Wooden Decking Size

Wooden Decking Market Growth Projections and Opportunities

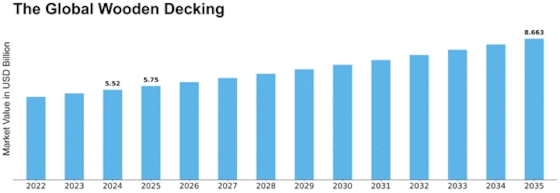

The wooden decking market’s dynamics and growth are influenced by various factors. One of such factors is the need for outdoor living spaces, as people expand their living areas. As a result, consumers have increasingly demanded timber decking to provide recreational and leisure outdoor areas in their homes. Wood has been used for decks due to its aesthetic value and warmth. The size of the wood decking market was valued at USD 5.1 billion in 2022. The wooden decking market for 2032 is projected to be USD 7.7 Billion from USD 5.3 Billion in 2023, at a CAGR of 4.70%.

Also, the building and housing industry shapes the wood deck industry because as construction grows so does usage of materials like decks mostly made of wood. Wood as a decking material is timeless and flexible following architectonic trends and taste preferences on the market nowadays; different trees species also have varied durability levels that affect how a certain type is received within the market.

Hardwood decking is favored by eco-conscious shoppers who care about environment. This trend has resulted in many manufacturers and suppliers taking up sustainable forestry methods and offering certified wood products. Better treatment, coating, installation methods make timber decks more durable and weatherproof. Composite decks are made mixing wood fibers with synthetic components like PVC giving it an enhanced appearance yet easier maintenance. Wooden deck success depends on disposable income availability coupled with consumer spending level. There are global challenges facing timber decking sector. These may be including but not limited to fluctuations on raw materials prices specifically lumber affecting manufacturers’ cost structures. Moreover, economic uncertainty together with regulatory changes may impact forestry enterprises either way both negatively or positively towards stability.

Several players are involved in the wooden decking market. In this competitive industry, firms must differentiate themselves through product innovation, quality and branding. Partnerships and cooperation within supply chains could give organizations a competitive advantage by ensuring a smooth flow of materials and efficient distribution.

Regulations also affect wooden deck sector as it faces building codes, environmental guidelines or sustainable forestry standards at all times during manufacturing hardwood decks, promoting sales or installing them.

Leave a Comment