Workflow Management System Size

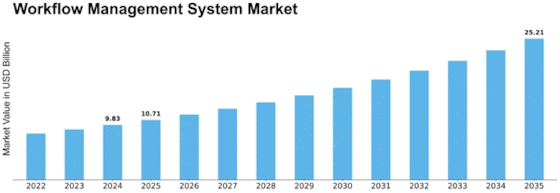

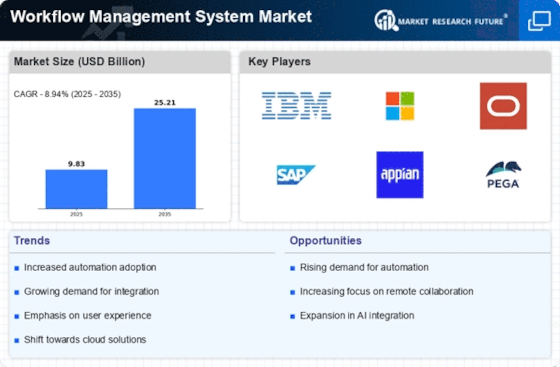

Workflow Management System Market Growth Projections and Opportunities

The Workflow Management market is fibered by numerous factors and topics, which are reflective of the emerging nature of business' process and the efficiency of organizations. Workflow management contains the creation, implementation and also the maximization of business processes that strives to guarantee the smooth flow of work in an organization. Nevertheless, a few factors are responsible for how the Workflow Management Market behaves.

Firstly and foremost, technological innovations comprise the fundamental pillars of Workflow Management transformation. The sophistication of technology advancement including artificial intelligence, automation and cloud computing has caused traditional business processes to be redefined. Through automation of recurrent functions, information routing based on data analytics and cloud-based technology adoption are few indicators of how the Workflow Management market is being influenced by technology trends. Management of organizations strive to improve their productivity, making their operations faster, with no errors possible.

The regulative framework continues to change as another essential part of the dynamics of market. Guidelines and regulations relating to the compliance, protections of data, and standards for various industries frame how companies develop and implement their work processes. Compliance functionalities come up with workflow management solutions which have adaptability to the changing requirements, hence, the prominent position in the market. Sellers have to keep themselves aware of the latest legal standards so that their systems remain aligned with the laws guiding the business in each industry.

Globalization also has an enormous impact on the development of the global Workflow Management marketplace. The importance of foundational and dynamic workflow solutions that can be implemented across different countries rises as businesses extend their operations throughout the world. Global brands need transcultural work management systems which would make it possible to coordinate deals in different languages, currencies and business practices. The vendors that possess and support localization functions in different business environments will serve the interests of multinational organizations the best way.

Workforce dynamics strengthen the market’s dynamic nature, leading to the growth of the Workflow Management market. The emergence of the remote work format, flexible shifts and distributed teams make organizations find appropriate workflow solutions which will fit their new arrangements. Cloud-based work management solutions that may enable collaboration when people are geographically dispersed, also offer flexibility of use, and provide solutions for remote work requirements become high in demand.

Finally, competition will have a vital impact upon this market while shaping it up. Vendors struggle to stand out amidst the competition by creating distinctive attributes, intuitive interfaces and also integrating with other enterprise applications. Sustainable innovation, experience enhancements of users, and appropriate partnerships are key factors that may enable vendors rise to the top of the industry. Concentrating on mergers and acquisitions is yet another factor that leads to nuance of market environment where companies try to widen their functional capabilities and markets.

Leave a Comment