Market Trends

Key Emerging Trends in the Wheel Speed Sensor Market

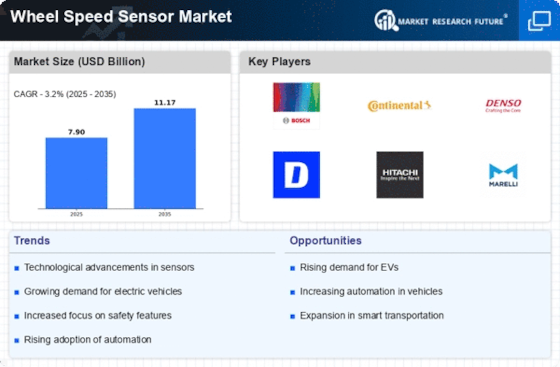

The wheel speed sensor market is witnessing several significant trends owing to the changing landscape in automotive technology, safety regulations and development of electric and autonomous vehicles. Of considerable interest is the thriving emergence of ADAS in motor vehicles. Wheel speed sensors provide essential data for these systems on real-time individual wheel speeds to improve vehicle stability, traction and anti-lock braking effectiveness. This trend is indicative of a sector-wide movement towards integrating advanced sensor technologies to improve automotive safety and performance. The penetration of EVs and hybrid vehicles is also shaping the dynamics in the wheel speed sensor markets. With the adoption of electrification in the automotive industry, accurate and reliable wheel speed data becomes ever more important for electric-drivetrain efficiency and safety. By promoting regenerative braking systems and improving the entire electric propulsion performance, wheel speed sensors help shape this market in accordance with its development towards e-mobility. Another major trend influencing the wheel speed sensor market is autonomous driving technology. In moving towards autonomous vehicles, the navigation, collision avoidance, and overall control of all vehicle will depend to high degree on accurate instant data from wheel speed sensors. The trend mirrors the increasing use of sensor fusion technologies to enable autonomous driving capabilities, in which wheel speed sensors are a vital input source for vehicle decision-making algorithms. The wheel speed sensor market trends include miniaturization and integration of sensors. The focus of the manufacturers is to design compact and lightweight wheel speed sensors that are easy to integrate into a vehicle’s overall appearance. This approach matches the overall automotive sector’s focus on lightweighting and small-size sensor solutions to address design limitations while increasing efficiency throughout a vehicle without sacrificing sensory performance. The growing vehicle connectivity is affecting the pattern of wheel speed sensors. Sensor integration with connected vehicle systems allows for real-time data transmission, remote diagnostics, and predictive maintenance as well as over the air updates. Such a trend helps the development of predictive analytics and condition-based maintenance strategies, making wheel speed sensors more reliable and increasing their life expectancy. The environmental aspects are emerging as a prominent trend in the wheel speed sensor market. In this regard, sustainability is a critical aspect in the automotive industry and as such manufacturers from sensors are venturing into eco-friendly materials for manufacture of sensors. This trend supports the shift in direction of industries towards greener practices that help reduce environmental impact of automotive components.

Leave a Comment