Market Share

Workflow Management System Market Share Analysis

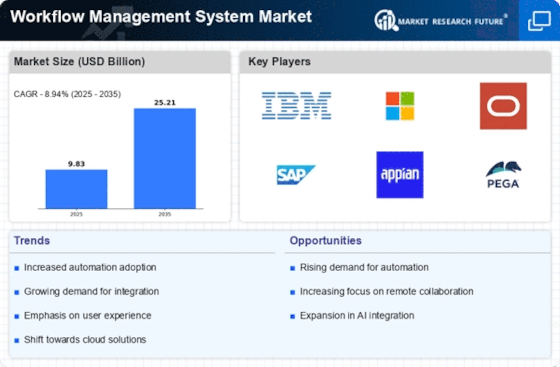

The Workflow Management market landscape is facing certain key trends, where digitalization clearly underlines its ability to transform the way businesses proceed with organizing their processes and improving their performance. There is one very important tendency in this sector and it is the growing spread of automation methods to boost the productivity of the workflows processes. Implementations of workflow management tools by the organizations serve the purpose of simplifying repetitive tasks and substituting them with the automation system which help shorten manual interventions and reduce inefficiencies. Such enhancements not only endorse process efficiency but also let the workers specialize in the jobs oriented on creativity and quality, yielding similar results in various sectors of the economy.

More and more enterprises are adopting cloud-aided workflow management services as the requirement for scalable and versatile tools increases to power the operations. Moving from on-specific and premise to cloud-based systems gives companies advantage of real-time accessibility, collaboration and adaptation to the business environment changing aspects as well. Moreover, the cloud-based approach ensures susceptibility for mobile work, which is currently becoming one of the most heartening tendencies of modern work as an individual can work remotely with flexible working hours and collaborate with distributed teams.

The embodiment of new technology such as artificial intelligence (AI) and machine learning (ML) is one of the crucial trend in the workflow management if the market are being considered. The AI-driven automation workflow solutions are endowed with the features in such a manner that from the advanced analytics to the predictive insights and the smart decision-making one would get the best, which is unmatchable in the current world. Machine learning algorithms is a process of optimization of the process with help of historic data identification of the patterns and learn it by suggesting for improvements. The integration among workflow systems also bolsters the flexibility of workflow systems, thus, companies can adjust quickly to the volatile market conditions and even the evolving consumer demands.

Efficient design and intelligent interface for the user with UI/UX and a smooth user concerned experience are the major thing of workflow management trends. The organizations, which increasingly emphasize employees’ satisfaction and collaboration, have to identify intelligible workflow products that require little training and ensure an easy user experience. One aspect of the app's focus on usability is the fact that it is really a mobile app that can be used to carry out work flows on the go, and to provide even greater accessibility.

It is no longer just a matter of workflow management, the idea of low-code and no-code platforms is transforming the workspace. These platforms endow non-technical users who have no tech experience the capacity to execute various operations without even typing. As the process of cultivating the workflow becomes more and more democratized, it enhances the speed of the development process and thereby allows professionals directly to be involved in developing and refining the workflow that best serves them. Such a trend is quite favorable, as the companies, for instance can be quick to adapt to the market requirement, or implement the new processes without extensive participation of the IT resources.

Leave a Comment