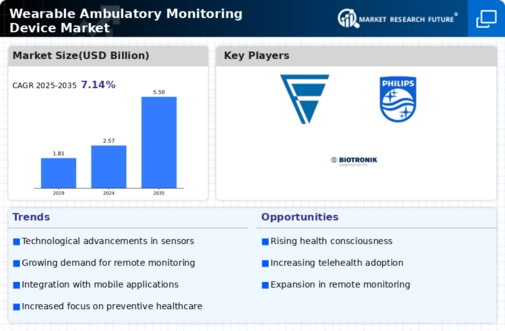

Leading market players are investing heavily in research and development in order to spread their product lines, which will help the Wearable Ambulatory Monitoring Device market grow even more. Market participants are also undertaking a various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Wearable Ambulatory Monitoring Device industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Wearable Ambulatory Monitoring Device industry to benefit clients and increase the market sector. In recent years, the Wearable Ambulatory Monitoring Device industry has offered some of the most significant advantages to medicine. Major players in the Wearable Ambulatory Monitoring Device market, including Abbott Laboratories, Boston Scientific Corporation, GE Healthcare, Koninklijke Philips NV, Medtronic, Nihon Kohden Corporation, Fakuda Denshi, ZOLL Medical Corporation, BioTelemetry Inc, Biotronik, and others, are trying to increase market demand by investing in research and development operations.

Abbott Laboratories is a US company of healthcare, popular for its medical devices and nutritional products. The company specializes in diagnostics, cardiovascular, diabetes, and neuromodulation products. It also manufactures nutrition brands, including, Ensure, Pedialyte, Glucerna, and Similac.

In July the launch of its latest implantable cardiac monitor (ICM), the Jot DX, was announced by Abbott Laboratories in the US. The Jot Dx ICM can be used by doctors and hospitals to view all abnormal cardiac rhythm data or use the 'Key Episodes' option to inform through an extraordinary feature that simplifies recorded arrhythmia rhythm.

The remote detection of cardiac arrhythmias in patients is allowed by this technology and also enhanced diagnostic accuracy. A personalized service, SyncUp offers customized education and training to assist patients in connecting to and staying connected to the ICM, utilized by Jot Dx ICM.

The GE Healthcare is a medical technology and digital solutions innovator. The company provides clinicians to make faster, more known decisions via intelligent devices, data analytics, services, and applications, helped by its Edison intelligence platform. The company works for precise health, helping drive productivity and enhanced outcomes for patients, health systems, and researchers, and providers throughout the world.

In June the launch of Portrait Mobile was announced by GE Healthcare, which is a wireless patient monitoring system that allows continuous monitoring throughout a patient's stay. The system assists clinicians in detecting patient deterioration.

The early detection of deterioration in patients can help minimize the length of stay and intensive care unit (ICU) admissions and enhance patient outcomes.