Expansion of IoT Devices

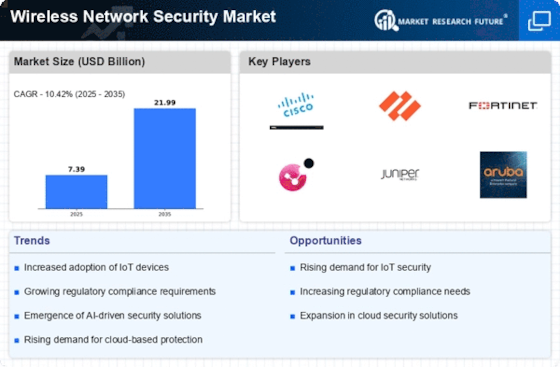

The proliferation of Internet of Things (IoT) devices is a significant driver for the Wireless Network Security Market. With billions of devices expected to be connected in the coming years, the need for secure wireless networks becomes paramount. IoT devices often lack robust security features, making them vulnerable to attacks. As organizations integrate these devices into their operations, they must implement comprehensive security protocols to protect sensitive information. Market analysis suggests that the increasing adoption of IoT technology will lead to a substantial rise in demand for wireless security solutions, as businesses seek to mitigate risks associated with unsecured devices.

Growing Cybersecurity Threats

The Wireless Network Security Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are facing a myriad of attacks, including phishing, ransomware, and advanced persistent threats, which necessitate robust security measures. According to recent data, cybercrime is projected to cost businesses trillions annually, prompting a heightened focus on securing wireless networks. As more devices connect to these networks, the potential attack surface expands, making it imperative for companies to invest in advanced wireless security solutions. This trend indicates a strong market growth trajectory as businesses prioritize safeguarding their data and infrastructure against evolving threats.

Rising Awareness of Data Privacy

The growing awareness of data privacy among consumers and organizations is a key driver for the Wireless Network Security Market. As data breaches become more prevalent, stakeholders are increasingly concerned about the protection of personal and sensitive information. This heightened awareness is prompting businesses to prioritize the implementation of effective wireless security measures to safeguard their data. Market trends suggest that as consumers demand greater transparency and security from organizations, the pressure to adopt advanced wireless security solutions will intensify. This shift in consumer expectations is likely to shape the future landscape of the wireless security market.

Regulatory Compliance Requirements

The Wireless Network Security Market is heavily influenced by the need for compliance with various regulatory frameworks. Organizations are mandated to adhere to standards such as GDPR, HIPAA, and PCI DSS, which necessitate stringent security measures for wireless networks. Non-compliance can result in hefty fines and reputational damage, driving companies to invest in security solutions that ensure adherence to these regulations. As regulatory bodies continue to tighten their requirements, the demand for advanced wireless security technologies is expected to grow. This trend highlights the critical role of compliance in shaping the market landscape and influencing purchasing decisions.

Increased Adoption of Cloud Services

The shift towards cloud computing is a pivotal factor impacting the Wireless Network Security Market. As businesses increasingly migrate their operations to the cloud, the security of wireless networks becomes a crucial concern. Cloud services often require secure access to sensitive data, necessitating the implementation of robust wireless security measures. Market data indicates that the cloud services market is projected to grow significantly, which in turn drives the demand for wireless security solutions. Organizations must ensure that their wireless networks are fortified against potential vulnerabilities associated with cloud access, thereby propelling market growth.