Enhanced Communication Capabilities

The Wireless Broadband in Public Safety Market is experiencing a surge in demand for enhanced communication capabilities among first responders. As public safety agencies increasingly rely on real-time data sharing, the need for robust wireless broadband solutions becomes paramount. This trend is underscored by the fact that effective communication can significantly improve response times during emergencies. In 2025, it is estimated that nearly 70% of public safety agencies will prioritize investments in wireless broadband technologies to facilitate seamless communication. This shift not only enhances operational efficiency but also fosters collaboration among various agencies, ultimately leading to improved public safety outcomes.

Integration of Advanced Technologies

The integration of advanced technologies is a pivotal driver in the Wireless Broadband in Public Safety Market. Technologies such as artificial intelligence, machine learning, and the Internet of Things are increasingly being utilized to enhance situational awareness and decision-making processes. For instance, the deployment of drones equipped with wireless broadband capabilities allows for real-time aerial surveillance during emergencies. As of 2025, it is projected that the adoption of these technologies will lead to a 30% increase in the effectiveness of public safety operations. This integration not only streamlines processes but also empowers agencies to respond more effectively to incidents.

Regulatory Support and Policy Development

Regulatory support and policy development play a crucial role in shaping the Wireless Broadband in Public Safety Market. Governments are increasingly establishing frameworks that promote the adoption of wireless broadband technologies within public safety agencies. In 2025, it is projected that new policies will be enacted to facilitate the deployment of next-generation wireless networks, ensuring that first responders have access to the latest communication tools. This regulatory environment not only encourages innovation but also provides a structured approach to funding and resource allocation. As a result, public safety agencies are likely to benefit from enhanced operational capabilities and improved service delivery.

Growing Demand for Data-Driven Decision Making

The Wireless Broadband in Public Safety Market is witnessing a growing demand for data-driven decision making among public safety agencies. The ability to collect, analyze, and utilize data in real-time is becoming increasingly critical for effective emergency response. In 2025, it is anticipated that approximately 60% of public safety organizations will implement data analytics tools powered by wireless broadband technologies. This trend indicates a shift towards proactive rather than reactive measures, allowing agencies to anticipate potential threats and allocate resources more efficiently. Consequently, the emphasis on data-driven strategies is likely to reshape the landscape of public safety operations.

Increased Funding for Public Safety Initiatives

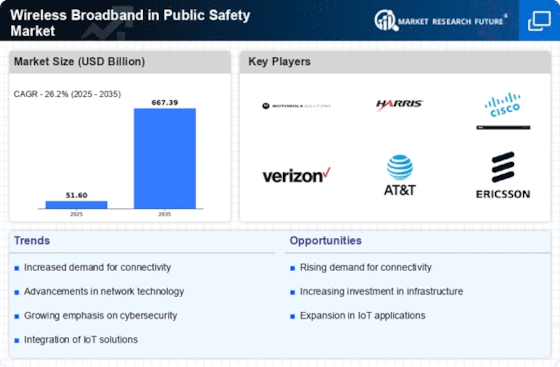

Increased funding for public safety initiatives is a significant driver in the Wireless Broadband in Public Safety Market. Governments and local authorities are recognizing the necessity of investing in advanced communication technologies to enhance public safety. In 2025, it is expected that funding for public safety projects will rise by 25%, with a substantial portion allocated to wireless broadband infrastructure. This influx of capital enables agencies to upgrade their communication systems, ensuring that first responders have access to reliable and high-speed connectivity during critical situations. Such investments are crucial for maintaining public trust and ensuring community safety.