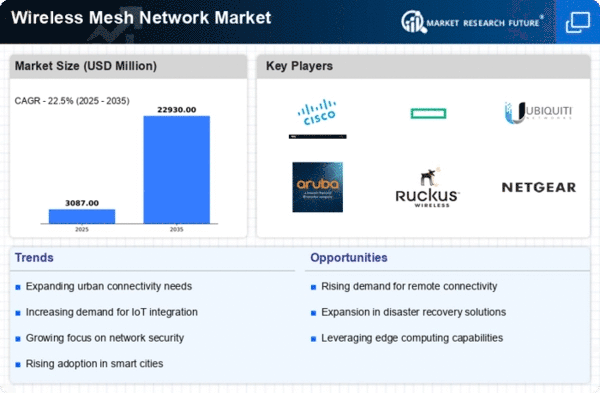

Market Growth Projections

The Global Wireless Mesh Network Market Industry is poised for substantial growth, with projections indicating a rise from 4.47 USD Billion in 2024 to 22.7 USD Billion by 2035. This trajectory suggests a robust compound annual growth rate of 15.9% from 2025 to 2035, reflecting the increasing demand for advanced networking solutions. Factors such as the proliferation of IoT devices, smart city initiatives, and the need for reliable connectivity are driving this growth. As organizations and governments invest in infrastructure that supports these technologies, the wireless mesh network market is likely to expand significantly in the coming years.

Cost-Effectiveness of Deployment

The Global Wireless Mesh Network Market Industry is characterized by the cost-effectiveness of deploying wireless mesh networks compared to traditional wired networks. The reduction in installation and maintenance costs associated with wireless solutions appeals to both small and large enterprises. Organizations can expand their network coverage without incurring substantial expenses, which is particularly advantageous for startups and small businesses. As the market evolves, the affordability of wireless mesh networks is likely to encourage wider adoption across various sectors, ultimately contributing to the overall growth of the industry.

Increased Adoption of IoT Devices

The Global Wireless Mesh Network Market Industry is witnessing increased adoption of Internet of Things (IoT) devices, which necessitate efficient and scalable networking solutions. As more devices connect to the internet, the demand for networks that can handle a multitude of connections simultaneously becomes critical. Wireless mesh networks offer a decentralized approach, allowing devices to communicate directly with one another, thereby enhancing network resilience. This trend is expected to contribute to a compound annual growth rate of 15.9% from 2025 to 2035, as organizations and consumers alike seek to leverage the benefits of interconnected devices in their daily operations.

Expansion of Smart City Initiatives

The Global Wireless Mesh Network Market Industry is significantly influenced by the expansion of smart city initiatives worldwide. Governments are increasingly investing in infrastructure that supports intelligent transportation systems, public safety, and environmental monitoring. Wireless mesh networks serve as a backbone for these initiatives, providing reliable communication channels for various applications. As cities evolve into smart ecosystems, the market is expected to grow substantially, with projections indicating a rise to 22.7 USD Billion by 2035. This growth is indicative of the potential for wireless mesh networks to enhance urban living through improved connectivity and data-driven decision-making.

Enhanced Network Reliability and Coverage

The Global Wireless Mesh Network Market Industry benefits from the enhanced network reliability and coverage that mesh networks provide. Unlike traditional networks, which rely on a single point of failure, wireless mesh networks distribute connectivity across multiple nodes. This decentralized structure ensures that even if one node fails, the network remains operational. As businesses and municipalities prioritize uninterrupted service, the appeal of wireless mesh networks continues to grow. The ability to cover large areas without significant infrastructure investment makes these networks particularly attractive for rural and underserved regions, further driving market growth.

Growing Demand for High-Speed Connectivity

The Global Wireless Mesh Network Market Industry experiences a growing demand for high-speed connectivity, driven by the increasing reliance on internet services across various sectors. As organizations seek to enhance their operational efficiency, the need for robust and reliable network solutions becomes paramount. In 2024, the market is projected to reach 4.47 USD Billion, reflecting a significant shift towards advanced networking technologies. This trend is particularly evident in urban areas, where the proliferation of smart devices necessitates seamless connectivity. The integration of wireless mesh networks facilitates this demand, enabling efficient data transmission and improved user experiences.