Ayurveda Market Overview

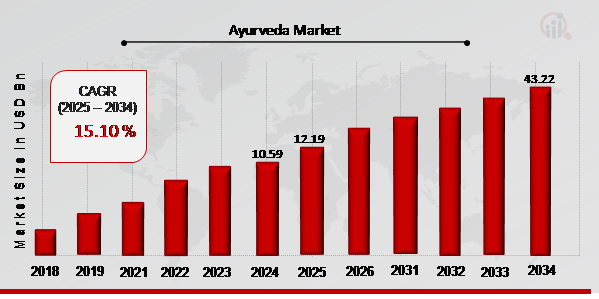

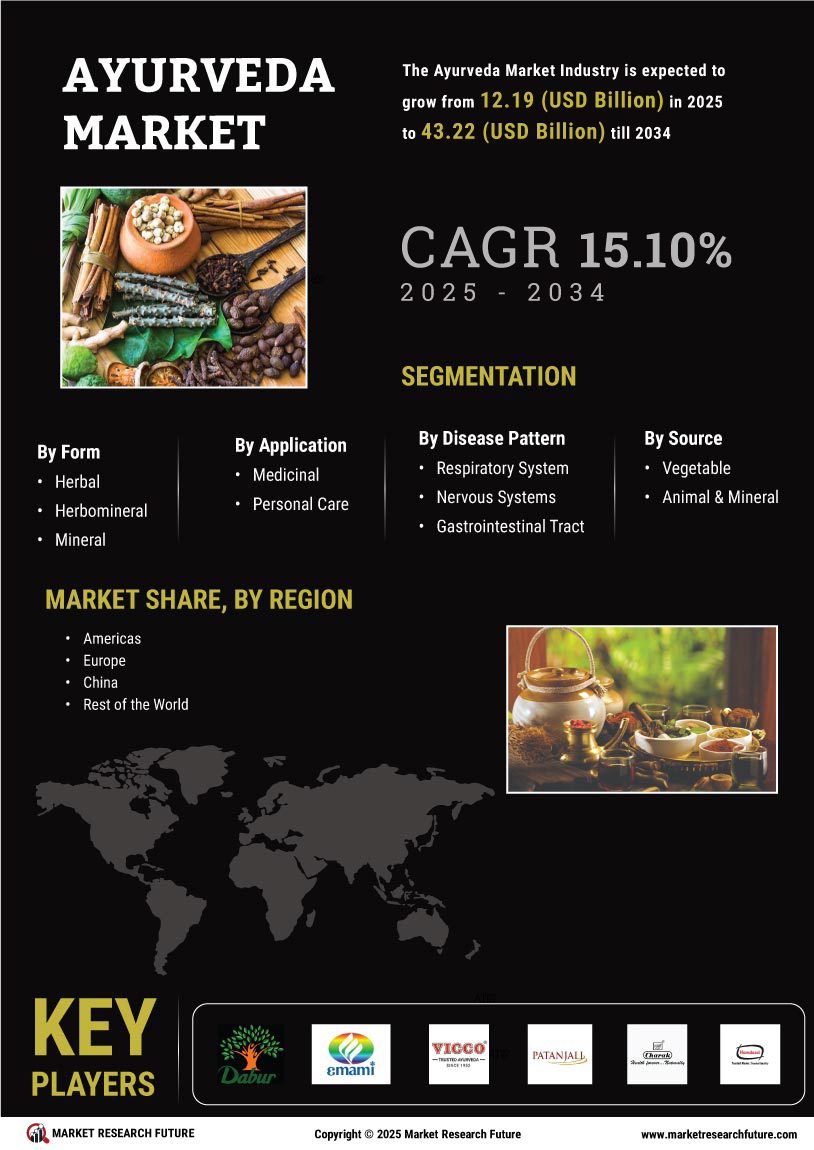

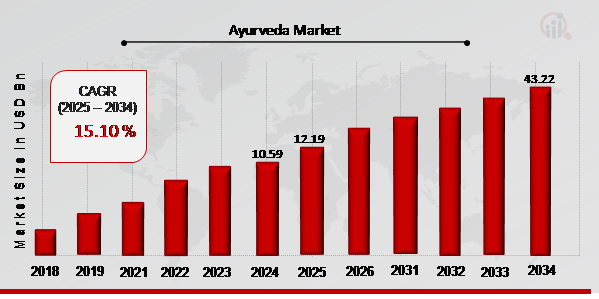

As per MRFR analysis, the Ayurveda Market Size was estimated at 10.59 (USD Billion) in 2024. The Ayurveda Market Industry is expected to grow from 12.19 (USD Billion) in 2025 to 43.22 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 15.10% during the forecast period (2025 - 2034). Consumer demand for ayurvedic medicines is driven by market drivers such as expanding knowledge of their advantages, increased awareness of the drawbacks of allopathy, accessibility, and rising disposable income. Additionally, makers of ayurvedic products can expand their markets due to the growing awareness of natural components in health and personal care products in industrialized nations, including the United States, Canada, Australia, Singapore, and Japan.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

July 2024, Amrutanjan Healthcare Limited announced a significant move in the Ayurveda space by introducing new Ayurvedic pain management solutions. These products are part of the company’s strategic expansion into holistic health and wellness.

Ayurveda Market Trends

- Minimal side effects of ayurveda medications are driving the market growth

The minimal side effects of ayurveda medications are one of the major factors fueling the growth of the Ayurveda market. The demand for herbal remedies that promote immunity has significantly increased on the international market. The rising prevalence of obesity and chronic health issues encourages people to choose foods and beverages that can help enhance immunity. The oldest healing science, ayurveda, has its roots in India and dates back more than 5,000 years. It strongly emphasizes maintaining good health and preventing and treating sickness by lifestyle choices like massage, meditation, yoga, dietary adjustments, and herbal treatments. These five natural elements—space, air, fire, water, and earth—combine in the body to form the three energies Vatta, Pitta, and Kapha. Ayurveda focuses on balancing these doshas, which are necessary for good health. It can be applied to increase flexibility, strength, and stamina, maintain health, and relieve stress. Comparatively speaking to allopathy treatments containing chemicals, ayurvedic medicines exclusively contain plant herbal extracts.

To stay competitive in the market, the major firms operating in the sector have a strong propensity to pursue a variety of growth methods, such as capacity expansion, partnerships, mergers and acquisitions, product launches, geographic expansion, and product development. It is believed that this will have a favorable effect on market expansion. For instance, in October 2022, Apollo Hospitals Enterprise announced formal negotiations to buy a 60% stake in AyurVAID, a renowned classical ayurvedic hospital chain. The acquisition would be funded by a combination of main and secondary capital injections totaling INR 26 crore. In addition, Patanjali paid INR 4,350 crore (USD 610 million) in December 2019 to acquire the insolvent Ruchi Soya Industries. Mid-cap company Ruchi Soya is listed on the NSE and BSE in India.

Many underdeveloped nations' healthcare systems depend heavily on ayurvedic medicines. For most mild illnesses, herbal medications and natural remedies are used. Visits to skilled physicians or chemists who fill prescriptions are rare and only reserved for serious illnesses in developing nations. Ayurvedic and herbal medication used for therapeutic purposes in underdeveloped nations consists of unprocessed herbs, plants, or plant parts that have been dried and used in whole or cut form. Herbs are formulated as teas for internal use (and occasionally as pills or capsules), and as salves and poultices for exterior use, which presents a commercial opportunity for ayurveda. Thus, driving the ayurveda market revenue.

Ayurveda Market Segment Insights

Ayurveda Form Insights

The ayurveda market segmentation, based on form includes Herbal, Herbomineral and Mineral. The herbal segment dominated the market because people and healthcare professionals are becoming more interested in herbal products. However, the herbomineral category is expected to develop the fastest in the coming years because ayurvedic herbomineral formulations contain specific metals or minerals as part of their composition.

Ayurveda Application Insights

The ayurveda market segmentation, based on application, includes Medicinal and Personal Care. The personal care category generated the most income. Due to growing consumer awareness of personal care products, modifications in consumption and lifestyle habits, and higher spending power among women, the personal care business is expected to grow due to well-established Ayurvedic manufacturing facilities. However, because of the rising acceptance of natural and organic medications and their advantages among consumers, the medicinal category is expected to increase quickly over the ayurveda market forecast period.

Figure 1: Ayurveda Market, by Application, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Ayurveda Source Insights

The ayurveda market segmentation, based on source includes Vegetable and Animal & Mineral. The vegetable segment dominated the market due to the widespread use of vegan food in developing nations like Australia, Singapore, and India. Additionally, the animal and mineral category is expanding at the quickest rate since more and more ayurvedic medications are using ingredients obtained from animals.

Ayurveda Disease Pattern Insights

The ayurveda market segmentation, based on disease pattern includes Respiratory System, Nervous Systems, Gastrointestinal Tract, Cardiovascular System, Infectious Diseases, Skeletal System and Skin And Hair. The skin And hair segment dominated the market due to the increased use of ayurveda to treat skin conditions like allergens and hereditary allergies. However, because there are more ayurvedic drugs available to address stomach ailments, the gastrointestinal tract is the category that is expanding at the highest rate.

Ayurveda End-User Insights

The ayurveda market segmentation, based on end-user includes Academia And Research and Hospitals And Clinics. The academia and research segment dominated the market since they continuously concentrate on inventing, researching, and developing fresh and efficient ayurvedic products. Additionally, due to a growth in the use of ayurvedic medicines to treat various disorders, the hospitals and clinics sector is predicted to expand significantly throughout the projection period.

Ayurveda Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North American ayurveda market area will dominate this market because more people are becoming health-conscious as consumers. Due to a strong green movement, attitudes towards natural care products are changing. This is because alternative medications are thought to negatively affect people. In the US market, this has helped the product gain traction. Additionally, the Ayurveda market would expand over the anticipated period due to rising knowledge of the therapeutic advantages and negligible adverse effects of ayurvedic medications.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: AYURVEDA MARKET SHARE BY REGION 2023 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe ayurveda market accounts for the second-largest market share due to rising healthcare costs, increased knowledge of early diagnosis, and accessibility to efficient ayurvedic medicine. Another main factors driving the market expansion in Europe is the rise in health concerns brought on by the adverse effects of Western medications and the expanding knowledge of the advantages of natural and organic medicines. Furthermore, a positive market outlook is being produced by this, combined with rising investments in various research and development (R&D) initiatives for generating new formulations, upgrading manufacturing processes, and integrating modern technology into producing ayurvedic products. Further, the German ayurveda market held the largest market share, and the UK ayurveda market was the fastest growing market in the European region

The Asia-Pacific Ayurveda Market is expected to grow at the fastest CAGR from 2024 to 2032 because of the extensive history of herbal medicine developed by countries like Indonesia, India, Sri Lanka, Myanmar, and others. Strong governmental initiatives, existing projects, and established ayurvedic manufacturing facilities will support the industry in the Asia-Pacific region. For example, in April 2021, the Ministry of AYUSH signed Country to Country Memoranda of Understanding (MoUs) with 18 countries for cooperation in Traditional Medicine and Homoeopathy, as well as MoUs for cooperative research/academic collaboration and MoUs for appointing AYUSH Academic Chairs in international universities that are located in 28 countries and spread information on AYUSH systems. These agreements were made to promote AYUSH systems around the world. Moreover, China’s ayurveda market held the largest market share, and the Indian ayurveda market was the fastest growing market in the Asia-Pacific region.

Ayurveda Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the ayurveda market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, ayurveda industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the ayurveda industry to benefit clients and increase the market sector. In recent years, the ayurveda industry has offered some of the most significant advantages to market. Major players in the ayurveda market attempting to increase market demand by investing in research and development operations include Leverayush, Shree Baidyanath Ayurved Bhawan Pvt. Ltd., Himalaya Drug Company, Kerala Ayurveda Ltd., Amrutanjan Healthcare Limited, Hamdard Laboratories, and Forest Essentials.

The Hamdard Foundation was established in 1964 to distribute firm revenues to advance societal goals. Following India's separation from Britain, "Hamdard" Unani branches were created in Bangladesh (formerly East Pakistan) and Pakistan. Hamdard Laboratories is a Unani pharmaceutical company in India. Hakeem Hafiz Abdul Majeed founded it in Delhi in 1906, and it became a waqf (non-profit trust) in 1948. Sharbat Rooh Afza, Safi, Roghan Badam Shirin, Sualin, Joshina, and Cinkara are some of its best-selling goods. It is connected to the Hamdard Foundation, a trust that supports philanthropic education. Hakeem Hafiz Abdul Majeed and the unani doctor Ansarullah Tabani created Hamdard Laboratories in 1906 in Delhi.

Himalaya Wellness Company's parent company and the group's holding company, Himalaya Holdings (HGH), has its corporate headquarters in the Cayman Islands. Regional headquarters for HGH are located in Dubai, Singapore, and Houston in addition to Bangalore. An international personal care and drug company established in Bangalore is Himalaya Wellness Company (formerly Himalaya Drug Company). It was first founded in 1930 in Dehradun by Mohammad Manal. Ayurvedic elements are used in the health care products this company produces, which goes by the name Himalaya Herbal Healthcare. Its operations are dispersed among locations in India, the United States, the Middle East, Asia, Europe, and Oceania, and its goods are sold in 106 nations worldwide. Liv.52, a liver medication initially released in 1955, is its flagship product.

Key Companies in the ayurveda market include

Ayurveda Industry Developments

April 2022: Ruchi Soya Industries, owned by Baba Ramdev, determined that changing the company name to Patanjali Foods Ltd. and carrying out and disclosing the details of the planned transaction would be the most effective ways to merge Patanjali Ayurved Ltd.'s food range within itself.

June 2021: Leading FMCG business Marico announced on July 14 that it has paid an undisclosed fee for a 60 percent ownership stake in Apcos Naturals Private Limited. Arush Chopra, the CEO, and Megha Sabhlok, the brand director, co-founded Apcos Naturals Private Limited, an ayurvedic beauty company, in 2010.

April 2021: The Ministry of AYUSH has signed Country to Country Memorandums of Understanding with 18 nations for cooperation in Traditional Medicine and Homoeopathy, as well as MoUs for collaborative research and academic collaboration and MoUs for establishing AYUSH Academic Chairs in foreign universities, in order to promote AYUSH systems around the world. Another choice is the AYUSH Information Cells, which are found in about 28 nations and disseminate knowledge about AYUSH systems.

December 2020: Once its two Gujarat factories, Vapi and Masat, have received WHO-GMP and Certificate of Pharmaceutical Products (CoPP) accreditations, Emami hopes to sell its healthcare sector under the Zandu brand into a number of additional markets.

December 2019: As part of its objective to popularize ayurveda among contemporary customers, Dabur India Limited, the largest science-based ayurveda company in the world, introduced two ground-breaking new products: the health-restorative Ratnaprash and the unique medication Hridayasava for enhancing heart health.

Ayurveda Market Segmentation

Ayurveda Form Outlook (USD Billion, 2018-2032)

-

Herbal

-

Herbomineral

-

Mineral

Ayurveda Application Outlook (USD Billion, 2018-2032)

Ayurveda Source Outlook (USD Billion, 2018-2032)

-

Vegetable

-

Animal & Mineral

Ayurveda Disease Pattern Outlook (USD Billion, 2018-2032)

-

Respiratory System

-

Nervous Systems

-

Gastrointestinal Tract

-

Cardiovascular System

-

Infectious Diseases

-

Skeletal System

-

Skin And Hair

Ayurveda End-User Outlook (USD Billion, 2018-2032)

-

Academia And Research

-

Hospitals And Clinics

Ayurveda Regional Outlook (USD Billion, 2018-2032)

-

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Rest of Europe

-

Asia-Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

Rest of the World

-

Middle East

-

Africa

-

Latin America

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

10.59 (USD Billion)

|

|

Market Size 2025

|

12.19 (USD Billion)

|

|

Market Size 2034

|

43.22 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

15.10 % (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2020 - 2024

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Form, Application, Source, Disease Pattern, End-User, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Leverayush, Shree Baidyanath Ayurved Bhawan Pvt. Ltd., Himalaya Drug Company, Kerala Ayurveda Ltd., Amrutanjan Healthcare Limited, Hamdard Laboratories, Forest Essentials |

| Key Market Opportunities |

Ayurveda Industry ExpandingGrowing Online Demand for Ayurvedic Products and the E-commerce Industry |

| Key Market Dynamics |

Growing Acceptance of Ayurvedic Medicine Around the WorldEffective Treatment without any Negative Drug Side EffectsIncreased Investment by Major Players in the Market and Participation by Ayurvedic Product Manufacturers in Promotional Activities |

Ayurveda Market Highlights:

Frequently Asked Questions (FAQ) :

The ayurveda market size was valued at USD 8.0 Billion in 2022.

The market is projected to grow at a CAGR of 15.10% during the forecast period, 2025-2034.

North America had the largest share in the market

The key players in the market are Leverayush, Shree Baidyanath Ayurved Bhawan Pvt. Ltd., Himalaya Drug Company, Kerala Ayurveda Ltd., Amrutanjan Healthcare Limited, Hamdard Laboratories, and Forest Essentials.

The personal care category dominated the market in 2022.

The vegetable category had the largest share in the market.