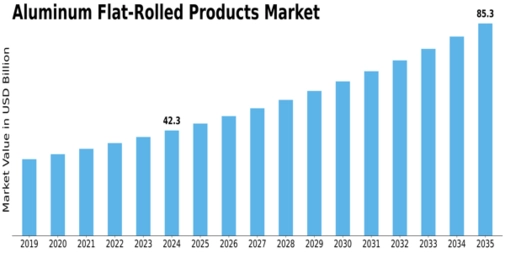

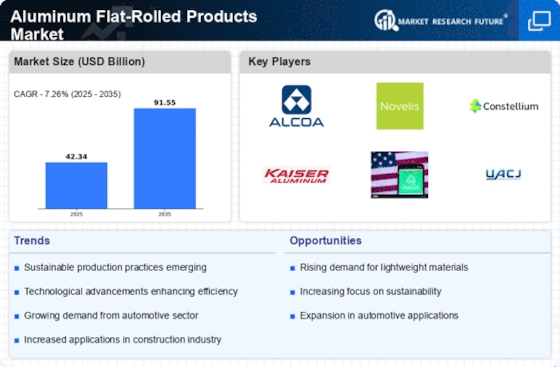

Aluminum Flat Rolled Products Size

Aluminum Flat Rolled Products Market Growth Projections and Opportunities

Demand, supply, and pricing are just a few of the elements that affect the aluminum flat-rolled products market and work together to create its future. The availability of raw materials and end-use industry trends are two important elements that influence the dynamics of the market for aluminum flat-rolled products. The following are the main market variables supporting the sector: Alumina and Bauxite Costs: The price and accessibility of raw materials, especially alumina and bauxite, have a big impact on how much aluminum flat-rolled goods cost to produce. Changes in the cost structure of aluminum production are directly impacted by fluctuations in the prices of various raw materials, which are determined by trade regulations, geopolitical events, and mining operations. Demand from the Transportation Industry: Aluminum flat-rolled products have wide application in the transportation sector, especially in the production of cars, airplanes, and ships. The market for aluminum flat-rolled goods is directly impacted by trends in the transportation industry, such as the desire for lightweight materials to improve fuel economy and lower emissions. Growth of the building Sector: Roofing, facades, and structural components are just a few of the uses for aluminum flat-rolled products in the building industry. The demand for these items is mostly driven by trends and activities in the construction industry, which are impacted by factors including urbanization and infrastructure development. Global Economic Conditions: The production of aluminum flat-rolled goods is greatly influenced by economic factors such as GDP growth, consumer expenditure, and industrial production. The demand for flat-rolled aluminum products is enhanced during times of economic boom due to an increase in industrial and construction activities. On the other hand, a decline in demand may result from an economic slump. Industry Requirements for End Users: Specific alloys, thicknesses, and surface treatments are needed for flat-rolled aluminum products according on the industry. Complying with these specifications is essential for producers of aluminum flat-rolled goods, and shifts in the demands of the end user sector can influence demand and spur new product development. Technological Developments: The market for aluminum flat-rolled products is influenced by developments in alloy compositions, surface treatment techniques, and rolling technologies. Enhancements to the formability, performance, and durability of items made using flat-rolled aluminum can make them more competitive in the market. Sustainability Initiatives: The market for aluminum flat-rolled products is impacted by the growing emphasis on environmental responsibility and sustainability. Since aluminum can be recycled, industry initiatives to implement environmentally friendly manufacturing techniques are in line with the growing trend toward sustainable practices. Trade Policies and Tariffs: Since the market for aluminum flat-rolled goods is international, trade policies and tariffs have a big influence on the sector. Market dynamics can be impacted by changes in trade agreements, import levies, and geopolitical events that impact the price and availability of aluminum. Competitive Landscape: The market for aluminum flat-rolled products is characterized by a competitive atmosphere due to the existence of several players. The dynamics of the market can be influenced by variables that impact pricing and market share, such as market consolidation, mergers and acquisitions, and the introduction of new rivals. Consumer Preferences and Trends: Changing consumer preferences for lightweight, durable, and aesthetically pleasing products influence the demand for aluminum flat-rolled products. Trends in consumer markets, including preferences for aluminum in packaging and household products, contribute to the overall market dynamics.

Leave a Comment