Market Analysis

In-depth Analysis of High Voltage Amplifier Market Industry Landscape

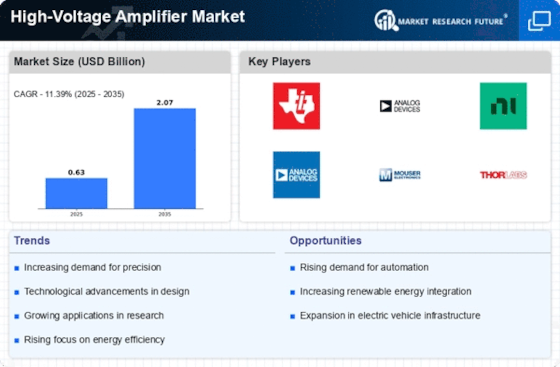

High voltage amplifiers are such that their market dynamics exhibit a lot of movement and changes, which affect the way they develop. Technological advancement is one such factor. There is always a need for high-voltage amplifiers as newer technologies emerge to support innovation in these fields. On the other hand, economic factors play a fundamental role in determining the market dynamics of high-voltage amplifiers. For instance, spending on research and development (R&D) is directly affected by the overall condition of an economy within certain regions or countries, depending on their capabilities and capacities. Hence, when economies expand, there will be more funding for advanced production systems. This will entail increased demand for high-voltage amplifiers worldwide. On top of that, government regulations and policies also have an impact on how markets operate. In some cases where safety standards and performance criteria are mandatory, as seen in industries like aerospace and healthcare, high-voltage amplifiers will be needed to meet these stringent requirements. Market competition also influences dynamic scenarios regarding High Voltage Amplifier market trends. Due to the presence of several other firms in that particular industry, they are forced to keep making improvements on their products, hence promoting innovation, which leads to better quality goods being produced all along. Also, global trends have far-reaching impacts on the high voltage amplifier market since activities such as growth towards renewable energy sources and the rising popularity of electric cars affect what types of HVAs would be needed by new progressive markets. Therefore, manufacturers should be able to recognize these changes if they want to make good business out of them. Customer preferences and requirements also influence market dynamics. The manufacturing of high-voltage amplifiers must adapt and create products that meet specific consumers' needs as the industry seeks increasingly specialized solutions. Market dynamics, on the other hand, are greatly shaped by the availability and price of raw materials. Geopolitical factors are another layer of complexity in the HVA market dynamics. Supply chains, manufacturing processes, and distribution channels can be affected by trade policies, geopolitical tensions, and global economic conditions, among other factors. Moreover, there is a wider trend towards miniaturization in the High Voltage Amplifier market. The growing trend for devices to be smaller and more compact has increased demand for high-performance voltage amplifiers that take up less space. As such, manufacturers have to invest more in research and development to keep up with these changing market demands.

Leave a Comment