Market Trends

Introduction

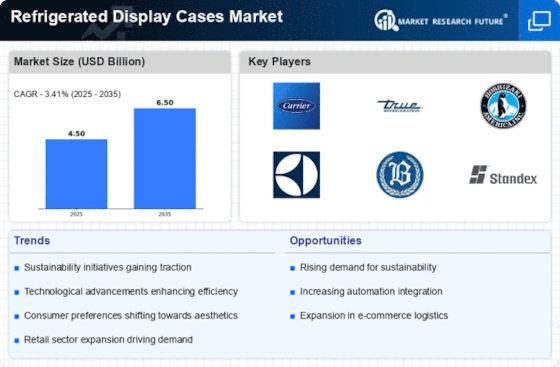

By the time we reach 2024, the refrigerated display case market is experiencing significant transformation, driven by a combination of macroeconomic factors. A number of technological advances, such as increased energy efficiency and smarter refrigerating systems, are changing the product offerings and the operational capabilities of the industry. At the same time, regulatory pressures, with an emphasis on reducing the impact on the environment, are pushing manufacturers to innovate and comply with stricter standards. And then there’s the changing consumer behavior, with the rising demand for sustainable and attractive shopping environments. These trends are strategically important for the industry. Not only do they define the competitive landscape, they also influence the way in which the industry addresses its wider sustainable development goals and consumers’ expectations.

Top Trends

-

Sustainability Initiatives

The governments of the world are pushing for greener technology. The demand for energy-saving refrigerated display cases is increasing. The European Green Deal, for example, aims to reduce greenhouse gas emissions, which drives manufacturers to innovation. Daikin is investing in green refrigerants that can reduce energy consumption by up to 30 percent. The trend is not only a response to government regulation, but also an opportunity for brand building. -

Smart Technology Integration

The use of IoT and smart technology in refrigerated cabinets has increased, and the operation has been greatly improved. Leaders in the industry have used smart temperature and humidity sensors to monitor the temperature and humidity of their products, and the percentage of food spoilage has been reduced by 15%. Emerson Electric Co., which has been leading the trend of the times, provides real-time data analysis to achieve accurate stock control. It is expected that the cost of operation will be greatly reduced. -

Customization and Modular Designs

There is a growing tendency towards a flexible, diversified, and modular cooling system that meets the various requirements of the trade. Retailers are increasingly looking for a solution tailored to their own space and product needs. True Manufacturing is a manufacturer of such a solution. Modular and flexible, it has led to an increase in customer satisfaction of 20 percent. This tendency will continue, as more and more retailers will want to be able to change their display solutions as needed. -

Focus on Food Safety

With the rising awareness of food hygiene, manufacturers are now concentrating on the hygienic features of refrigerated display cabinets. The stricter hygienic standards of the authorities are bringing new developments in antimicrobial surfaces. For example, Hussmann has developed cabinets with a 99% reduction in microbial contamination using a special UV-C light. This is expected to increase trust and thus influence buying decisions. -

Expansion in E-commerce

The growth of e-commerce is reshaping the market for cold displays, as the trend for grocery shopping by Internet grows. There is a corresponding demand for compact, efficient and mobile cold displays. The market leaders are investing in technology that enables a smooth transfer to the e-commerce platforms. This is bound to change the strategies of retail and the logistics of supply chains. -

Enhanced Aesthetics and Branding

In the case of refrigerated cabinets, the design of the interior is of increasing importance to the retailers, for the sake of brand visibility and the customer experience. The use of attractive and innovative designs and finishes is now standard. It has been shown that sales can be increased by up to 25 percent by attractive and appealing displays. The trend is being driven forward by companies like AHT Cooling Systems, which offers stylish and practical solutions. This aesthetic emphasis is expected to create competition and innovation. -

Increased Use of Natural Refrigerants

Business is increasingly turning to natural refrigerants in order to comply with the regulations. Because of their low global warming potential, natural refrigerants such as CO2 and hydrocarbons are increasingly used. Bitzer is one of the pioneers of this trend. Its systems can reduce CO2 emissions significantly. This transition will change the supply chain and the development of future products. -

Digital Marketing and Consumer Engagement

The refrigerated display cases market is a digitally dominated market, and digital marketing strategies are becoming increasingly important for the companies operating in this market. Social media and targeted advertising are used by companies to reach their potential customers, and this has resulted in an increase of 40% in the number of inquiries received. Companies such as Panasonic use the digital platform to showcase their innovations. This is expected to increase brand loyalty and sales through improved customer interaction. -

Global Supply Chain Optimization

The need for an efficient supply chain is becoming more and more important in the chilled cabinet market, especially post-pandemic. Consequently, companies are investing in logistics technology to improve the performance of their operations and to reduce lead times. For example, Arneg has implemented advanced tracking systems that have increased the efficiency of its deliveries by 25%. This trend will likely increase the market’s resilience and its competitiveness. -

Regulatory Compliance and Standards

A major trend in the display-case market is compliance with the changing regulations. In order to meet stricter safety and energy-efficiency standards, manufacturers have had to adopt new methods. Carrier is already offering products that meet the new requirements in order to ensure that it has access to the market. This trend will encourage innovation and increase the costs of those who do not comply.

Conclusion: Navigating the Competitive Landscape Ahead

Looking to 2024, the refrigerated display cabinets market is characterized by high fragmentation, and both established and new players are fighting for a larger share. A regional trend is a growing demand for energy-efficient and sustainable solutions, which is forcing the suppliers to adapt and innovate. A few of the established companies are relying on their established brand and distribution network, while the newcomers are focusing on newer technologies such as automation and artificial intelligence, to increase operational efficiency and customer engagement. For suppliers that want to be at the forefront, the ability to integrate sustainable practices and be flexible in their product offerings will be decisive. These capabilities should therefore be prioritised in the investment plans to keep up with the competition and to meet the changing demands of the consumers.

Leave a Comment