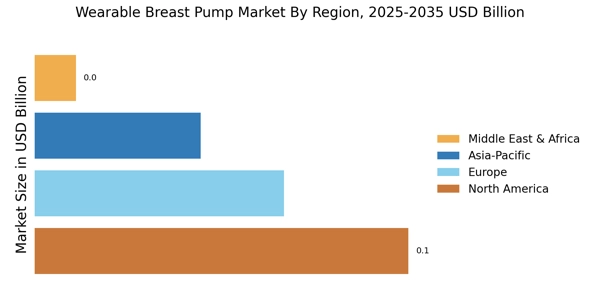

North America : Leading Innovation and Demand

North America is the largest market for wearable breast pumps, accounting for approximately 45% of the global market share. The growth is driven by increasing awareness of breastfeeding benefits, technological advancements, and supportive healthcare policies. Regulatory catalysts, such as the Affordable Care Act, mandate insurance coverage for breastfeeding equipment, further boosting demand. The region's focus on maternal health and convenience is propelling market expansion. The United States is the primary market, with key players like Willow Innovations, Freemie, and Medela leading the competitive landscape. Canada also contributes significantly, with a growing emphasis on innovative breastfeeding solutions. The presence of established brands and a robust distribution network enhances market accessibility, ensuring that consumers have a variety of options to choose from. The competitive environment is characterized by continuous product innovation and strategic partnerships among leading companies.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant increase in the wearable breast pump market, holding approximately 30% of the global share. The growth is fueled by rising health consciousness among new mothers, government initiatives promoting breastfeeding, and advancements in wearable technology. Countries like Germany and the UK are leading this trend, supported by favorable regulations that encourage breastfeeding practices and maternal health initiatives. Germany stands out as a key player in the market, with brands like Elvie and Medela gaining traction. The competitive landscape is evolving, with new entrants focusing on innovative designs and user-friendly features. The presence of established companies alongside startups fosters a dynamic environment, driving product differentiation. As awareness of the benefits of breastfeeding continues to grow, the demand for wearable breast pumps is expected to rise, making Europe a promising market for future investments.

Asia-Pacific : Rapid Growth in Emerging Markets

Asia-Pacific is rapidly emerging as a significant market for wearable breast pumps, accounting for about 20% of the global market share. The growth is driven by increasing disposable incomes, urbanization, and changing societal norms regarding breastfeeding. Countries like China and South Korea are at the forefront, with rising awareness of maternal health and the convenience of wearable technology contributing to market expansion. China, in particular, is witnessing a surge in demand, with local brands like Momcozy gaining popularity. The competitive landscape is characterized by a mix of international and domestic players, each striving to capture market share through innovative products and marketing strategies. The region's unique cultural dynamics and growing acceptance of breastfeeding technology are expected to further propel market growth, making Asia-Pacific a key area for investment and development in the coming years.

Middle East and Africa : Untapped Potential and Growth

The Middle East and Africa region is gradually emerging in the wearable breast pump market, holding approximately 5% of the global share. The growth is primarily driven by increasing awareness of breastfeeding benefits, rising disposable incomes, and a shift towards modern parenting practices. Countries like South Africa and the UAE are leading this trend, with government initiatives promoting maternal health and breastfeeding awareness. South Africa is becoming a focal point for market growth, with local and international brands entering the space. The competitive landscape is still developing, with opportunities for new entrants to establish themselves. As the region continues to embrace modern parenting solutions, the demand for wearable breast pumps is expected to rise, presenting significant opportunities for growth and investment in the coming years.