Growth in Renewable Energy Sector

The Welding Consumables Market is poised to benefit from the burgeoning renewable energy sector. As nations increasingly invest in sustainable energy solutions, the demand for welding consumables used in the construction of renewable energy infrastructure, such as wind turbines and solar panels, is expected to rise. In 2025, the renewable energy market is projected to expand significantly, with investments reaching unprecedented levels. This growth will likely create new opportunities for welding consumables manufacturers, as they develop products tailored to the unique requirements of renewable energy applications. The shift towards sustainability not only aligns with The Welding Consumables Market for long-term growth.

Increased Focus on Safety Standards

The Welding Consumables Market is increasingly influenced by heightened safety standards and regulations. As industries prioritize worker safety, the demand for consumables that comply with stringent safety guidelines is likely to rise. Regulatory bodies are continuously updating safety protocols, which necessitates the use of high-quality welding materials that minimize risks associated with welding operations. In 2025, it is anticipated that companies will invest more in training and equipment that align with these safety standards, thereby driving the consumption of compliant welding consumables. This trend not only enhances workplace safety but also fosters a culture of responsibility within organizations, ultimately benefiting the welding consumables market.

Rising Demand in Construction Sector

The Welding Consumables Market is experiencing a notable surge in demand, primarily driven by the expansion of the construction sector. As infrastructure projects proliferate, the need for robust welding solutions becomes paramount. In 2025, the construction industry is projected to grow at a compound annual growth rate of approximately 5.5%, which directly correlates with increased consumption of welding materials. This growth is not merely a regional phenomenon; it spans various markets, including residential, commercial, and industrial construction. Consequently, manufacturers of welding consumables are likely to adapt their offerings to meet the evolving requirements of this sector, ensuring that they provide high-quality, durable products that can withstand the rigors of construction applications.

Emerging Markets and Economic Development

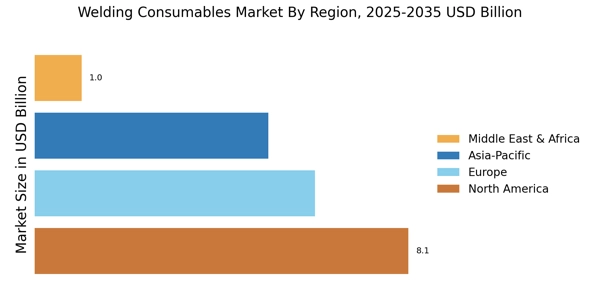

The Welding Consumables Market is witnessing growth driven by emerging markets and their economic development. Countries in Asia, Africa, and Latin America are experiencing rapid industrialization, leading to increased demand for welding consumables across various sectors. In 2025, it is estimated that these regions will contribute significantly to the overall market growth, as investments in manufacturing and infrastructure projects escalate. This trend presents a unique opportunity for manufacturers to expand their reach and cater to the specific needs of these developing economies. As local industries evolve, the demand for high-quality welding consumables that meet international standards is likely to rise, further propelling market growth.

Technological Innovations in Welding Processes

Technological advancements are reshaping the Welding Consumables Market, as innovations in welding processes enhance efficiency and effectiveness. The introduction of automated welding systems and advanced materials is likely to improve the quality of welds while reducing production times. For instance, the adoption of laser welding technology has gained traction, offering precision and speed that traditional methods cannot match. This shift towards automation and advanced techniques is expected to drive the demand for specialized welding consumables, as manufacturers seek to optimize their operations. As a result, the market may witness a diversification of product offerings, catering to the specific needs of various industries, including automotive and aerospace.