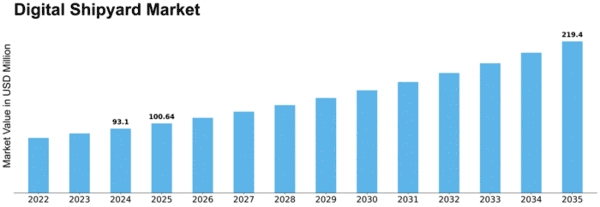

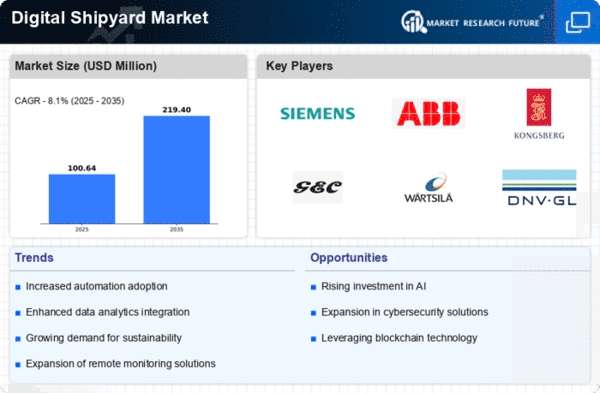

Digital Shipyard Size

Digital Shipyard Market Growth Projections and Opportunities

Simulation and virtual training have become popular and cost-effective alternatives to traditional live training. This innovative solution has gained significant attention in recent years due to its versatility in applications, including virtual military training, emergency evacuation simulations, virtual firefighting exercises, and more. Notably, all branches of the military, such as the army, navy, and air force, have benefited from this advanced training method.

Advancements in computer technology have played a crucial role in enhancing simulation platforms. The continuous improvement of computer processors, graphics capabilities, computing speed, hardware, and visual displays has resulted in more realistic simulations. This progress allows individuals to engage in activities like piloting a plane, operating a submarine, dropping bombs, and firing missiles in a lifelike virtual environment—tasks that would be challenging or impossible in the real world.

The military simulation and virtual training market are primarily driven by factors such as the increasing emphasis on maritime security, leading to a growing demand for virtual solutions in naval training. Additionally, there is a focus on implementing flight simulators to train combat aircraft pilots. However, it's important to note that virtual systems may not fully replicate the psychological effects experienced during live training, posing a potential limitation to market growth. Despite this challenge, the adoption of augmented reality (AR) technology in the aerospace and defense sector, along with the rising use of unmanned aerial vehicles (UAVs) and the subsequent demand for drone simulators, presents promising growth opportunities for the market.

The global military simulation and virtual training market are projected to experience a Compound Annual Growth Rate (CAGR) of 6.92% during the forecast period from 2018 to 2023. In 2017, North America led the market with a 35.02% share, followed by Europe and Asia-Pacific with shares of 24.45% and 22.74%, respectively. Asia-Pacific has emerged as a lucrative region for companies in the military simulation and virtual training sector, driven by significant defense spending and demand from countries such as China, India, and South Korea.

The market segmentation is based on platform, solution, and region. The airborne segment held the largest market share (50.04%) in 2017, with a market value of USD 2,474.3 million. This segment is projected to witness a CAGR of 7.02% during the forecast period. In terms of solution, the flight simulation and training segment accounted for the largest market share (40.49%) in 2017, with a market value of USD 2,002.1 million. This segment is expected to experience a CAGR of 7.20% during the forecast period.

Leave a Comment