Expansion of IoT Devices

The proliferation of Internet of Things (IoT) devices significantly influences the Wireless Infrastructure Monitoring Market. With an estimated 30 billion connected devices anticipated by 2025, the demand for effective monitoring solutions escalates. These devices generate vast amounts of data, necessitating sophisticated infrastructure to manage and analyze this information. As organizations seek to optimize their operations and enhance efficiency, the need for comprehensive monitoring systems becomes increasingly critical. The Wireless Infrastructure Monitoring Market is likely to benefit from this trend, as businesses invest in technologies that can seamlessly integrate with their existing infrastructure to support the growing IoT ecosystem.

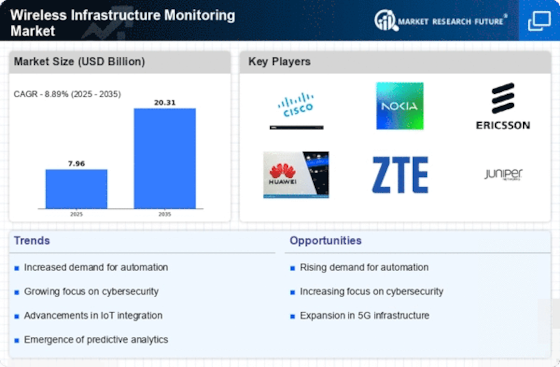

Advancements in Technology

Technological advancements play a pivotal role in shaping the Wireless Infrastructure Monitoring Market. Innovations in artificial intelligence, machine learning, and data analytics are transforming the way organizations monitor their wireless infrastructure. These technologies enable predictive maintenance, allowing companies to identify potential issues before they escalate into significant problems. In 2025, the market is projected to benefit from these advancements, as organizations seek to leverage cutting-edge solutions to enhance operational efficiency. The Wireless Infrastructure Monitoring Market is likely to see increased adoption of smart monitoring systems that utilize these technologies to provide actionable insights and improve overall network performance.

Growing Cybersecurity Concerns

As cybersecurity threats continue to escalate, the Wireless Infrastructure Monitoring Market faces increasing pressure to enhance security measures. Organizations are recognizing the importance of safeguarding their wireless infrastructure against potential breaches and attacks. In 2025, the market is expected to witness a surge in demand for monitoring solutions that incorporate advanced security features. This trend is driven by the need for real-time threat detection and response capabilities, which are essential for maintaining the integrity of wireless networks. The Wireless Infrastructure Monitoring Market is likely to evolve as companies prioritize cybersecurity in their infrastructure investments, leading to the development of more sophisticated monitoring technologies.

Regulatory Compliance and Standards

The Wireless Infrastructure Monitoring Market is also shaped by the increasing emphasis on regulatory compliance and industry standards. Governments and regulatory bodies are implementing stringent guidelines to ensure the safety and reliability of wireless networks. This regulatory landscape compels organizations to adopt advanced monitoring solutions that can provide real-time insights and facilitate compliance reporting. In 2025, it is estimated that compliance-related investments will account for a significant portion of the market, as companies strive to meet these evolving requirements. Consequently, the Wireless Infrastructure Monitoring Market is likely to see a rise in demand for solutions that not only monitor performance but also ensure adherence to regulatory standards.

Rising Demand for Network Reliability

The Wireless Infrastructure Monitoring Market experiences a notable surge in demand for enhanced network reliability. As businesses increasingly rely on uninterrupted connectivity, the need for robust monitoring solutions becomes paramount. In 2025, the market is projected to reach a valuation of approximately 5 billion USD, driven by the necessity for real-time monitoring and proactive maintenance. Organizations are investing in advanced monitoring systems to mitigate downtime and ensure seamless operations. This trend is particularly evident in sectors such as telecommunications and transportation, where network failures can lead to significant financial losses. Consequently, the Wireless Infrastructure Monitoring Market is poised for substantial growth as companies prioritize reliability in their infrastructure.