Market Analysis

In-depth Analysis of Ablation Devices Market Industry Landscape

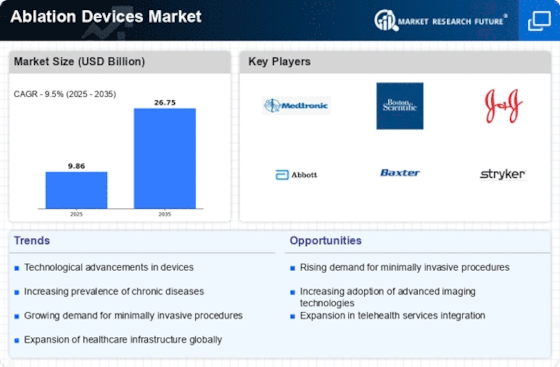

The ablation devices market operates at the forefront of medical technology, driven by various factors that shape its dynamics, demand, and innovation. Technological advancements play a pivotal role in the market dynamics of ablation devices. Continuous innovations in device design, energy sources, and imaging technologies contribute to the development of more efficient and targeted ablation solutions. The market responds by offering advanced devices that improve procedural accuracy, reduce treatment times, and enhance patient outcomes, fostering a competitive landscape and propelling the market's evolution. Regulatory considerations are crucial in shaping the market dynamics of ablation devices. The approval processes for new ablation technologies undergo rigorous regulatory scrutiny to ensure patient safety and efficacy. Adherence to regulatory requirements influences the strategies of market players, impacting product development, clinical trials, and market entry approaches. A robust regulatory framework contributes to the credibility and trustworthiness of ablation devices within the healthcare ecosystem. Economic factors, including healthcare expenditure and reimbursement policies, significantly contribute to market dynamics. The cost-effectiveness of ablation procedures and the availability of reimbursement influence the adoption and accessibility of these technologies. Market players navigate economic considerations by developing cost-effective devices and engaging in discussions to improve reimbursement policies, ensuring wider access to innovative ablation solutions. Globalization and collaboration among healthcare institutions contribute to the dynamics of the ablation devices market. International partnerships for research, development, and the sharing of best practices foster a more interconnected market where ablation solutions are accessible and adaptable across geographic borders. This globalization enhances the exchange of expertise, broadens the availability of ablation devices worldwide, and contributes to a more standardized approach to healthcare. The market responds by developing ablation devices that address the specific needs of different demographic groups, including elderly individuals with complex medical conditions. Environmental considerations, including sustainability and eco-friendly practices, influence market dynamics. The development of environmentally friendly materials and energy-efficient technologies in ablation devices reflects a commitment to sustainability within the healthcare industry. Market players explore solutions that align with broader efforts to promote environmental responsibility in medical practices. The adoption of digital health technologies and data analytics is influencing market dynamics. Advances in real-time monitoring, predictive analytics, and remote support contribute to personalized and efficient ablation care. The market responds by incorporating digital health solutions into ablation devices to enhance procedural guidance, improve patient outcomes, and optimize healthcare delivery.

Leave a Comment