solutions.

- Technological advancements leading to improved temperature control and display aesthetics.

- Strong growth in the retail and foodservice sectors driving market expansion.

- Diverse product offerings catering to various industries, including supermarkets, restaurants, and convenience stores.

Weaknesses

- High initial investment costs for advanced refrigerated display cases.

- Maintenance and repair costs can be significant over time.

- Limited awareness among small businesses about the benefits of modern refrigerated display solutions.

- Dependence on electricity and potential issues with power outages affecting performance.

Opportunities

- Growing trend towards online grocery shopping increasing demand for refrigerated displays in logistics.

- Expansion into emerging markets with rising disposable incomes and urbanization.

- Increased focus on sustainability leading to innovations in energy-efficient designs.

- Potential for integration with smart technology for enhanced monitoring and management.

Threats

- Intense competition leading to price wars and reduced profit margins.

- Economic downturns affecting consumer spending and retail operations.

- Regulatory changes regarding energy efficiency standards impacting product designs.

- Supply chain disruptions affecting availability of components and materials.

Summary

The refrigerated display case market in 2024 is characterized by high demand, driven by energy efficiency and technological advancements, especially in the retail and food service industries. The high initial cost and the high cost of maintenance are a significant weakness. Opportunities arise in emerging markets and the growing trend of e-commerce. Threats arise from competition and from changes in the regulatory framework. Opportunities and threats can be exploited by deploying the strengths of the companies and reducing the weaknesses.

Leave a Comment