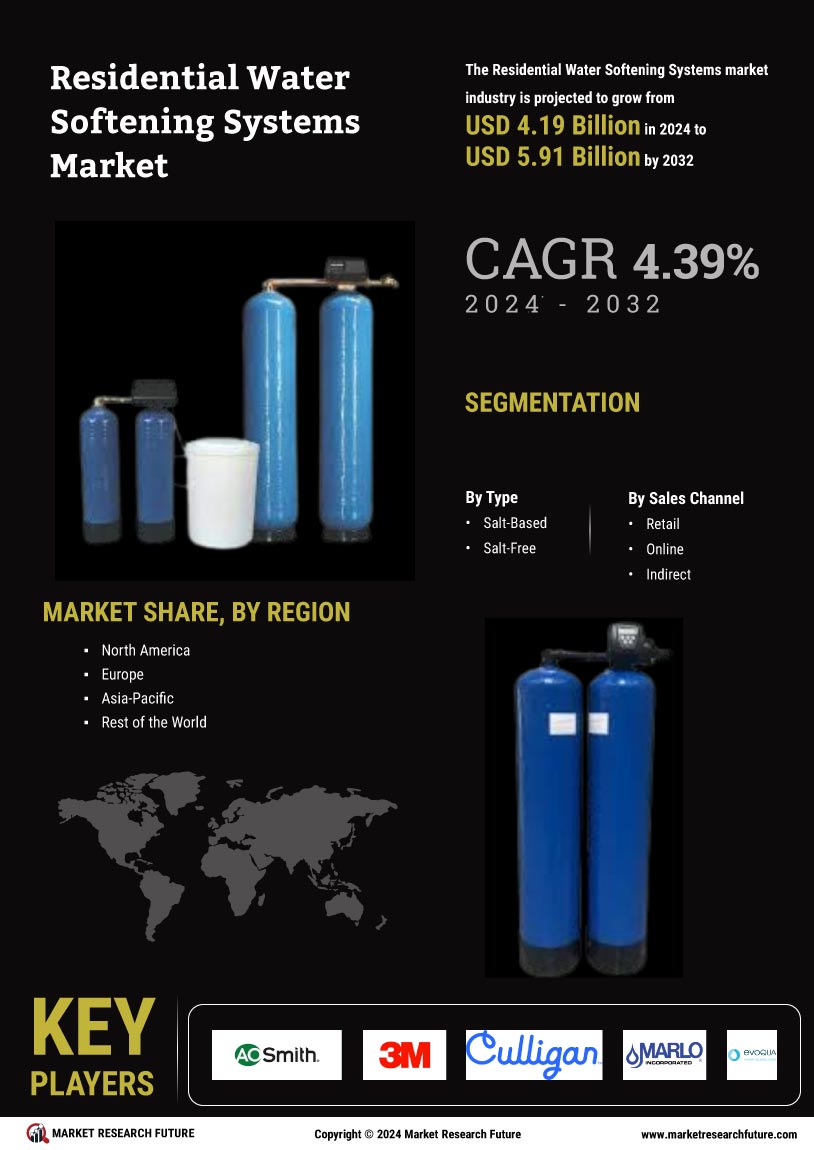

Rising Water Quality Concerns

The increasing awareness regarding water quality issues is a primary driver for the Residential Water Softening Systems Market. Consumers are becoming more cognizant of the adverse effects of hard water, which can lead to scale buildup in plumbing and appliances, ultimately affecting their longevity and efficiency. Reports indicate that approximately 85% of households in certain regions experience hard water problems, prompting a surge in demand for water softening solutions. This heightened concern over water quality is likely to propel the market forward, as homeowners seek effective solutions to mitigate the negative impacts of hard water on their daily lives.

Growing Health and Wellness Trends

The rising focus on health and wellness among consumers is driving the Residential Water Softening Systems Market. As individuals become more health-conscious, they are seeking ways to improve their overall quality of life, including the quality of their water. Hard water can lead to skin irritation and other health issues, prompting consumers to invest in water softening systems. Market data indicates that the health and wellness sector is expanding rapidly, with consumers increasingly prioritizing products that contribute to their well-being. This trend is expected to bolster the demand for residential water softening solutions, as they are perceived as beneficial for both health and home maintenance.

Regulatory Standards and Guidelines

Government regulations aimed at improving water quality and safety are influencing the Residential Water Softening Systems Market. Various regions have implemented stringent guidelines regarding water treatment and quality standards, which necessitate the adoption of water softening systems. For instance, regulations that limit the levels of calcium and magnesium in drinking water are driving consumers to invest in water softening technologies. As municipalities and local governments continue to enforce these regulations, the demand for residential water softening systems is expected to rise, creating a favorable environment for market growth.

Increased Home Renovation Activities

The ongoing trend of home renovations and improvements is contributing to the growth of the Residential Water Softening Systems Market. As homeowners invest in upgrading their living spaces, they are increasingly considering water softening systems as essential components of modern home amenities. The home improvement market has seen a notable increase, with expenditures on renovations rising significantly in recent years. This trend suggests that more consumers are willing to allocate budgets for water treatment solutions, thereby enhancing the market's potential. The integration of water softeners into home renovation projects is likely to become a standard practice.

Technological Innovations in Water Softening

Technological advancements in water softening systems are significantly impacting the Residential Water Softening Systems Market. Innovations such as smart water softeners, which utilize IoT technology for monitoring and efficiency, are gaining traction among consumers. These systems not only enhance the user experience but also optimize salt and water usage, leading to cost savings. The introduction of more efficient and environmentally friendly softening methods, such as salt-free systems, is also appealing to eco-conscious consumers. As these technologies continue to evolve, they are likely to attract a broader customer base, further stimulating market growth.