Market Share

Wood Chipper Market Share Analysis

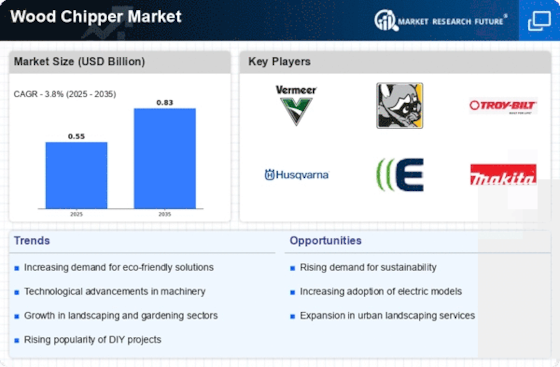

Market share positioning strategies play a crucial role in the competitive landscape of the Wood Chipper Market. With the increasing demand for wood chippers across various industries such as agriculture, landscaping, and forestry, companies are constantly striving to gain a larger share of the market. One common strategy is differentiation, where companies focus on unique features and capabilities of their wood chippers to stand out from competitors. This could include offering advanced shredding technologies, improved fuel efficiency, or enhanced safety features. By highlighting these distinguishing factors, companies can attract customers who prioritize specific attributes in their wood chippers.

Moreover, pricing strategies are another key aspect of market share positioning. Some companies opt for a penetration pricing strategy, offering their wood chippers at lower prices to gain a larger market share quickly. This approach can be effective in attracting price-sensitive customers and capturing market share from competitors. On the other hand, premium pricing strategies target customers who are willing to pay a higher price for superior quality or additional features. By positioning their wood chippers as high-end products, companies can differentiate themselves and appeal to customers seeking top-of-the-line equipment.

In addition to differentiation and pricing, distribution channels play a significant role in market share positioning. Companies may choose to focus on expanding their distribution networks to reach a broader customer base. This could involve partnering with dealers, distributors, or online retailers to increase the availability of their wood chippers in different regions or markets. By ensuring easy access to their products, companies can effectively compete for market share against competitors with similar offerings.

Furthermore, marketing and branding strategies are essential for shaping the perception of wood chipper brands in the market. Companies often invest in advertising campaigns, sponsorships, and promotional activities to increase brand awareness and visibility. Building a strong brand image can help companies establish a loyal customer base and command a higher market share. Additionally, emphasizing factors such as reliability, durability, and customer satisfaction in marketing efforts can influence purchasing decisions and contribute to market share growth.

Moreover, innovation plays a crucial role in maintaining a competitive edge in the wood chipper market. Companies that invest in research and development to introduce new technologies and features can attract customers seeking cutting-edge solutions. Whether it's developing eco-friendly wood chippers with reduced emissions or incorporating automation for enhanced efficiency, innovation can drive market share growth by meeting evolving customer needs and preferences.

Furthermore, strategic partnerships and collaborations can also contribute to market share positioning. By joining forces with complementary businesses or industry players, companies can leverage each other's strengths and resources to gain a competitive advantage. This could involve collaborations with engine manufacturers to enhance performance or partnerships with rental companies to expand market reach. Through strategic alliances, companies can access new markets, technologies, and distribution channels, ultimately strengthening their position in the wood chipper market.

Leave a Comment