Summary Overview

3PL Services Market Overview

The global 3PL (third-party logistics) services market is experiencing substantial growth, fuelled by the rising demand for efficient supply chain solutions and the need for businesses to enhance their operational efficiencies. As companies increasingly focus on core competencies, they are outsourcing logistics operations to specialized providers. This report offers an extensive analysis of procurement trends within the 3PL sector, emphasizing cost optimization strategies, supply chain resilience, and the pivotal role of digital logistics platforms to enhance visibility and efficiency. . Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for 3PL services market development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems.

The outlook for the 3PL services market remains highly promising, with several key projections and trends anticipated to drive growth through 2032:

-

Market Size: The global 3PL services market is projected to reach approximately USD 1 trillion by 2032, with a compound annual growth rate (CAGR) of around 10% from 2024 to 2032. Growth rate10%

-

Sector Contributions: Key sectors contributing to growth include:

-

E-commerce: The explosion of online shopping is significantly increasing demand for 3PL services for order fulfilment and last-mile delivery. -

Manufacturing: Manufacturers are leveraging 3PL providers to optimize distribution and manage inventory more effectively.

-

Technological Transformation and Innovations: Advances in logistics technology, including automation, robotics, and real-time tracking systems, are enhancing the efficiency and responsiveness of 3PL (third-party logistics) services. These innovations enable better inventory management, route optimization, and faster delivery times, which are essential for meeting the demands of a fast-paced market. In addition, supplier performance management and vendor performance assessment are becoming critical for companies in this competitive landscape, as businesses seek to ensure high standards in service reliability, cost-effectiveness, and delivery efficiency from their 3PL providers.

-

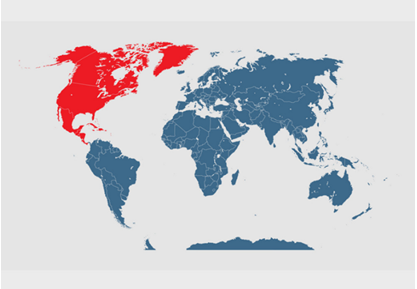

Regional Insights: While North America holds the largest share of the market, Asia-Pacific is expected to exhibit the highest growth rate due to expanding manufacturing hubs and increasing demand for logistics services.

Key Trends and Sustainability Outlook

-

Sustainable Logistics: The movement toward sustainable practices is prompting 3PL providers to adopt eco-friendly initiatives and optimize transportation routes to reduce carbon footprints. -

Digital Transformation: The adoption of digital logistics technologies is improving real-time tracking, inventory management, and customer service. -

Omnichannel Logistics: Companies are increasingly adopting omnichannel strategies to streamline operations and provide customers with a seamless shopping experience.

Growth Drivers

-

Surging E-commerce Demand: The growth of online retail is driving the need for efficient and scalable logistics solutions. -

Global Trade Expansion: Increasing international trade activities are propelling demand for 3PL services to manage complex supply chains. -

Technological Advancements: The integration of IoT, AI, and automation is optimizing logistics operations, enhancing supply chain visibility and control. -

Cost Management: As businesses seek to reduce operational costs, outsourcing logistics to 3PL providers is becoming a viable strategy for achieving efficiency and flexibility. -

Focus on Customer Experience: Enhanced logistics services, including faster delivery times and improved order accuracy, are becoming critical for maintaining competitive advantage.

Overview of Market Intelligence Services for the 3PL Services Market

Recent analysis reveal that the 3PL (third-party logistics) services market is experiencing significant cost dynamics due to advancements in logistics technology, fluctuating fuel prices, and growing demands for efficient supply chain solutions. Market reports provide comprehensive cost breakdowns, including projections for warehousing, transportation, and technology investments, enabling stakeholders to anticipate pricing shifts and identify cost-saving opportunities. By utilizing these insights, companies can enhance their procurement strategies, manage logistics expenditures more effectively, and make informed, data-driven decisions regarding the outsourcing of their logistics operations. With real-time data and sector-specific forecasts, stakeholders are better positioned to optimize their logistics investments, maximize efficiency, and adapt swiftly to changing market conditions.

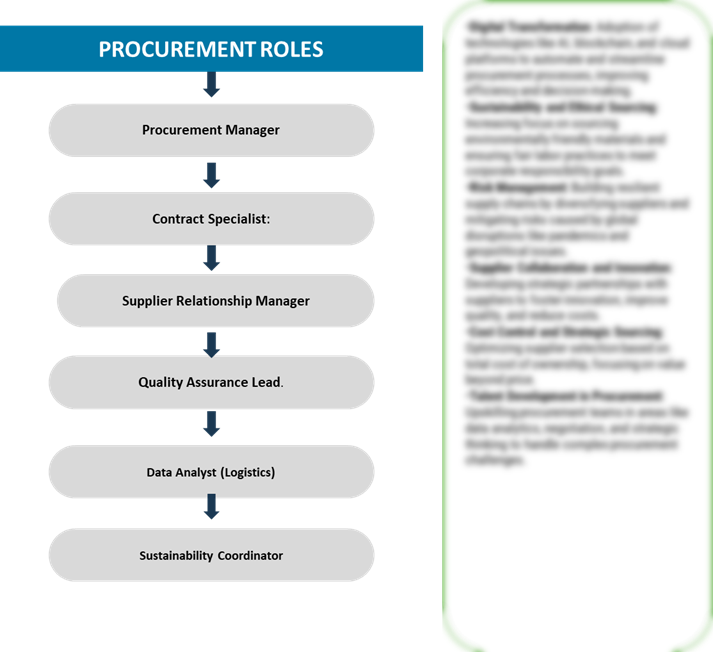

Procurement Intelligence for 3PL Services: Category Management and Strategic Sourcing

To stay ahead in the 3PL services market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective logistics services and ensuring the timely availability of essential functions, such as warehousing, transportation, and distribution, to meet client demands efficiently.

3PL Services Market Pricing Outlook: Spend analysis

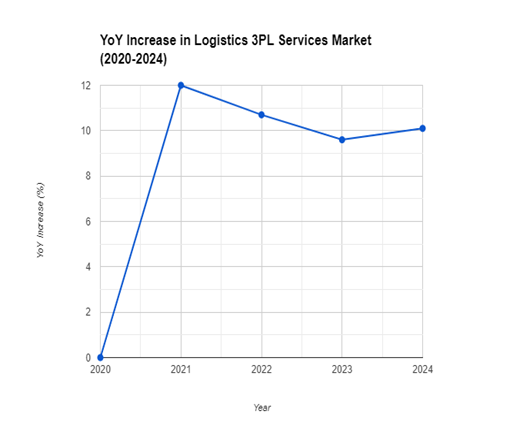

The 3PL (third-party logistics) services market is undergoing dynamic pricing trends, primarily driven by shifts in fuel costs, labor rates, and technological advancements. Increased demand for logistics services, particularly due to the growth of e-commerce and global supply chain complexities, is contributing to rising costs across the sector. The graph shows a general upward trend in pricing for 3PL services market, likely due to rising costs, increased complexity, and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamics.

Comprehensive Price Forecast:

Our analysis indicates a steady upward trajectory in pricing, influenced by several factors, including rising fuel prices, increased labor costs, and the need for investments in advanced logistics technologies. Projections suggest that pricing will continue to escalate through 2032, reflecting strong growth in key sectors such as e-commerce, manufacturing, and healthcare logistics.

As customer expectations rise for faster delivery and enhanced service quality, competition among 3PL providers is intensifying. This competitive landscape necessitates strategic procurement approaches to mitigate rising costs, including:

-

Long-term Contracts: Establishing long-term agreements with logistics providers to lock in rates and ensure cost predictability. -

Technological Investment: Leveraging automation and data analytics to improve operational efficiency and reduce labor costs. -

Route Optimization: Implementing advanced route planning solutions to minimize transportation costs and enhance delivery efficiency.

By adopting proactive procurement strategies, organizations within the 3PL market can effectively manage price fluctuations and maintain a competitive edge in this rapidly evolving environment.

Cost Breakdown for the 3PL Services Market: Total cost of ownership TCO and cost saving opportunities

- Transportation Costs (50%)

-

Description: Includes costs associated with freight transportation, including shipping, fuel surcharges, and third-party carrier fees. -

Trends: Fluctuating fuel prices are a significant factor influencing transportation costs. As demand for fast and reliable shipping increases, logistics providers face rising operational costs, pushing overall prices upward.

- Warehousing Costs (XX%)

-

Description: XX -

Trends: XX

- Labor Costs (XX%)

-

Description: XX -

Trends: XX

- Technology and Software Costs (XX%)

-

Description: XX -

Trends: XX

Cost-Saving Opportunity in the 3PL Services Market: Negotiation Lever and Purchasing Negotiation Strategies

Optimizing procurement strategies in the 3PL services market offers significant avenues for cost savings and enhanced operational efficiency across various sectors. Collaborative logistics partnerships allow companies to share transportation resources and costs, leveraging collective bargaining power to secure better rates from carriers.

Implementing advanced route optimization software helps reduce transportation distances and fuel consumption, leading to substantial savings in logistics expenditures. Investing in automation technologies, such as robotics in warehousing, can lower labor costs and increase throughput, enabling businesses to manage inventory more effectively.

Adopting sustainable practices, like using electric vehicles or energy-efficient equipment, not only reduces fuel and operational costs but also aligns with growing regulatory demands for environmentally friendly logistics solutions.

Data analytics tools can enhance visibility throughout the supply chain, allowing organizations to identify inefficiencies and eliminate waste, thus streamlining operations and minimizing costs. Strengthening supplier relationships can lead to favorable terms, such as reduced freight charges or volume discounts, which aid in managing cash flow more effectively.

These strategies not only foster sustainable logistics practices but also empower organizations to enhance service levels, improve delivery performance, and ultimately increase profitability while managing resources efficiently.

Supply and Demand Overview of the 3PL Services Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The 3PL services market is experiencing robust growth driven by the surge in e-commerce, the need for efficient supply chain solutions, and advancements in logistics technology. Demand is particularly high due to the ongoing need for reliable warehousing, transportation, and last-mile delivery services, supported by collaborations among logistics providers, manufacturers, and retail companies. This growth is further reinforced by the emphasis on cost-effective, flexible, and scalable logistics solutions to meet evolving customer demands across various sectors.

Demand Factors:

-

E-commerce Growth: The rapid expansion of e-commerce is significantly driving demand for third-party logistics services, as businesses seek efficient distribution networks to handle increasing order volumes and customer expectations for quick delivery. -

Customization & Flexibility: Companies are increasingly seeking tailored logistics solutions that can adapt to fluctuating demand, fostering the need for 3PL providers that offer flexible service models. -

Globalization of Trade: As businesses expand their operations internationally, the demand for 3PL services rises to manage complex supply chains across borders, ensuring timely and cost-effective delivery of goods. -

Technological Integration: The adoption of advanced technologies, such as IoT, AI, and big data analytics, is enhancing operational efficiencies, further driving the demand for 3PL services that can leverage these innovations.

Supply Factors:

-

Diverse Service Offerings: 3PL providers are expanding their service portfolios to include transportation, warehousing, inventory management, and value-added services, ensuring they meet diverse client needs. -

Increased Competition: The entry of new players and the expansion of existing providers into new markets enhance competition, resulting in better service quality, pricing, and innovation. -

Technological Advancements: Ongoing innovations in logistics technology, such as automated warehousing and real-time tracking systems, improve service efficiency and reliability, increasing the attractiveness of 3PL solutions. -

Strategic Partnerships: Collaborations between 3PL providers and manufacturers, retailers, and technology companies are enhancing supply chain capabilities and resilience, enabling better resource management and logistics execution.

Regional Demand-Supply Outlook: 3PL Services Market in North America

North America: Leading Hub in the 3PL Services Market

North America, particularly the United States and Canada, continues to hold a prominent position in the global 3PL services market, characterized by:

-

E-commerce Dominance: Major e-commerce players are heavily reliant on 3PL services to meet consumer demands for rapid fulfillment and flexible shipping options, driving significant market growth. -

Investment in Infrastructure: Continuous investments in logistics infrastructure, including transportation networks and warehousing facilities, support the efficiency and scalability of 3PL operations. -

Technological Innovation: North American companies are at the forefront of logistics technology advancements, integrating automated systems and data analytics to optimize supply chain processes. -

Regulatory Framework: A stable regulatory environment facilitates international trade and logistics operations, promoting growth and innovation within the 3PL sector. -

Sustainability Initiatives: There is a growing emphasis on sustainable logistics practices, with 3PL providers adopting eco-friendly solutions to meet both regulatory requirements and consumer preferences.

North America remains a key hub for 3PL services innovation and growth

Supplier Landscape: Supplier Negotiations and Strategies

The supplier penetration in the 3PL services market is substantial, with a growing number of global and regional players contributing to the provision of logistics and supply chain services. These suppliers play a crucial role in the overall market dynamics, impacting pricing, service quality, and efficiency. The market is highly competitive, with suppliers ranging from large, established logistics firms to specialized providers focused on niche services like last-mile delivery and temperature-controlled logistics.

Currently, the supplier landscape is characterized by significant consolidation among top-tier logistics providers, which dominate the market share. However, emerging logistics firms and technology-driven startups are also expanding their presence by focusing on specialized services and advanced logistics technology solutions tailored to the specific needs of various industries.

Some of the key suppliers in the 3PL Services Market include:

- DHL Supply Chain

- FedEx Logistics

- UPS Supply Chain Solutions

- C.H. Robinson Worldwide, Inc.

- Kuehne + Nagel

- DB Schenker

- CEVA Logistics

- Nippon Express Co., Ltd.

- DSV

- XPO logistics

Key development: Procurement Category Significant Developments

Key Development |

Description |

Technology Investment |

Enhanced operations using AI, IoT, and automation (e.g., XPO Logistics, C.H. Robinson). |

Sustainability Focus |

Adoption of eco-friendly practices and carbon-neutral shipping (e.g., DHL, UPS). |

Emerging Market Expansion |

Increased presence in Asia-Pacific to capture growth opportunities (e.g., FedEx Logistics). |

Last-Mile Delivery Innovations |

Development of advanced last-mile solutions to improve service (e.g., UPS). |

Warehouse Automation |

Implementation of robotics and automated systems for efficiency (e.g., Kuehne + Nagel). |

Mergers and Acquisitions |

Consolidation in the market (e.g., DSV's acquisition of Panalpina). |

Supply Chain Resilience |

Diversification of supplier bases and improved inventory management for stability. |

Digital Transformation |

Adoption of digital platforms for streamlined operations and enhanced analytics (e.g., Ryder, Geodis). |

Procurement Attribute/Metric |

Details |

Market Sizing |

The 3PL market is projected to grow from USD 1.34 trillion in 2023 to USD 3 trillion by 2032, registering a CAGR of 10%. |

3PL Adoption Rate |

Over 60% of businesses globally use 3PL services to enhance efficiency, reduce costs, and manage logistics complexities. |

Top Strategies for 2024 |

Focus on digital transformation, last-mile delivery optimization, supply chain resilience, and sustainability initiatives. |

Process Automation in 3PL |

Around 40% of 3PL providers have automated more than half of their operations, including inventory management and shipment tracking. |

Procurement Challenges |

Key challenges include rising transportation costs, labor shortages, supply chain disruptions, and regulatory compliance issues. |

Key Suppliers |

Prominent players include C.H. Robinson, DB Schenker, FedEx, Kuehne + Nagel, DSV, XPO Logistics, and UPS. |

Key Regions Covered |

Major regions are North America, Europe, Asia-Pacific, and Rest of the World, with key hubs in U.S., Germany, China, and India. |

Market Drivers and Trends |

Driven by e-commerce growth, globalization, and demand for cost-effective solutions. Trends include AI, IoT, and green logistics. |

Key development: Procurement Category Significant Developments

Key Development |

Description |

Technology Investment |

Enhanced operations using AI, IoT, and automation (e.g., XPO Logistics, C.H. Robinson). |

Sustainability Focus |

Adoption of eco-friendly practices and carbon-neutral shipping (e.g., DHL, UPS). |

Emerging Market Expansion |

Increased presence in Asia-Pacific to capture growth opportunities (e.g., FedEx Logistics). |

Last-Mile Delivery Innovations |

Development of advanced last-mile solutions to improve service (e.g., UPS). |

Warehouse Automation |

Implementation of robotics and automated systems for efficiency (e.g., Kuehne + Nagel). |

Mergers and Acquisitions |

Consolidation in the market (e.g., DSV's acquisition of Panalpina). |

Supply Chain Resilience |

Diversification of supplier bases and improved inventory management for stability. |

Digital Transformation |

Adoption of digital platforms for streamlined operations and enhanced analytics (e.g., Ryder, Geodis). |

Procurement Attribute/Metric |

Details |

||||||||||||||||||||||||||||||||||||

Market Sizing |

The 3PL market is projected to grow from USD 1.34 trillion in 2023 to USD 3 trillion by 2032, registering a CAGR of 10%. |

||||||||||||||||||||||||||||||||||||

3PL Adoption Rate |

Over 60% of businesses globally use 3PL services to enhance efficiency, reduce costs, and manage logistics complexities. |

||||||||||||||||||||||||||||||||||||

Top Strategies for 2024 |

Focus on digital transformation, last-mile delivery optimization, supply chain resilience, and sustainability initiatives. |

||||||||||||||||||||||||||||||||||||

|

Process Auto 3PL Services Market Overview The global 3PL (third-party logistics) services market is experiencing substantial growth, fuelled by the rising demand for efficient supply chain solutions and the need for businesses to enhance their operational efficiencies. As companies increasingly focus on core competencies, they are outsourcing logistics operations to specialized providers. This report offers an extensive analysis of procurement trends within the 3PL sector, emphasizing cost optimization strategies, supply chain resilience, and the pivotal role of digital logistics platforms to enhance visibility and efficiency. . Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for 3PL services market development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems. The outlook for the 3PL services market remains highly promising, with several key projections and trends anticipated to drive growth through 2032:

Growth rate10%

Key Trends and Sustainability Outlook

Growth Drivers

Overview of Market Intelligence Services for the 3PL Services MarketRecent analysis reveal that the 3PL (third-party logistics) services market is experiencing significant cost dynamics due to advancements in logistics technology, fluctuating fuel prices, and growing demands for efficient supply chain solutions. Market reports provide comprehensive cost breakdowns, including projections for warehousing, transportation, and technology investments, enabling stakeholders to anticipate pricing shifts and identify cost-saving opportunities. By utilizing these insights, companies can enhance their procurement strategies, manage logistics expenditures more effectively, and make informed, data-driven decisions regarding the outsourcing of their logistics operations. With real-time data and sector-specific forecasts, stakeholders are better positioned to optimize their logistics investments, maximize efficiency, and adapt swiftly to changing market conditions. Growth rate: 7.28 % Procurement Intelligence for 3PL Services: Category Management and Strategic Sourcing To stay ahead in the 3PL services market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective logistics services and ensuring the timely availability of essential functions, such as warehousing, transportation, and distribution, to meet client demands efficiently. 3PL Services Market Pricing Outlook: Spend analysis The 3PL (third-party logistics) services market is undergoing dynamic pricing trends, primarily driven by shifts in fuel costs, labor rates, and technological advancements. Increased demand for logistics services, particularly due to the growth of e-commerce and global supply chain complexities, is contributing to rising costs across the sector. The graph shows a general upward trend in pricing for 3PL services market, likely due to rising costs, increased complexity, and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamics. Comprehensive Price Forecast: Our analysis indicates a steady upward trajectory in pricing, influenced by several factors, including rising fuel prices, increased labor costs, and the need for investments in advanced logistics technologies. Projections suggest that pricing will continue to escalate through 2032, reflecting strong growth in key sectors such as e-commerce, manufacturing, and healthcare logistics. As customer expectations rise for faster delivery and enhanced service quality, competition among 3PL providers is intensifying. This competitive landscape necessitates strategic procurement approaches to mitigate rising costs, including:

By adopting proactive procurement strategies, organizations within the 3PL market can effectively manage price fluctuations and maintain a competitive edge in this rapidly evolving environment. Cost Breakdown for the 3PL Services Market: Total cost of ownership TCO and cost saving opportunities

Cost-Saving Opportunity in the 3PL Services Market: Negotiation Lever and Purchasing Negotiation StrategiesOptimizing procurement strategies in the 3PL services market offers significant avenues for cost savings and enhanced operational efficiency across various sectors. Collaborative logistics partnerships allow companies to share transportation resources and costs, leveraging collective bargaining power to secure better rates from carriers. Implementing advanced route optimization software helps reduce transportation distances and fuel consumption, leading to substantial savings in logistics expenditures. Investing in automation technologies, such as robotics in warehousing, can lower labor costs and increase throughput, enabling businesses to manage inventory more effectively. Adopting sustainable practices, like using electric vehicles or energy-efficient equipment, not only reduces fuel and operational costs but also aligns with growing regulatory demands for environmentally friendly logistics solutions. Data analytics tools can enhance visibility throughout the supply chain, allowing organizations to identify inefficiencies and eliminate waste, thus streamlining operations and minimizing costs. Strengthening supplier relationships can lead to favorable terms, such as reduced freight charges or volume discounts, which aid in managing cash flow more effectively. These strategies not only foster sustainable logistics practices but also empower organizations to enhance service levels, improve delivery performance, and ultimately increase profitability while managing resources efficiently. Supply and Demand Overview of the 3PL Services Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM) The 3PL services market is experiencing robust growth driven by the surge in e-commerce, the need for efficient supply chain solutions, and advancements in logistics technology. Demand is particularly high due to the ongoing need for reliable warehousing, transportation, and last-mile delivery services, supported by collaborations among logistics providers, manufacturers, and retail companies. This growth is further reinforced by the emphasis on cost-effective, flexible, and scalable logistics solutions to meet evolving customer demands across various sectors. Demand Factors:

Supply Factors:

Regional Demand-Supply Outlook: 3PL Services Market in North America North America: Leading Hub in the 3PL Services Market North America, particularly the United States and Canada, continues to hold a prominent position in the global 3PL services market, characterized by:

North America remains a key hub for 3PL services innovation and growth Supplier Landscape: Supplier Negotiations and Strategies The supplier penetration in the 3PL services market is substantial, with a growing number of global and regional players contributing to the provision of logistics and supply chain services. These suppliers play a crucial role in the overall market dynamics, impacting pricing, service quality, and efficiency. The market is highly competitive, with suppliers ranging from large, established logistics firms to specialized providers focused on niche services like last-mile delivery and temperature-controlled logistics. Currently, the supplier landscape is characterized by significant consolidation among top-tier logistics providers, which dominate the market share. However, emerging logistics firms and technology-driven startups are also expanding their presence by focusing on specialized services and advanced logistics technology solutions tailored to the specific needs of various industries. Some of the key suppliers in the 3PL Services Market include:

Key development: Procurement Category Significant Developments

mation in 3PL |

Around 40% of 3PL providers have automated more than half of their operations, including inventory management and shipment tracking. |

||||||||||||||||||||||||||||||||||||

Procurement Challenges |

Key challenges include rising transportation costs, labor shortages, supply chain disruptions, and regulatory compliance issues. |

||||||||||||||||||||||||||||||||||||

Key Suppliers |

Prominent players include C.H. Robinson, DB Schenker, FedEx, Kuehne + Nagel, DSV, XPO Logistics, and UPS. |

||||||||||||||||||||||||||||||||||||

Key Regions Covered |

Major regions are North America, Europe, Asia-Pacific, and Rest of the World, with key hubs in U.S., Germany, China, and India. |

||||||||||||||||||||||||||||||||||||

Market Drivers and Trends |

Driven by e-commerce growth, globalization, and demand for cost-effective solutions. Trends include AI, IoT, and green logistics. |