Baby Wipes Size

Market Size Snapshot

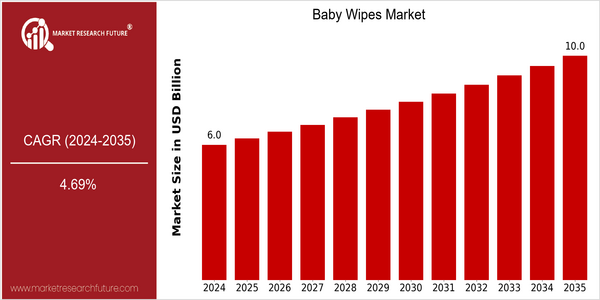

| Year | Value |

|---|---|

| 2024 | USD 6.04 Billion |

| 2035 | USD 10.0 Billion |

| CAGR (2025-2035) | 4.69 % |

Note – Market size depicts the revenue generated over the financial year

In 2024, the market size of the baby wipes market is expected to reach $ 6.04 billion, and by 2035, the market size is expected to reach $ 10 billion. The annual growth rate is expected to be 4.36% from 2025 to 2035. The main driving force for this market is the growing awareness of parents in terms of hygiene and convenience, and the birth rate in emerging economies is still rising. The trend of using green and biodegradable products is also the trend of the times, which has a positive influence on the industry. The three major companies in the baby wipes market are Procter & Gamble, Kimberly-Clark, and Unicharm. They are constantly improving their products through R & D. The strategic cooperation with retailers and the launch of new products that meet the needs of consumers are also driving the market. For example, the launch of hypoallergenic and organic baby wipes has aroused the interest of consumers with health consciousness, which has led to an increase in the number of users and a large number of users. These new products and trends will continue to develop, and the future of the industry will be shaped by them.

Regional Market Size

Regional Deep Dive

The baby-wipes market is experiencing strong growth in various regions, mainly driven by an increasing awareness of hygiene and convenience, as well as the increasing number of working parents. In North America, a strong preference for premium and eco-friendly products is seen, while in Europe the trend is towards organic and biodegradable products. In the Asia-Pacific region, urbanization and rising incomes are driving demand for baby-care products. In the Middle East and Africa, rising disposable incomes are positively affecting the market. In Latin America, although still a developing market, baby-wipes are slowly becoming a basic necessity, mainly because of changing lifestyles and an increased awareness of health.

Europe

- The European market is increasingly focused on organic baby wipes, with brands like WaterWipes and Naty gaining popularity due to their commitment to natural ingredients and sustainability.

- The European Union's stringent regulations on chemical use in baby products are prompting manufacturers to innovate and reformulate their products to comply with safety standards.

Asia Pacific

- Rapid urbanization in countries like China and India is leading to a surge in demand for convenient baby care products, with local brands such as Mamaearth capitalizing on this trend.

- Innovations in packaging, such as resealable pouches, are becoming popular in the region, enhancing product convenience and reducing waste.

Latin America

- In Latin America, the growing awareness of hygiene and health among parents is driving the demand for baby wipes, with brands like Pampers and Huggies expanding their product lines.

- Local manufacturers are beginning to introduce cost-effective options to cater to the price-sensitive segments of the market, which is expected to broaden the consumer base.

North America

- The trend towards eco-friendly and sustainable baby wipes is gaining momentum, with companies like Seventh Generation and Honest Company leading the charge in offering biodegradable options.

- Regulatory changes in the U.S. regarding the labeling of personal care products are pushing manufacturers to be more transparent about ingredients, which is influencing consumer purchasing decisions.

Middle East And Africa

- The rise of e-commerce platforms in the Middle East is facilitating easier access to baby wipes, with companies like Noon and Jumia expanding their offerings.

- Cultural shifts towards modern parenting practices are increasing the acceptance and use of baby wipes among new parents in the region.

Did You Know?

“Did you know that the global baby wipes market is projected to reach over $5 billion by 2025, driven largely by the increasing trend of convenience among parents?” — Market Research Future

Segmental Market Size

The baby-wipes segment plays an important role in the personal care market, which is experiencing a stable growth due to the growing awareness of hygiene and comfort. Among the main driving forces are the growing number of working parents looking for convenient cleaning solutions and the increasing focus on products with a low environmental impact, as consumers become more and more aware of the environment. The market is also influenced by government regulations that require the use of safe, non-toxic materials in baby products. The baby-wipes market is in its maturity phase, with the leading companies like Procter & Gamble and Kimberly-Clark dominating the market with their innovation. The main applications are for changing diapers, cleaning hands and faces, and general cleaning. Brands like Huggies and Pampers are the leading brands. Among the trends that have increased the demand for hygiene products are the pandemics such as the H1N1 flu, and the increasing focus on sustainability is putting pressure on manufacturers to develop biodegradable, plant-based baby-wipes. The development of the segment is characterized by the use of advanced material science and sustainable packaging methods, which ensure that baby-wipes meet both consumers’ needs and environmental standards.

Future Outlook

The baby wipes market is expected to grow from $6.04 billion in 2024 to $10 billion by 2035, at a compound annual growth rate (CAGR) of 4.69%. Rising birth rates in developing countries, growing hygiene awareness among parents, and the convenience of baby wipes for on-the-go care are driving the market. The baby wipes market will be further driven by urbanization, especially in Asia-Pacific and Latin America, where penetration is expected to reach more than 70% by 2035, up from 50% in 2024. The development of biodegradable and eco-friendly baby wipes will also drive the market, as consumers become increasingly conscious of the environment. And government regulations to promote sustainable products will further increase their appeal. In addition, the rise of e-commerce and subscription services for baby products will make it easier for consumers to buy baby wipes, increasing their uptake. Brands that focus on sustainable production and convenience will be well positioned to capture a growing share of the market.

Leave a Comment