Surge in IoT Applications

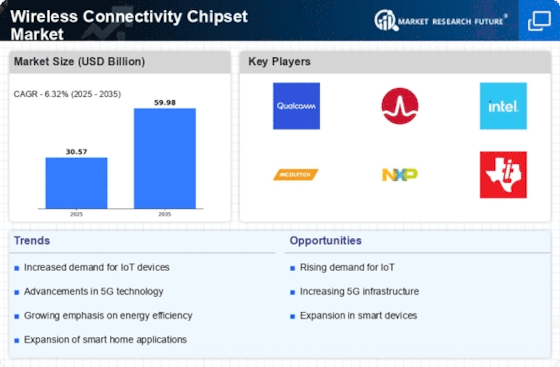

The proliferation of Internet of Things (IoT) applications appears to be a primary driver for the Wireless Connectivity Chipset Market. As more devices become interconnected, the demand for efficient and reliable wireless connectivity solutions intensifies. In 2025, it is estimated that the number of connected IoT devices will surpass 30 billion, necessitating advanced chipsets that can support diverse communication protocols. This surge in IoT applications not only enhances consumer convenience but also drives innovation in various sectors, including healthcare, automotive, and smart homes. Consequently, manufacturers are compelled to develop chipsets that can handle the increasing data traffic and provide seamless connectivity, thereby propelling the growth of the Wireless Connectivity Chipset Market.

Emergence of Edge Computing

The emergence of edge computing is reshaping the Wireless Connectivity Chipset Market by shifting data processing closer to the source of data generation. This paradigm shift reduces latency and bandwidth usage, which is particularly beneficial for applications requiring real-time data processing. As edge computing gains traction, the demand for chipsets that can efficiently handle local data processing and connectivity is expected to rise. By 2025, the edge computing market is projected to grow significantly, further driving the need for specialized chipsets that can support this architecture. Consequently, manufacturers are likely to focus on developing solutions that enhance the performance and efficiency of edge devices, thereby influencing the Wireless Connectivity Chipset Market.

Advancements in 5G Technology

The ongoing advancements in 5G technology are likely to have a profound impact on the Wireless Connectivity Chipset Market. With the rollout of 5G networks, there is a marked increase in the demand for chipsets that can support higher data rates and lower latency. By 2025, it is projected that 5G subscriptions will reach over 1.5 billion, creating a substantial market for chipsets designed specifically for this technology. These chipsets are essential for enabling applications such as augmented reality, virtual reality, and ultra-high-definition video streaming. As a result, companies are investing heavily in research and development to create innovative solutions that meet the requirements of 5G, thereby driving the Wireless Connectivity Chipset Market forward.

Growing Demand for Smart Devices

The escalating demand for smart devices is a significant factor influencing the Wireless Connectivity Chipset Market. As consumers increasingly adopt smart home technologies, wearables, and other connected devices, the need for robust wireless connectivity solutions becomes paramount. In 2025, the smart home market is expected to reach a valuation of over 150 billion, which will inevitably drive the demand for advanced chipsets capable of supporting multiple connectivity standards. This trend indicates that manufacturers must focus on developing chipsets that not only provide reliable connectivity but also integrate seamlessly with various platforms. The Wireless Connectivity Chipset Market is thus poised for growth as it adapts to the evolving landscape of consumer electronics.

Increased Focus on Automotive Connectivity

The increased focus on automotive connectivity is emerging as a crucial driver for the Wireless Connectivity Chipset Market. With the automotive sector rapidly evolving towards connected and autonomous vehicles, the demand for advanced wireless chipsets is surging. By 2025, it is anticipated that the connected car market will exceed 200 billion, necessitating chipsets that can support vehicle-to-everything (V2X) communication. This trend indicates that manufacturers must innovate to create chipsets that ensure reliable connectivity in dynamic environments. As automotive manufacturers prioritize safety and efficiency, the Wireless Connectivity Chipset Market is likely to experience substantial growth, driven by the need for sophisticated connectivity solutions.