Technological Innovations

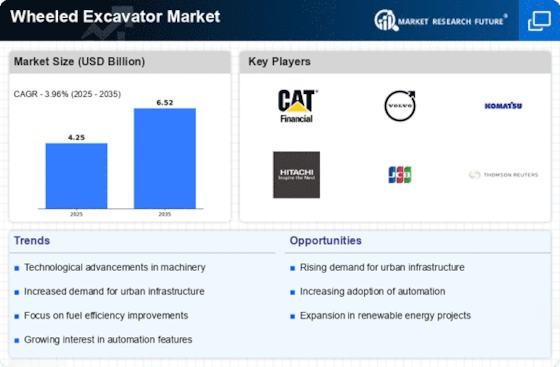

Technological advancements are playing a crucial role in shaping the Wheeled Excavator Market. Innovations such as telematics, automation, and advanced hydraulic systems are enhancing the performance and efficiency of wheeled excavators. For instance, the integration of telematics allows operators to monitor machine performance in real-time, leading to improved maintenance and reduced downtime. Additionally, the introduction of electric and hybrid models is gaining traction, aligning with the industry's shift towards sustainability. As of 2025, it is estimated that the adoption of these technologies could increase operational efficiency by up to 20%. This technological evolution not only improves productivity but also attracts new customers to the Wheeled Excavator Market, as companies seek to leverage these advancements for competitive advantage.

Rising Urbanization Trends

Urbanization is a prominent trend influencing the Wheeled Excavator Market. As populations migrate towards urban areas, the demand for housing, transportation, and public services escalates. This urban expansion necessitates extensive construction activities, thereby increasing the need for efficient excavation and earthmoving equipment. In 2025, urban areas are projected to house over 60% of the global population, leading to a heightened demand for wheeled excavators. These machines are particularly suited for urban environments due to their compact size and maneuverability, allowing them to operate in confined spaces. Consequently, the rising urbanization trends are likely to drive the growth of the Wheeled Excavator Market, as construction companies seek reliable equipment to meet the challenges of urban development.

Increased Demand for Construction Equipment

The Wheeled Excavator Market is experiencing a surge in demand for construction equipment, driven by ongoing infrastructure projects and urban development. As nations invest in enhancing their infrastructure, the need for versatile machinery like wheeled excavators becomes paramount. In 2025, the construction sector is projected to grow at a rate of approximately 5.5% annually, indicating a robust market for wheeled excavators. These machines are favored for their mobility and efficiency, allowing for quick transitions between job sites. Furthermore, the rise in public-private partnerships in construction projects is likely to bolster the demand for wheeled excavators, as they are essential for various tasks, including excavation, grading, and material handling. This trend suggests a promising outlook for the Wheeled Excavator Market in the coming years.

Regulatory Support for Infrastructure Development

Government policies and regulations are increasingly supporting infrastructure development, which is a key driver for the Wheeled Excavator Market. Many countries are implementing favorable policies to stimulate construction activities, including tax incentives and funding for public works projects. In 2025, it is anticipated that infrastructure spending will reach unprecedented levels, with estimates suggesting an increase of over 10% compared to previous years. This financial backing is likely to create a conducive environment for the growth of the wheeled excavator segment, as these machines are integral to various construction tasks. Moreover, regulatory frameworks that prioritize sustainable construction practices may further enhance the demand for advanced wheeled excavators, which are designed to meet stringent environmental standards. Thus, the regulatory landscape appears to be a significant catalyst for the Wheeled Excavator Market.

Focus on Sustainability and Environmental Compliance

The emphasis on sustainability and environmental compliance is becoming increasingly relevant in the Wheeled Excavator Market. As environmental regulations tighten, construction companies are compelled to adopt eco-friendly practices, including the use of machinery that minimizes emissions and energy consumption. The wheeled excavator segment is responding to this demand by introducing models that comply with stringent environmental standards. In 2025, it is expected that the market for low-emission and energy-efficient wheeled excavators will expand significantly, potentially capturing a larger share of the overall market. This shift towards sustainability not only aligns with global environmental goals but also enhances the appeal of wheeled excavators to environmentally conscious clients. Therefore, the focus on sustainability is likely to be a driving force in the Wheeled Excavator Market.