Shift Towards Remote Work Models

The shift towards remote work models is significantly influencing the Workload Scheduling Automation Market. As organizations adapt to flexible work arrangements, the need for effective workload management becomes paramount. Automated scheduling solutions facilitate collaboration and ensure that tasks are assigned efficiently, regardless of team members' locations. Data indicates that companies embracing remote work are likely to see a 20% increase in employee productivity when utilizing automated scheduling tools. This trend highlights the importance of technology in supporting remote teams and maintaining operational continuity. As remote work becomes a permanent fixture in many organizations, the demand for innovative workload scheduling solutions is expected to grow, reflecting the evolving nature of work.

Integration of Advanced Analytics

The integration of advanced analytics into the Workload Scheduling Automation Market is becoming increasingly prevalent. Organizations are leveraging data analytics to gain insights into workload patterns and resource utilization. This analytical approach enables businesses to make informed decisions regarding scheduling, thereby optimizing performance. Recent studies indicate that companies utilizing analytics-driven scheduling can reduce operational costs by approximately 25%. The ability to predict workload demands and adjust schedules accordingly is a game changer for many industries, particularly in sectors like finance and healthcare. As the demand for data-driven decision-making continues to rise, the incorporation of advanced analytics into workload scheduling solutions is expected to enhance their effectiveness and appeal.

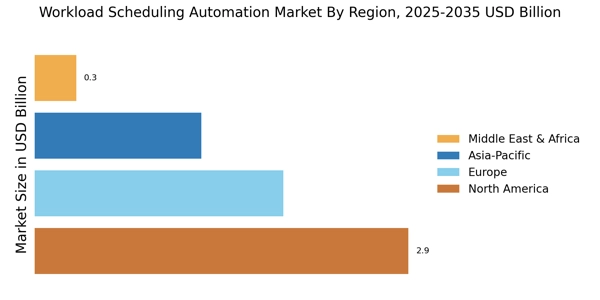

Growing Complexity of IT Environments

The growing complexity of IT environments is a significant driver for the Workload Scheduling Automation Market. As organizations adopt multi-cloud and hybrid cloud strategies, managing workloads across diverse platforms becomes increasingly challenging. This complexity necessitates sophisticated scheduling solutions that can seamlessly integrate with various systems and applications. Data suggests that over 70% of enterprises are now operating in multi-cloud environments, which amplifies the need for effective workload management. Automated scheduling tools that can adapt to these intricate environments are likely to see heightened demand. This trend underscores the importance of flexibility and scalability in workload scheduling solutions, as businesses seek to maintain operational efficiency amidst evolving technological landscapes.

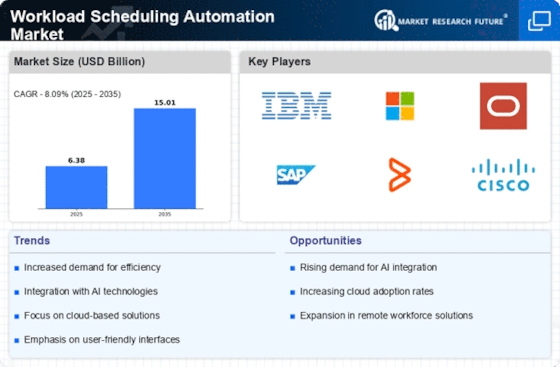

Rising Demand for Operational Efficiency

The Workload Scheduling Automation Market is experiencing a notable surge in demand for operational efficiency. Organizations are increasingly recognizing the need to streamline their processes to enhance productivity and reduce costs. According to recent data, companies that implement workload scheduling automation can achieve up to a 30% increase in operational efficiency. This trend is driven by the necessity to manage complex workloads effectively, especially in sectors such as IT and manufacturing. As businesses strive to optimize resource allocation and minimize downtime, the adoption of automated scheduling solutions is likely to grow. This shift not only improves task management but also allows organizations to focus on strategic initiatives, thereby fostering innovation and competitiveness in the marketplace.

Increased Focus on Compliance and Security

The heightened focus on compliance and security is driving growth in the Workload Scheduling Automation Market. Organizations are under increasing pressure to adhere to regulatory requirements and ensure data security. Automated scheduling solutions can help mitigate risks associated with human error and enhance compliance by providing consistent and auditable processes. Recent findings indicate that companies that implement automated scheduling are 40% more likely to meet compliance standards. This trend is particularly relevant in sectors such as finance and healthcare, where regulatory scrutiny is intense. As businesses prioritize security and compliance, the demand for robust workload scheduling automation tools is expected to rise, reflecting a broader commitment to risk management.