Growing Demand for Sustainable Materials

The increasing global emphasis on sustainability drives the demand for eco-friendly materials, including wood plastic composites. As consumers and industries seek alternatives to traditional plastics and wood, the Global Wood Plastic Composites Market Industry is poised for growth. In 2024, the market is valued at approximately 6.11 USD Billion, reflecting a shift towards sustainable building materials. This trend is particularly evident in construction and automotive sectors, where the use of composites can reduce environmental impact while maintaining performance. The potential for wood plastic composites to replace less sustainable materials positions them favorably in a market increasingly focused on environmental responsibility.

Increased Awareness of Environmental Impact

Growing awareness of the environmental impact of materials used in construction and manufacturing drives interest in wood plastic composites. The Global Wood Plastic Composites Market Industry is witnessing a shift as consumers and businesses prioritize products that minimize ecological footprints. This heightened awareness encourages the adoption of composites, which combine the benefits of wood and plastic while reducing waste. As more stakeholders recognize the advantages of using sustainable materials, the market is likely to experience robust growth, aligning with global efforts to mitigate climate change and promote responsible consumption.

Regulatory Support for Eco-Friendly Products

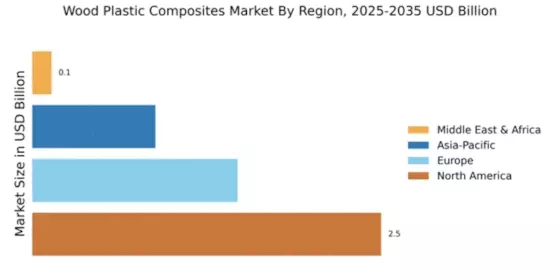

Government regulations promoting the use of sustainable materials significantly influence the Global Wood Plastic Composites Market Industry. Many countries are implementing policies that encourage the adoption of eco-friendly products, which include wood plastic composites. For instance, incentives for using recycled materials in construction projects can enhance market growth. As regulatory frameworks evolve to support sustainability, the demand for wood plastic composites is expected to rise, potentially contributing to a market valuation of 12 USD Billion by 2035. This regulatory environment fosters innovation and investment in the sector, aligning with global sustainability goals.

Rising Construction and Renovation Activities

The resurgence in global construction and renovation activities fuels the demand for wood plastic composites. As urbanization accelerates and infrastructure projects expand, the Global Wood Plastic Composites Market Industry stands to benefit from increased usage in decking, fencing, and other outdoor applications. The anticipated growth in construction spending is likely to enhance the market's value, with projections indicating a compound annual growth rate of 6.33% from 2025 to 2035. This trend underscores the importance of wood plastic composites as a preferred material choice for builders seeking durability and aesthetic appeal.

Technological Advancements in Manufacturing Processes

Innovations in manufacturing techniques enhance the production efficiency and quality of wood plastic composites. The Global Wood Plastic Composites Market Industry benefits from advancements such as improved extrusion and molding technologies, which enable the creation of more durable and versatile products. These technological improvements not only reduce production costs but also expand the application range of composites in various sectors, including furniture and decking. As manufacturers adopt these advanced processes, the market is likely to see increased competitiveness and product diversity, further driving growth in the coming years.