Market Trends

Key Emerging Trends in the Kitchen Chimney Market

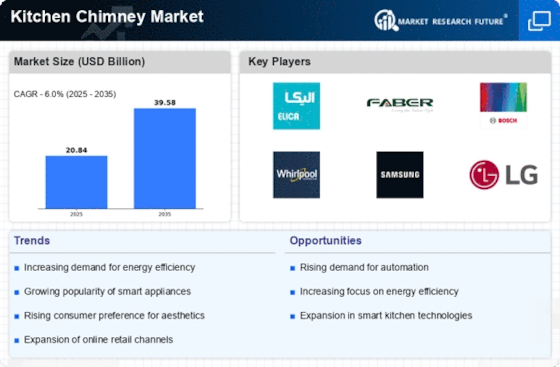

The kitchen chimney industry is as of now encountering a critical shift because of developing shopper tastes. Progressively, the market is perceiving the worth of smoothed out, simple plans that offer productive ventilation while flawlessly mixing into contemporary kitchen style. To fulfil this interest, producers are integrating tastefully satisfying plans and top notch gets done, subsequently increasing the generally speaking visual appeal of the kitchen. In accordance with the more extensive shrewd home patterns, the kitchen chimney market is consolidating keen advancements, for example, contact controls, remote observing, and mix with savvy home environments to give purchasers more noteworthy adaptability and accommodation. As buyer inclinations shift toward manageability and energy productivity, there is a developing interest for ecologically dependable kitchen chimneys. By creating models with negligible natural effect, makers exhibit their devotion to mindful strategic approaches. Kitchen stacks are right now seeing an upsurge in customization patterns, as makers offer items with adaptable coatings, level changes, and extraction aspects to oblige explicit requirements. The kitchen chimney market is encountering a huge expansion popular because of wellbeing cognizant shoppers' developing familiarity with air quality, especially in the kitchen, and the requirement for modern filtration frameworks to guarantee a perfect cooking climate. The ascent of web-based business and internet shopping is essentially affecting the market, as customers progressively use advanced stages for buying, assessing, and investigating items. Accordingly, producers are constrained to alter and improve their contributions. For kitchen chimneys, treated steel stays prevalent because of its strength, low upkeep prerequisites, and contemporary tasteful. Notwithstanding, an arising pattern is the utilization of elective materials for class, for example, glass and planner wraps up. The industry is progressively embracing sound decrease innovations with an end goal to keep up with execution and furnish purchasers with a serene and open to cooking climate. In light of advancing shopper inclinations, the industry is encountering dynamic patterns that incorporate smoothed out plans, clever advancements, energy proficiency, customization, and wellbeing cognizant characteristics. Because of these turns of events, makers are growing their product offerings to satisfy the developing needs of contemporary shoppers, subsequently getting a cutthroat direction for the business.

Leave a Comment