Market Trends

Key Emerging Trends in the Ablation Devices Market

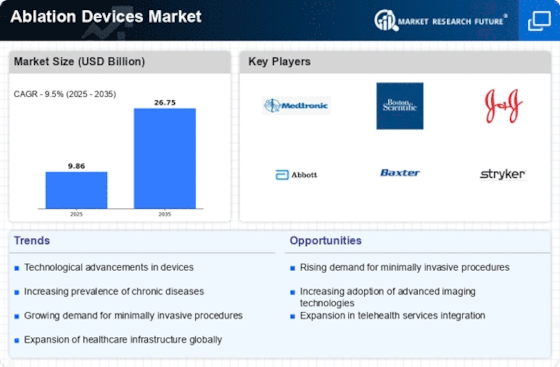

The ablation devices market is undergoing transformative trends driven by technological advancements, an increasing prevalence of chronic diseases, and a growing demand for minimally invasive treatment options. One significant trend is the rising adoption of radiofrequency ablation (RFA) and microwave ablation technologies. These techniques offer precise and targeted destruction of abnormal tissues, such as tumors, while minimizing damage to surrounding healthy structures. The trend towards RFA and microwave ablation reflects a shift towards less invasive interventions, providing patients with reduced recovery times and improved treatment outcomes. Technological innovations in catheter-based ablation devices are shaping the landscape of the market. Advances in catheter design, navigation systems, and imaging technologies enhance the accuracy and efficiency of ablation procedures. This trend contributes to improved procedural success rates, shorter hospital stays, and enhanced patient safety. The integration of cutting-edge technologies underscores a commitment to advancing the field of ablation and providing patients with more effective treatment options. The market is witnessing a surge in the development of robotic-assisted ablation systems. Robotic platforms enable greater precision and dexterity in performing ablation procedures, particularly in complex anatomical locations. Robotic-assisted ablation technologies enhance the capabilities of healthcare professionals, offering improved procedural control and expanding the applicability of ablation in challenging cases. This trend reflects the ongoing advancements in surgical technologies and their application in minimally invasive ablation procedures. The growing prevalence of cardiovascular diseases, particularly atrial fibrillation, is influencing the ablation devices market. The market is experiencing a shift towards hybrid ablation approaches, combining catheter-based and surgical ablation techniques. Hybrid ablation procedures offer a comprehensive treatment strategy, particularly in cases where traditional methods may have limitations. This trend reflects a holistic approach to ablation, providing healthcare professionals with versatile options to tailor treatments based on individual patient needs. This trend underscores the importance of ablation devices in addressing the rising burden of cardiovascular diseases. The integration of advanced imaging technologies, such as magnetic resonance imaging (MRI) and computed tomography (CT), is gaining prominence in the ablation devices market. Real-time imaging guidance enhances the visualization of target tissues during ablation procedures, allowing for more precise and accurate treatment. This trend contributes to improved procedural outcomes, reduced complications, and increased patient safety. The market is witnessing a focus on the development of energy-efficient ablation technologies. Innovations in energy sources, such as cryoablation and high-intensity focused ultrasound (HIFU), offer alternatives to traditional ablation methods. These energy-efficient approaches aim to optimize treatment efficacy while minimizing the impact on surrounding tissues. This trend aligns with the broader goal of enhancing the safety and efficiency of ablation procedures. Pain management through neurostimulation and radiofrequency ablation for chronic pain conditions is a notable trend in the market. Ablation devices, such as radiofrequency ablation for facet joint pain, provide minimally invasive options for managing chronic pain and improving patients' quality of life. This trend reflects a growing recognition of ablation as a viable and effective solution in the field of pain management. The market is witnessing a surge in the development of ablation devices for oncology applications. Ablation technologies, including radiofrequency and microwave ablation, are being employed to treat various solid tumors, offering a minimally invasive alternative to traditional surgical resection. This trend reflects the expanding role of ablation in the multidisciplinary approach to cancer treatment, providing patients with less invasive options and faster recovery times.

Leave a Comment