Market Analysis

In-depth Analysis of Micro Mobile Data Center Market Industry Landscape

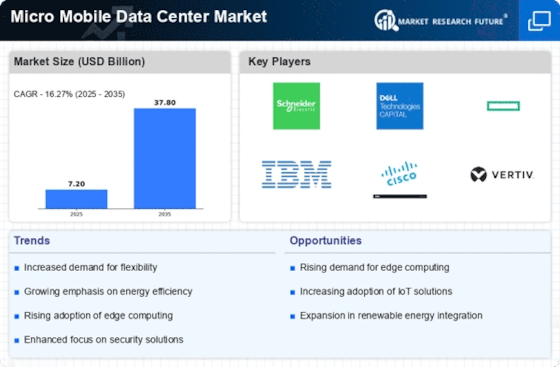

Several market aspects affect the Micro Mobile Data Center Market's growth and dynamics. The rise of data-intensive applications and the Internet of Things are driving edge computing demand. Compact and transportable data center solutions are in demand as organizations handle and analyze data locally. With its edge network computing resources, micro mobile data centers are gaining popularity in numerous sectors.

Advances in technology shape the Micro Mobile Data Center Market. Micro mobile data centers are getting more efficient, powerful, and adaptable as computing technologies advance. Modular architecture, energy efficiency, and strong security are common in these systems. The market is constantly evolving as suppliers create solutions for varied applications and sectors' computing demands.

Edge computing and 5G networks affect the Micro Mobile Data Center Market. Micro mobile data centers serve edge computing settings as low-latency, high-bandwidth applications become more popular. 5G networks increase the requirement for edge infrastructure, increasing the deployment of mini mobile data centers to process and store data closer to end-users.

Micro Mobile Data Center market dynamics depend on competition. With many manufacturers offering different solutions, competition is strong. Vendors differentiate themselves by creating deployable, scalable, and edge computing-compatible solutions. Competitive pressure drives providers to innovate to meet enterprises' changing edge computing demands.

Economic variables affect Micro Mobile Data Center Market. Businesses and service providers invest in edge computing infrastructure based on their finances. In economic downturns, enterprises may emphasize cost-cutting, affecting micro mobile data center implementation. In contrast, when economies recover, IT infrastructure is improved to accommodate rising technologies, driving the Micro Mobile Data Center Market.

Geopolitics and global events can affect market dynamics. Micro mobile data centers and edge computing systems may be affected by geopolitics and global events. International cooperation, trade policies, and geopolitical issues might influence Micro Mobile Data Center Market vendor and organization decisions.

Micro Mobile Data Center providers must consider customer preferences and industry standards. Different sectors may have different edge computing deployment demands and obstacles. Micro mobile data center vendors must personalize and effectively meet these needs. Understanding and meeting these market peculiarities helps providers stand out and fulfill various consumer expectations.

Leave a Comment